When it comes to energy drinks, Red Bull is undoubtedly one of the most recognized brands worldwide. The company’s unique marketing strategies and strong brand presence have made it a juggernaut in the energy drink industry. But is it possible to invest in Red Bull stock? In this blog post, we will explore the reality of Red Bull as a privately-owned company, its position in the global energy drink market, alternative investments, and the future of the industry.

Short Summary

Red Bull is a privately-owned company, meaning it cannot be purchased on public stock exchanges.

Investors can gain exposure to the energy drink market without investing directly in Red Bull stock by exploring alternative investment opportunities such as Monster Beverage Corp., Coca-Cola, and PepsiCo Inc.

The future of Red Bull and the energy drink industry is dependent upon health concerns, regulation, and the potential for a Red Bull IPO.

The Reality of Red Bull Stock

Red Bull is a privately-owned company, with owners Mark Mateschitz and the Yoovidhya family owning 49% and 51% of the company, respectively. Mark’s father Dietrich Mateschitz founded the company alongside Chaleo Yoovidhya and when Dietrich passed away in October of 2022, his son Mark took over. Chaleo passed away in 2012.

Red Bull being privately-owned means that it is not possible for investors to directly purchase Red Bull stock on public stock exchanges, as there is no publicly available Red Bull stock price.

So, why is Red Bull a private company, and what does this mean for potential investors?

Understanding Private Companies

A private company is a firm held under private ownership, meaning its shares are not publicly traded on the stock market. The founders of Red Bull chose to maintain control over the company and its operations, as well as to avoid the scrutiny and regulations that come with being a publicly traded company.

While investing in private companies can offer exclusive deals and opportunities, it also entails risks such as less regulation and oversight, and lower liquidity compared to public companies.

Reasons for Red Bull’s Private Status

Red Bull’s private status allows the company to retain greater control and flexibility in its operations, enabling it to make quick decisions and maintain its competitive edge. However, being a private company also restricts Red Bull’s access to capital, which could limit its growth potential and increase risk.

Despite these drawbacks, Red Bull has managed to secure a dominant position in the global energy drinks market with its popular Red Bull Energy Drink and continues to experience impressive growth.

The Global Energy Drink Market

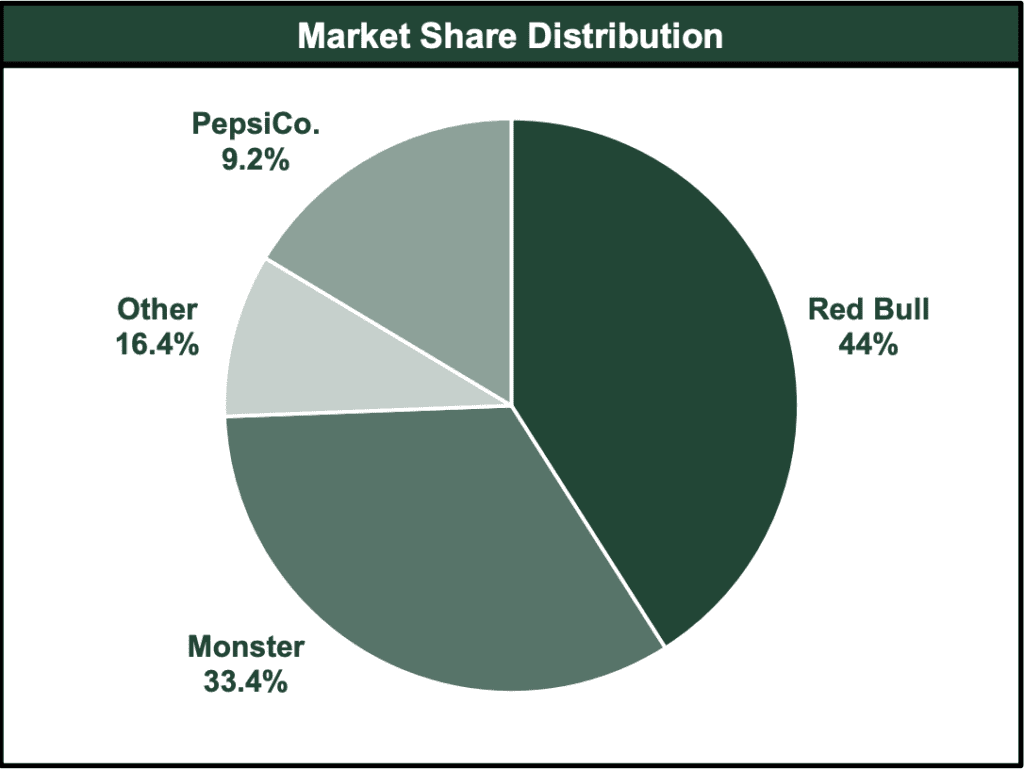

The energy drink market is a rapidly growing industry, with Red Bull being a major player. In 2020, the global energy drink market was valued at $45.8 billion and is projected to reach $108.4 billion by 2031. Red Bull, with its iconic red and blue cans, holds a significant 27% of the global energy drinks market share.

So, how does this impressive growth affect the potential to buy Red Bull stock for investing?

Market Size and Growth

The expanding global energy drink market presents an attractive opportunity for investors looking to capitalize on the industry’s growth, with a compound annual growth rate (CAGR) of 8.2% over the forecast period of 2022-2031.

Red Bull’s success is remarkable. In a single year, its revenues grew from €7.16 billion ($7.74 billion) in 2020 to €8.87 billion ($9.59 billion) in 2021.

Top Competitors in the Industry

While Red Bull is a dominant force in the energy drink market, it is not without competition. Some of the most prominent companies in the sector include Monster Beverage, Rockstar, and PepsiCo. These companies, along with Red Bull, have been vying for market share, offering a diverse range of products and marketing strategies to attract consumers.

However, unlike Red Bull, some of its top competitors are publicly traded, presenting alternative investment opportunities for those interested in the energy drink industry.

Alternative Investments in the Energy Drink Sector

For investors looking to capitalize on the growth of the energy drink market without directly investing in Red Bull stock, there are alternative options available. Some of Red Bull’s publicly traded competitors include Monster Beverage Corp (NASDAQ: MNST), Coca-Cola (NYSE: KO), and PepsiCo Inc. (NASDAQ: PEP). Each of these companies presents unique investment opportunities in the energy drink sector.

Monster Beverage Corp (NASDAQ: MNST)

Monster Beverage is a leading energy drink company with a diverse product lineup and global expansion. The company produces and markets various lines of energy drinks, such as:

Monster Energy

Monster Ultra

Monster Hydro

Muscle Monster

Java Monster

Juice Monster

Dragon Tea

Monster Beverage:

Exhibits a remarkable compound annual growth rate of 43.63%

Holds a substantial market share in the US energy drink market (about 26%)

Has a current return on equity of 19.59% (ttm)

Monster Beverage presents an attractive investment opportunity for those interested in the energy drink industry.

Related Article: Investing In Zipline Stock: An Overview Of Pre-IPO Shares

Coca-Cola (NYSE: KO)

Coca-Cola, a well-established beverage company, owns a significant 16.7% stake in Monster Beverage and facilitates the distribution of Monster Energy drinks globally. With a brand value of $97.9 billion in 2022, Coca-Cola is a stable investment option, renowned for its stock price growth and stability.

Besides its iconic flagship product, Coca-Cola produces a range of beverages, including sodas, energy drinks, and coffee beverages. By investing in Coca-Cola, investors can indirectly benefit from Monster Beverage’s success in the energy drink market.

PepsiCo Inc. (NASDAQ: PEP)

PepsiCo is another major player in the beverage industry, owning a variety of popular brands, such as:

Pepsi

Rockstar Energy

Mountain Dew

Lay’s

Quaker Oats

Gatorade

Doritos

SodaStream

With a current stock price of $180.25 (as of 8/28/23), PepsiCo offers investors a chance to capitalize on the growth of the energy drink sector through its diverse product portfolio.

While PepsiCo may not be as focused on energy drinks like Red Bull or Monster Beverage, its strong presence in the overall beverage industry makes it an appealing investment option.

Related Article: Understanding Unrealized Gains

Red Bull’s Impact on the Global Brand Landscape

Red Bull’s success in the competitive beverage industry can be attributed to its unique marketing strategies and strong cultural influence. The company, Red Bull GmbH, has built a powerful brand identity through its experiential marketing tactics, extreme sports sponsorships, and initiatives that extend beyond the realm of sports. As a result, Red Bull has become synonymous with a lively and daring lifestyle, resonating with consumers across the globe.

The company’s marketing efforts have been incredibly successful, allowing it to establish a strong brand.

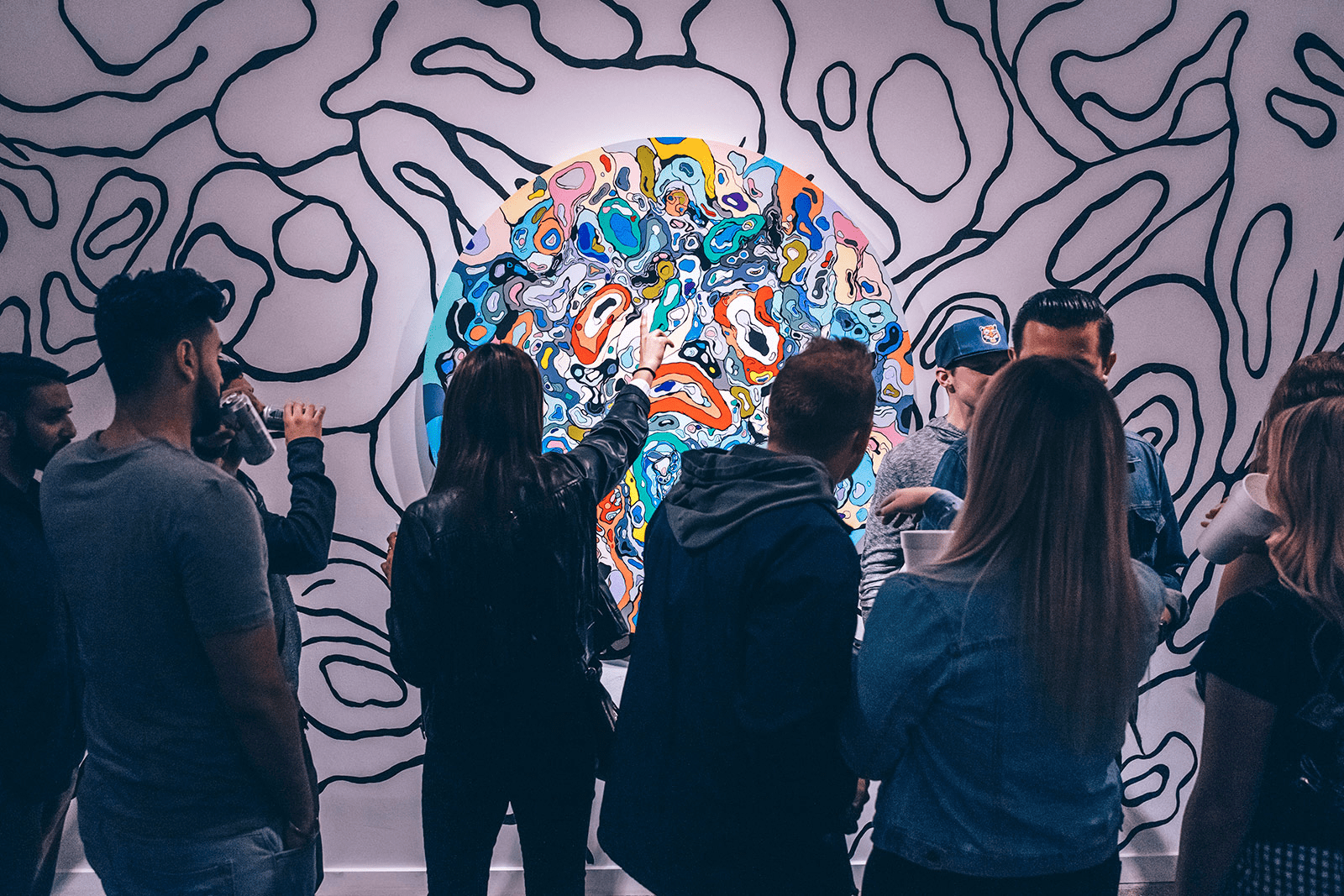

Experiential Marketing and Extreme Sports Sponsorship

Red Bull’s experiential marketing strategy focuses on providing customers with memorable experiences, including events, product sampling, and other activities that create a lasting impression. The company sponsors a wide range of extreme sports, such as skateboarding, snowboarding, motocross, surfing, mountain biking, and BMX. Through these sponsorships, Red Bull has differentiated itself from its competitors and established a strong brand identity, allowing it to expand its reach and foster a devoted customer base.

Red Bull’s experiential marketing strategy has enabled the company to stand out from the competition.

Red Bull’s Cultural Influence

Red Bull’s impact on culture extends beyond the realm of sports. The company has established initiatives like the Red Bull House of Art, which supports young artists in creating new art and exhibitions. This commitment to nurturing creativity and innovation has further solidified Red Bull’s position as a cultural icon.

As the energy drink market continues to grow, Red Bull’s unique marketing strategies and cultural influence are likely to remain key factors in the company’s ongoing success.

The Future of Red Bull and the Energy Drink Industry

The future of Red Bull and the energy drink industry may be influenced by health concerns, regulation, and the potential for a Red Bull IPO. As the market continues to expand, it is essential for investors to consider these factors when evaluating investment opportunities in the sector.

Health Concerns and Regulation

Health concerns surrounding energy drinks, such as an increased risk of heart problems and high blood pressure, have led to calls for stricter regulations on the industry. Potential regulations could include restrictions on caffeine content, limits on marketing to minors, and taxes on energy drinks.

These measures could impact the industry’s growth by leading to decreased sales, increased prices, and a reduction in the number of energy drink companies.

Potential for a Red Bull IPO

As far as we know, Red Bull is not currently considering an Initial Public Offering (IPO). However, it is conceivable that the company may pursue a public offering in the future, which could create new investment opportunities for investors.

A Red Bull IPO could grant the company access to additional capital, increased visibility, and the opportunity to broaden its operations.

Summary

In conclusion, the energy drink market presents exciting investment opportunities, with Red Bull being a dominant player in the industry. However, as a privately-owned company, investing in Red Bull stock directly is currently not possible. Alternative companies that are publicly traded, such as Monster Beverage, Coca-Cola, and PepsiCo, offer investors exposure to the growing energy drink sector. The future of the industry may be influenced by health concerns, regulation, and the potential for a Red Bull IPO, making it essential for investors to stay informed on the latest developments.

Frequently Asked Questions

Can I buy shares in Red Bull?

Unfortunately, Red Bull is a privately owned company, which means there is no direct stock market link. This means that retail investors cannot buy or sell Red Bull shares as they are not publicly available.

Is Red Bull a public listed company?

Red Bull is a private company, with no stock available for purchase on the public market. 100% of Red Bull’s stock is owned by Mark Mateschitz and Chaleo Yoovidhya, and there are no plans to list the company on a public exchange.

Is Red Bull owned by Coca-Cola?

No, Red Bull is not owned by Coca-Cola. It is owned by the Austrian company Red Bull GmbH and its biggest competitors in the beverage industry are Pepsi and Coca-Cola.

Who are Red Bull’s main competitors in the energy drink market?

Red Bull’s main competitors in the energy drink market are Monster Beverage, Coca-Cola and PepsiCo Inc.

Are there alternative investments available in the energy drink sector?

Yes, investors can consider alternative investments in the energy drink sector such as Monster Beverage Corp, Coca-Cola, and PepsiCo Inc.