The world of online sports betting is witnessing explosive growth, and one company stands out in this highly competitive landscape: FanDuel. With a dominant market position, strategic partnerships, and a focus on expanding its presence in untapped markets, FanDuel is an investment opportunity worth considering. In this blog post, we will take you through a comprehensive analysis of FanDuel’s market position, financial performance, potential IPO, and the key factors to consider when investing in this promising company, particularly focusing on the prospects of Fanduel stock.

Short Summary

FanDuel holds a dominant 50% share of the US sports betting landscape, providing daily fantasy sports contests, online sportsbooks and retail locations.

Investors can obtain exposure to FanDuel through Flutter Entertainment Plc which is listed on the London Stock Exchange and Irish Stock Exchange.

When investing in FanDuel stock investors should consider market trends & opportunities, regulatory environment as well as potential risks & challenges posed by competition and saturation.

Understanding FanDuel’s Market Position

FanDuel’s strong market position is due to its wide range of sports betting services, partnerships, and sponsorships with major sports leagues. The company holds a dominant 50% share of the US sports betting landscape, surpassing the combined market share of its two closest rivals.

With the increasing prevalence of online sports betting, FanDuel has the potential to become a major player among sports betting stocks.

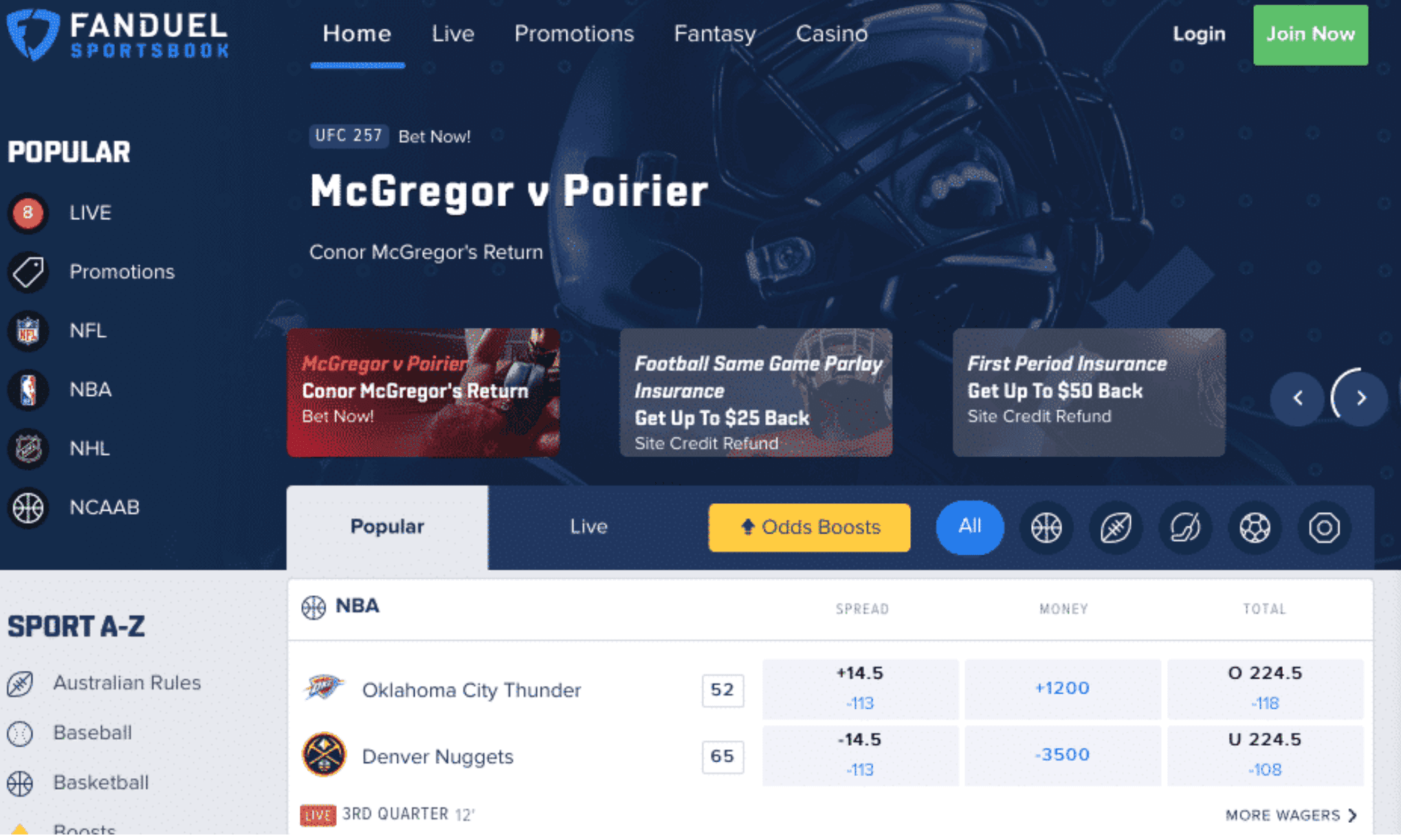

Sports Betting Services Provided

FanDuel offers a variety of sports betting services, including:

Spread betting: This is the most common type of sports betting. In spread betting, you bet on whether a team will win by more or fewer points than the spread, which is a number set by FanDuel. For example, if the spread for a football game is -7.5 points, you would bet on the team you think will win by more than 7.5 points. If the team you bet on wins by 8 points, you would win your bet.

Moneyline betting: This type of betting is simpler than spread betting. In moneyline betting, you simply bet on which team you think will win the game. The odds for each team will reflect how likely FanDuel thinks they are to win. For example, if the odds for a football game are -110 for the home team and +100 for the away team, you would bet $110 to win $100 if you bet on the home team.

Totals betting: This type of betting is also known as over/under betting. In totals betting, you bet on whether the total number of points scored in a game will be over or under a number set by FanDuel. For example, if the total for a football game is 50 points, you would bet on whether you think the total number of points scored will be more than or less than 50 points.

Prop bets: Prop bets are bets on specific events that happen during a game. For example, you could bet on who will score the first touchdown in a football game, or who will hit the most home runs in a baseball game. Prop bets can be very creative, and there are always new ones being offered.

Parlays: Parlays are bets that combine multiple bets into one bet. If all of the bets in the parlay win, you will win a larger payout than if you had simply bet on each bet individually. However, if one of the bets in the parlay loses, you will lose the entire bet.

Same Game Parlay: Same Game Parlay (SGP) is a type of parlay bet that allows you to combine multiple bets on the same game into one bet. This can be a great way to increase your potential winnings, but it also increases your risk. If one of your bets in the SGP loses, you will lose the entire bet.

FanDuel also offers a variety of other sports betting services, such as live betting and in-game betting. Live betting allows you to place bets on games that are already in progress, while in-game betting allows you to place bets on specific events that happen during a game.

Partnerships and Sponsorships

FanDuel has established strong partnerships and sponsorships with major sports leagues, boosting its brand recognition and user base. These collaborations not only enhance FanDuel’s credibility, but also create a loyal customer base.

For instance, FanDuel’s partnership with Major League Baseball (MLB) allows the company access to official MLB data, providing users with real-time statistics and insights for an enhanced betting experience.

Investing in FanDuel Through Flutter Entertainment

Investors can gain exposure to FanDuel by investing in its parent company, Flutter Entertainment, which owns multiple online gaming brands. Flutter Entertainment is a global sports betting and gaming operator with a diverse portfolio of brands, including the fanduel parent, Paddy Power, FoxBet, TVG, Poker Stars, and Betfair US.

By investing in Flutter Entertainment, investors can benefit from FanDuel’s growth without directly investing in the company.

Flutter Entertainment Plc

Flutter Entertainment Plc is a leading global provider of sports betting, gaming, and entertainment services. The company is listed on the London Stock Exchange (LSE) and the Irish Stock Exchange (ISE), granting investors access to more extensive capital markets.

Investing in Flutter Entertainment Plc offers exposure to a renowned online gaming company with a broad portfolio of brands and potential for significant growth.

Stock Exchange Listings

Flutter Entertainment’s stock is listed on the London Stock Exchange (LSE) and the Irish Stock Exchange (ISE). This makes it accessible to investors worldwide, including flutter shareholders, offering an opportunity to invest in a company with a strong presence in the sports betting and gaming industry.

Currently, Flutter Entertainment is discussing the possibility of listing on an American stock exchange, which could further enhance its accessibility and appeal to investors.

Related Article: Exploring The Future Of Triller IPO

FanDuel’s Potential IPO and Future Growth

A public listing for FanDuel could provide the company with deeper access to capital markets, allowing it to raise funds for expansion and growth. However, going public also presents risks and challenges, such as increased competition, potential regulatory changes, and market saturation within the online sports betting industry.

Analyzing these factors is crucial for investors considering FanDuel as a potential investment, especially in the following segments of the market.

Deeper Capital Markets Access

An IPO could help FanDuel raise capital for expansion and growth, enabling investments in new products and services, as well as the expansion of its customer base. Additionally, going public could offer liquidity to existing shareholders, allowing them to realize their investments.

However, the exact timeline for an IPO remains uncertain, as it depends on various factors such as market conditions and the company’s financial performance.

Risks and Challenges

FanDuel faces risks such as increased competition, regulatory changes, and market saturation in the online sports betting industry. Increased competition can result in decreased profits, reduced market share, and weakened customer loyalty. Potential regulatory changes could result in increased costs, heightened compliance requirements, and potential legal ramifications.

Market saturation could result in decreased demand, lower prices, and reduced profits. Investors must weigh these risks against the potential rewards of investing in FanDuel.

Analyzing FanDuel’s Financial Performance

Source Yahoo

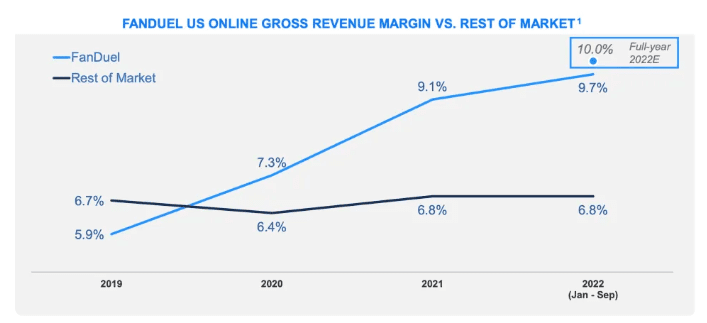

FanDuel’s financial performance is characterized by strong revenue growth and market share. The company has consistently reported higher revenues than its competitors and holds a significant 50% market share in the US online sports betting market.

| Top Sports Betting Companies (US) | Market Share |

|---|---|

| FanDuel | 50% |

| DraftKings | 33% |

| BetMGM | 17% |

Revenue and Market Share

Since 2018, FanDuel’s revenue has grown from $300 million in 2018 to a projected $4.5 billion by 2023. This impressive growth showcases the company’s ability to capture a significant share of the rapidly expanding online sports betting market.

FanDuel’s growth has been driven by the legalization of sports betting in the United States. In 2018, only a handful of states had legalized sports betting. However, by 2022, sports betting is legal in 30 states and the District of Columbia. This has created a huge market for FanDuel and its competitors.

FanDuel has also benefited from its strong brand recognition and its innovative marketing campaigns. The company has been able to attract a large number of users, which has helped to drive its revenue growth.

In addition to sports betting, FanDuel also offers a variety of other products, such as daily fantasy sports (DFS) and online casino games. These products have also contributed to FanDuel’s growth.

| Year | Revenue (USD) |

|---|---|

| 2018 | $300 Million |

| 2019 | $1.2 Billion |

| 2020 | $2.4 Billion |

| 2021 | $3.2 Billion |

| 2022 | $3.9 Billion |

| 2023 (projected) | $4.5 Billion |

Australia Segment Focus

The Australian sports betting and gaming market is expected to continue to grow in the coming years. The market is projected to be worth over $2 billion by 2025. However, FanDuel does not have a direct presence in the Australian sports betting market. The company does have a partnership with Sportsbet, which is the largest online sports betting company in Australia.

Under the terms of the partnership, FanDuel provides Sportsbet with its technology and risk management services. This allows Sportsbet to offer a wider range of betting options to its customers.

FanDuel also has a minority stake in Sportsbet. This gives FanDuel a strategic interest in the Australian sports betting market.

FanDuel is likely to increase its presence in the Australian sports betting market in the future. The company has expressed interest in entering the market directly, and it is likely to do so once the regulatory environment is more favorable.

In the meantime, FanDuel will continue to partner with Sportsbet to provide its customers with access to the best possible betting experience.

FanDuel’s partnership with Sportsbet details:

The partnership was announced in 2019.

The partnership is for a term of five years.

FanDuel provides Sportsbet with its technology and risk management services.

FanDuel has a minority stake in Sportsbet.

The partnership is worth an estimated $100 million.

Key Factors to Consider When Investing in FanDuel Stock

Source Reuters

Investors should consider key factors such as market trends, opportunities, and the regulatory environment when evaluating FanDuel as an investment. The online sports betting industry is experiencing rapid growth, and FanDuel is well-positioned to capitalize on this trend.

However, the regulatory environment for online sports betting is constantly evolving, and investors should monitor changes that could impact FanDuel’s operations and growth prospects.

Market Trends and Opportunities

The growth of the online sports betting market: The online sports betting market is growing rapidly, as more and more people are using online platforms to place bets. FanDuel is a leader in the online sports betting market, and it is well-positioned to continue to grow as the market expands.

The increasing popularity of mobile sports betting: Mobile sports betting is becoming increasingly popular, as people are increasingly using their smartphones and tablets to place bets. FanDuel offers a mobile app that is user-friendly and easy to use, and it is well-positioned to capitalize on the growth of mobile sports betting.

The expansion of legalized sports betting: The legalization of sports betting is expanding to new states and jurisdictions, which creates new opportunities for FanDuel to grow its business. FanDuel is already active in a number of states, and it is likely to continue to expand its operations as more states legalize sports betting.

The growing popularity of fantasy sports: Fantasy sports is a popular form of sports betting, and FanDuel is a leading provider of fantasy sports contests. The growth of fantasy sports is a positive trend for FanDuel, as it provides the company with another way to reach sports fans and generate revenue.

The development of new technologies: The sports betting and gaming industry is constantly evolving, as new technologies are developed. FanDuel is at the forefront of innovation in the industry, and it is well-positioned to capitalize on new technologies as they emerge.

Regulatory Environment

The regulatory environment for online sports betting is constantly evolving, and investors should monitor changes that could impact FanDuel’s operations and growth prospects. Some states, like New York and Nevada, have prohibited FanDuel, deeming the games illegal gambling. FanDuel is contesting the rulings in New York and Nevada, but the outcome remains uncertain. The company is arguing that its games are not illegal gambling and that the states are violating the U.S. Constitution by prohibiting them. The courts will ultimately decide whether FanDuel is allowed to operate in New York and Nevada.

FanDuel’s regulatory environment is constantly evolving. As the laws and regulations governing gambling change, FanDuel must adapt its business to comply with the new rules. This can be a challenge, but FanDuel has a strong track record of compliance and is well-positioned to continue to operate in a changing regulatory environment.

Summary

In summary, FanDuel presents a compelling investment opportunity in the rapidly growing online sports betting market. With a dominant market position, diverse sports betting services, strategic partnerships, and strong financial performance, FanDuel offers significant potential for investors. However, investors must carefully weigh the risks and challenges, such as the evolving regulatory environment and increased competition, against the potential rewards of investing in this promising company.

Frequently Asked Questions

Is FanDuel publicly traded stock?

FanDuel is not a publicly traded company, so it cannot be bought directly.

However, Flutter Entertainment owns 95% of the company and its stock is traded on the London Stock Exchange, meaning that stock in FanDuel can be indirectly purchased through buying stock in Flutter Entertainment.

What sports betting services does FanDuel offer?

FanDuel provides daily fantasy sports, online sportsbooks, and physical retail locations for sports betting.

What is FanDuel’s market share in the US?

As of March 8, 2023, FanDuel has a 50% market share in the US sports betting market. This means that FanDuel is the leading sports betting company in the United States.

What are the risks and challenges associated with investing in FanDuel?

Investing in FanDuel carries a variety of potential risks including increased competition, regulatory changes and market saturation. Therefore, investors should consider these challenges before deciding to invest in the online sports betting industry.