Are you considering investing in the high-growth streaming industry? Hulu, a popular streaming service, is attracting investors’ attention. In this comprehensive guide, we will explore Hulu’s business model, ownership structure, and potential investment opportunities through its parent companies, Disney and Comcast.

Short Summary

Invest in Hulu stock indirectly by buying Disney or Comcast stocks through an online broker.

Evaluate potential of streaming stocks and choose the right online broker for investments.

Consider risks and rewards before investing in Hulu to maximize profits.

Understanding Hulu’s Business Model

Hulu quarterly subscribers 2019 to 2023 (mm)

Hulu is a premium streaming service that offers live and on-demand television and movies, with plans starting at just $5.99 per month. Their primary subscription model includes advertisements, making it an affordable option for millions of subscribers. With a current valuation of approximately $27 billion, Hulu is a force to be reckoned with in the streaming industry.

So, how can you invest in Hulu’s promising future? Unfortunately, Hulu is not a publicly traded company. But don’t worry! There’s still a way to gain exposure to Hulu’s stock through its parent companies, Disney and Comcast.

Let’s dive deeper into the ownership structure of Hulu to understand how to invest in this streaming giant.

Ownership of Hulu: Disney and Comcast

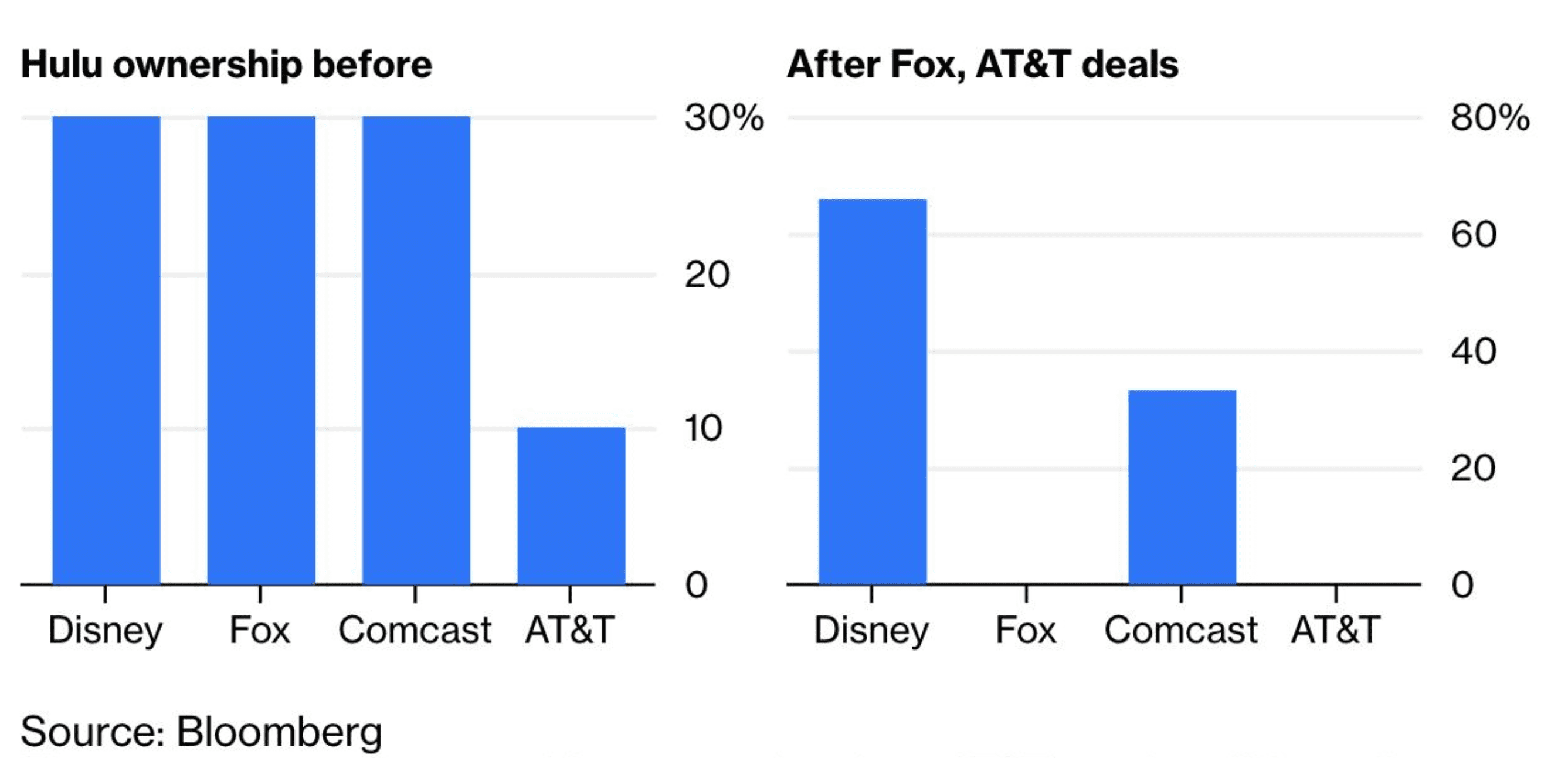

Hulu’s ownership is divided between two media giants: Disney, holding a 67% majority stake, and Comcast, owning a 33% minority stake. This ownership structure is essential for investors, as it provides an indirect way to invest in Hulu’s growth story through these parent companies.

Let’s explore each company’s ownership stake in Hulu and their implications for potential investors.

Disney’s Majority Ownership

Disney’s commanding 67% stake in Hulu makes it the most significant player in the streaming service’s ownership. By investing in Disney stock, you gain exposure to Hulu, as well as Disney’s other businesses, including movies, television networks, theme parks, and more.

The advantages of investing in Disney stock are numerous. In addition to the company’s majority ownership in Hulu, Disney has a vast array of entertainment assets that contribute to its overall success. However, like any investment, there are risks involved, such as market volatility and company-specific risks.

Comcast’s Minority Stake

Comcast, on the other hand, holds a 33% minority stake in Hulu. While it’s not a majority share, investing in Comcast stock still allows you to indirectly invest in Hulu’s growth potential. Comcast has various profitable assets, such as Peacock, NBC Broadcast, Dream Works, and cable networks, which enhance the company’s overall value.

By investing in Comcast, you diversify your investment in the streaming industry. Keep in mind, though, that Disney and Comcast have a tentative agreement for Disney to acquire Comcast’s remaining stake by 2024 for an estimated value of $27.5 billion or more. This may impact your investment strategy, so it’s essential to stay informed about any changes in the future.

Investing in Hulu through Parent Companies

To invest in Hulu indirectly through Disney and Comcast, you’ll need to purchase their stocks using an online broker, such as eToro, Webull, TD Ameritrade, or Tradestation. Disney’s stock is traded under the ticker symbol NYSE:DIS, while Comcast’s stock symbol is CMCSA.

Buying Disney Stock

Investing in Disney stock is an excellent way to access Hulu’s potential. As mentioned earlier, Disney holds a significant majority stake in Hulu, making it a significant player in the streaming industry. By investing in Disney, you’ll also benefit from the company’s vast array of entertainment assets, which contribute to its overall success.

Purchasing Comcast Stock

Comcast’s minority stake in Hulu means that by investing in their stock, you’ll also indirectly invest in Hulu. While the company’s ownership in Hulu is not as significant as Disney’s, it’s still an opportunity to diversify your investment in the streaming industry.

The Possibility of a Hulu IPO

While Hulu is not currently publicly traded, a future IPO (Initial Public Offering) might be possible if Disney decides to raise capital by offering Hulu stock on the market. However, at this time, there are no plans for a Hulu IPO, as Disney has not expressed any intentions to pursue this route.

Although there’s no Hulu IPO on the horizon, it’s essential to keep an eye on the streaming industry and any potential changes in the future. By staying informed and up-to-date, you’ll be better equipped to make informed decisions about investing in streaming stocks, such as Hulu’s parent companies, Disney and Comcast.

Streaming Industry Competitors

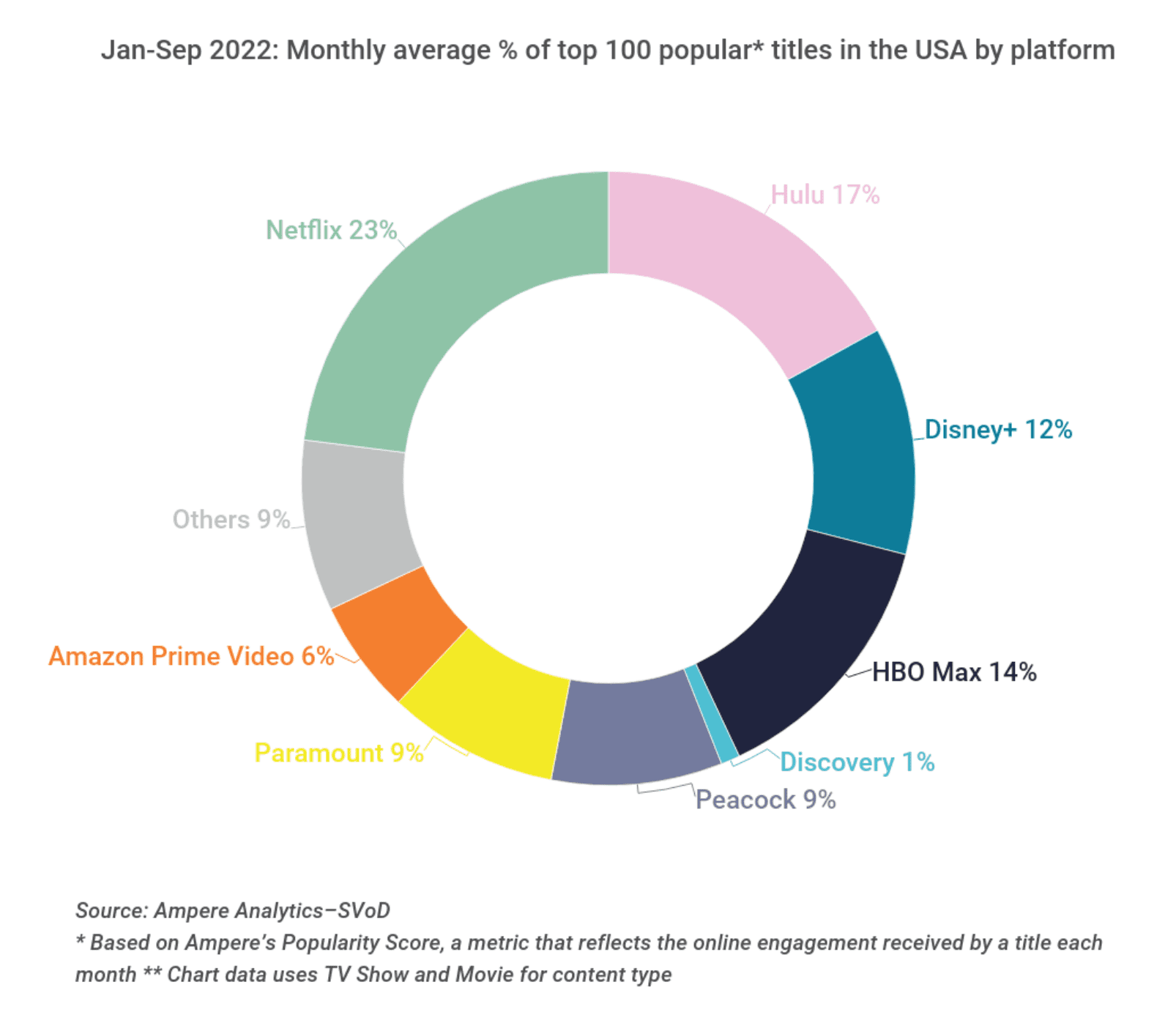

The streaming industry is highly competitive, with several major players vying for subscribers and market share. Hulu’s main competitors include Netflix, Amazon Prime Video, and Disney’s own streaming service, Disney+. Each competitor offers unique pricing models and content, catering to different audience preferences.

Netflix is currently the king of streaming services. The company has gained a massive subscriber base of over 222 million from 190 countries around the world, making it an undeniable leader in streaming films TV series. What sets it apart from its rivals is its large library of original content, high-quality programs and a streamlined interface that’s easy to use.

However, when you factor in Disney+ and Hulu combined, the offering accounts for more then Netflix’s percentage market share.

Risks and Rewards of Investing in Hulu

Hulu quarterly revenue 2019 to 2023 ($mm)

Investing in Hulu, either directly or through its parent companies, carries both risks and rewards. Some of the potential risks include competition from other streaming services, uncertainty surrounding Hulu’s business model, and the fact that the company is not currently profitable.

Summary

In conclusion, investing in Hulu stock in 2023 is not possible through a direct IPO, but you can still gain exposure to the company’s growth through its parent companies, Disney and Comcast. By understanding Hulu’s business model, ownership structure, and the competitive landscape of the streaming industry, you can make more informed investment decisions and potentially profit from this high-growth market. Remember to research and choose the right online broker for your streaming investments, and always stay informed about the industry’s developments. Happy investing!

Frequently Asked Questions

Is Hulu on the stock market?

Unfortunately, Hulu is not on the stock market as it is a private company. It is owned by Disney (NYSE: DIS), and investors can purchase shares of that stock instead.

What is the cost of Hulu stock?

Unfortunately, Hulu is not a publicly traded company, and therefore does not have a stock price.

What is the stock name for Hulu?

The stock name for Hulu is NYSE:DIS, as Disney is the majority owner of Hulu. Investors can purchase Disney stocks to invest in Hulu.

How much is Hulu valued at?

Hulu’s current valuation is at $27 Billion