The world of fintech has been abuzz with the potential of Stripe’s initial public offering (IPO). As one of the most highly-valued and rapidly-growing payment processing companies, Stripe’s IPO is highly anticipated. But what does this mean for investors interested in Stripe stock? How can you invest in Stripe before it goes public, and what alternatives exist in the fintech sector? In this blog post, we’ll explore these questions and more, offering insights into the exciting investment landscape surrounding Stripe stock and other fintech giants.

Key Takeaways

Stripe is a private fintech company with strong financial performance and potential for an IPO in 2023 or 2024.

Accredited investors can invest pre-IPO through platforms such as EquityBee, Linqto and EquityZen. Retail investors should be aware of the benefits and challenges before participating in Stripe’s IPO.

Investors should stay informed on market conditions, conduct due diligence, explore alternative investment opportunities within the rapidly growing fintech industry while keeping up to date with developments regarding Stripe’s upcoming IPO.

Stripe’s Current Status: Private Company

Despite the high anticipation, as of mid-2023, Stripe is still a private company and not publicly traded. Thus, the only available method to buy Stripe stock is through private market transactions.

Expectations for a future Stripe IPO are mounting, spurred by the company’s impressive growth and robust investor base. For the time being, prospective investors in this fintech powerhouse need to either explore different avenues or wait until the company goes public.

Understanding Stripe: The Fintech Powerhouse

Founded in 2010 by brothers Patrick and John Collison, Stripe has emerged as a leading fintech company specializing in software that enables online financial transactions. With a vast array of services, including:

Payment processing

Revenue management applications

Fraud prevention

Buy Now Pay Later options

Stripe aims to increase the GDP of the internet. Stripe’s extensive list of investors includes notable names such as:

Andreessen Horowitz

Sequoia Capital

Thrive Capital

General Catalyst

Goldman Sachs Asset Management

The company has also raised more than $6 billion in venture capital funding, fueling its rapid growth and bolstering its position in the market.

Notably, Stripe’s impressive client roster includes tech giants like Amazon and Google, showcasing the company’s strong foothold in the industry. With such credentials, it comes as no surprise that investors are eagerly awaiting the opportunity to invest in Stripe’s potential IPO.

Stripe Valuation and Financial Performance

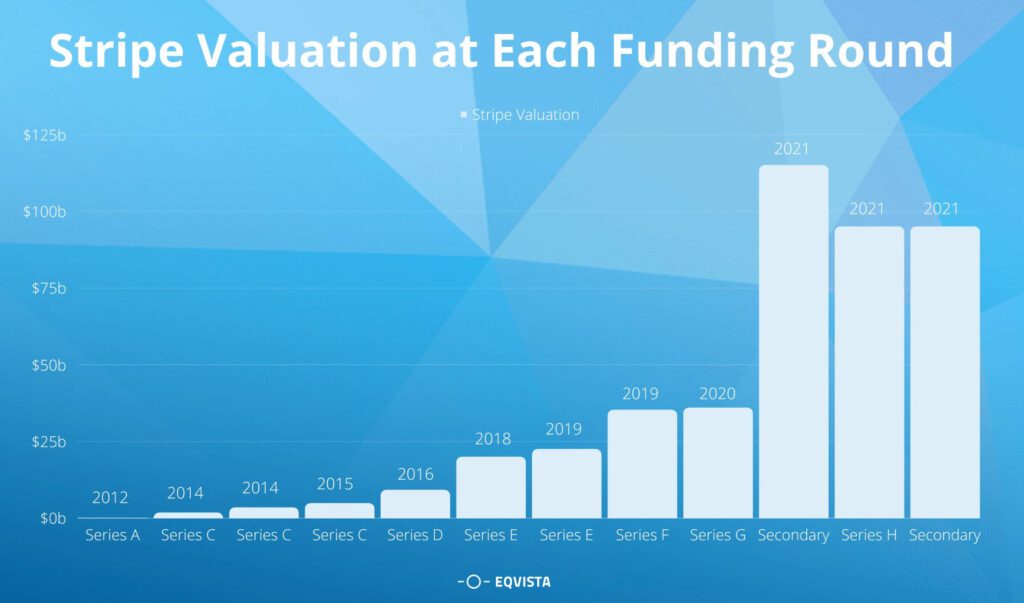

Source: eqvista.com

As of now, Stripe’s valuation stands at $50 billion, following a recent funding round that raised $6.5 billion. In 2022, the company’s gross revenue hit roughly $14 billion, marking a significant rise from 2020 and 2021 and highlighting its robust financial performance.

Stripe’s valuation, however, has faced fluctuations, including:

Peaking at $95 billion in March 2021

Falling in July 2022

Falling in January 2023

Falling in late February due to a slump in technology startups and pre-IPO ventures.

Despite these fluctuations, the company remains on a strong growth trajectory, making its potential IPO an attractive proposition for investors, considering the stock price. The ability to provide liquidity to current and former employees was a significant factor in the company’s recent $6.5 billion capital raise.

Key Metrics

| Year | Revenue (USD) | Growth Rate |

|---|---|---|

| 2023 | $14 billion | 20% |

| 2022 | $12 billion | 62% |

| 2021 | $7.4 billion | 70% |

| 2020 | $4.4 billion | 171% |

| 2019 | $1.6 billion | 93% |

Potential IPO Timeline for Stripe

Stripe’s IPO timeline remains uncertain, as the company has registered its plans to go public with the Securities and Exchange Commission but is still considering various factors and options for going public. Within the next 12 months, Stripe may either go public through an IPO or allow its employees to sell shares via a secondary offering.

The company’s decision to pursue an initial public offering and become a publicly traded company will depend on factors such as market conditions, financial performance, and strategic objectives, all of which will be addressed in the following subsections.

Factors Influencing Stripe’s IPO Decision

One of the key factors influencing Stripe’s IPO decision is the prevailing market conditions. With robust investor enthusiasm for technology equities and a sound economy, the current market conditions are conducive to a potential IPO.

Additionally, Stripe’s strong financial performance and strategic objectives, such as expanding its customer base, increasing its market share, and continuing innovation in the payments sector, play a significant role in the company’s decision to go public.

Potential IPO Date and Method

As of now, the potential Stripe IPO date is undetermined, with the company discussing the possibility of a public listing with investment banks such as Goldman Sachs and JPMorgan. The timing of the IPO is still unknown. It could take place in 2023 or 2024, when market conditions improve.

Stripe is considering several options for its IPO, including a direct listing or allowing employees to sell shares on a secondary market. Both methods present unique opportunities and challenges, and the company will ultimately choose the option that best aligns with its goals and market conditions.

How to Invest in Stripe Pre-IPO

Investing in Stripe pre-IPO can be challenging, as the company remains private and investment opportunities are limited. Only accredited investors are permitted to invest in Stripe pre-IPO, which narrows the pool of potential investors.

Despite these limitations, there are still options available to those who are eager to invest in Stripe before it goes public. The following subsections will explore pre-IPO investing platforms, waiting for public trading, and participating in Stripe’s IPO.

Related Article: Understanding Warrants Vs Options: A Comprehensive Guide

Pre-IPO Investing Platforms

Accredited investors can use platforms like EquityBee, Linqto, and EquityZen to access pre-IPO investment opportunities in private companies, including Stripe. These platforms facilitate the purchase of pre-IPO shares, allowing investors to gain exposure to promising companies before they trade publicly.

However, the demand for high-profile companies on pre-IPO investing platforms is high, which can reduce the chances of acquiring shares. Investors looking to invest in Stripe pre-IPO should be prepared to act quickly and diligently monitor the available opportunities.

Waiting for Public Trading

For most investors, waiting for public trading may be the most accessible option. This requires patience and close monitoring of Stripe’s IPO developments, as well as staying informed about potential changes in market conditions.

Once Stripe goes public, investors can purchase shares through a brokerage account, such as an account at Public.com. While waiting for the opportunity to invest in Stripe, investors can continue to research the company and stay abreast of any news or updates regarding its potential IPO.

Related Article: What Is Capital Markets? An Overview Of Instruments, Examples, And How It Works

Participating in Stripe’s IPO

Participating in Stripe’s IPO may prove difficult for retail investors, as access to IPOs are typically limited to institutional investors and high-net-worth individuals. However, retail investors may still have opportunities to access Stripe’s IPO through pre-IPO investing platforms, as previously mentioned.

When considering participation in Stripe’s IPO, investors should weigh the potential benefits and challenges, as well as remain informed about the timeline and factors affecting the company’s decision to go public.

Alternative Investment Opportunities in Fintech

While waiting for Stripe’s IPO, investors can explore alternative fintech investment opportunities in the market. Publicly traded fintech companies such as PayPal, Adyen, and Block offer compelling investment options for those interested in the industry.

Investors can diversify their portfolios with these alternative fintech companies to mitigate dependence on Stripe’s IPO while still maintaining exposure to the vibrant, fast-growing fintech industry:

Square

PayPal

Adyen

Shopify

Klarna

Key Takeaways for Investors

Key points for investors considering Stripe or other fintech investments include:

Keeping an eye on developments in Stripe’s IPO

Investigating other fintech investment opportunities

Conducting comprehensive due diligence prior to investing.

Investors should also remain informed about the broader context, such as stock market conditions and their financial objectives, as well as consult market resources like the Motley Fool Stock Advisor for updates and analysis.

Summary

In conclusion, the anticipation surrounding Stripe’s potential IPO offers an exciting investment opportunity for those interested in the fintech space. By exploring pre-IPO investing platforms, considering alternative fintech investments, and staying informed about market trends and developments, investors can position themselves for success in this rapidly growing industry. As the landscape continues to evolve, investors should remain vigilant and adaptable, ready to seize the opportunities that arise in the dynamic world of fintech investing.

Frequently Asked Questions

Is Stripe going to IPO?

Stripe has made plans to go public in the near future with a valuation of $50 billion, as reported by The Information. This IPO has been long-awaited and is expected to be one of the biggest IPOs in the market. Although there is no concrete date set yet, the company is deciding between a direct listing or letting employees sell shares on a secondary market.

Can I invest in Stripe stock?

Unfortunately, it is not possible to invest in Stripe stock as it is a privately-held company. You can learn more about investing in the private market or register to get started.

Why won’t Stripe go public?

So far, co-founders Patrick and John Collision have opted to keep Stripe private, rather than pursue an IPO or direct listing. This is due to their preference for keeping tight control of the payment processor, despite the availability of options for running a public company.

What is the valuation of Stripe stock?

Stripe’s current stock valuation stands at $50 billion, following its 2021 funding round which valued the company at $95 billion.

Who owns stripe?

Patrick and John Collison, Irish entrepreneur brothers, founded Stripe in 2009 and own it today, with John serving as President and Patrick as CEO. They are joined by 46 investors from the company’s funding rounds, making Stripe a privately held company.