The Triller app has taken the social media world by storm, positioning itself as a viable rival to TikTok. As Triller prepares for its highly anticipated initial public offering (IPO), the company’s journey has been nothing but smooth. From a failed merger to a shift in listing strategy, Triller’s path towards going public has been brimming with unexpected twists and turns. But what does this mean for the future of Triller, and what can investors expect from the upcoming IPO? Join us as we explore the latest updates on Triller IPO date and its journey in the ever-evolving social media landscape.

In this comprehensive analysis, we will dive deep into Triller’s IPO journey, its financials, competitive landscape, expansion strategy, and the key players involved. We’ll also delve into the company’s IPO timeline and the potential impact of market volatility on its public debut. So, let’s embark on this captivating exploration of the future of Triller IPO and its stock, ILLR.

Short Summary

Triller’s IPO journey has taken them from exploring a reverse merger through a SPAC to planning for a traditional listing with projected valuation of $3 billion.

The company is yet to become profitable despite impressive revenue growth, facing legal battles and contractual licensing costs that hinder profitability.

Triller has submitted confidential registration statement to the SEC indicating potential launch in Q4, Market volatility may cause delays.

Triller’s IPO Journey: From SPAC Merger to Direct Listing

Triller, established in 2015 by David Leiberman and Sammy Rubin, initially explored the possibility of going public via a reverse merger through a special purpose acquisition company (SPAC). However, in August 2022, Triller announced a change in direction, opting to pursue a traditional IPO instead. This decision set the stage for Triller’s public debut, with the company planning to trade under the ticker symbol “ILLR,” making it an interesting option for those looking to invest in Triller stock.

With a projected IPO valuation of $3 billion, Triller has been actively recruiting talent to strengthen its position in the market, including nine different TikTok employees. The company has been successful in raising an impressive sum of $300 million in venture capital funding from notable investors. Names such as Proxima Media, Pegasus Tech Ventures, Mahi de Silva, Lowercase Capital, and Carnegie Technologies have come together to provide advantage to the firm.

The Failed SeaChange Merger

Triller’s initial plan to merge with SeaChange, a digital media solutions provider, fell through before the company could evaluate alternative pathways to go public. The company then considered utilizing a SPAC merger as a means of going public, an approach that ultimately did not materialize. This left investors eagerly awaiting further updates on Triller’s IPO plans, which took an unexpected turn in August 2022 when the company announced its intention to pursue a traditional IPO rather than a SPAC merger.

The failed SeaChange merger served as a catalyst for Triller’s reassessment of its IPO strategy, prompting the company to explore other options for going public. By shifting its focus to a traditional IPO, Triller has set the stage for a potentially successful public listing as it continues to strengthen its position in the competitive social media landscape.

Embracing Direct Listing

In a somewhat unconventional move, Triller decided to pursue a direct listing as its preferred method of going public. A direct listing is an alternative strategy to becoming publicly traded, which does not require the same level of due diligence from Wall Street as an IPO does. Private companies, like Triller, may opt for a direct listing if they have sufficient funds and are not specifically utilizing the public markets for fundraising.

By embracing a direct listing, Triller has demonstrated its confidence in its financial standing and its ability to navigate the competitive landscape. This strategic move also highlights the company’s determination to forge its own path, even when faced with the challenges and uncertainties that come with going public.

Related Article: Invest In Instacart IPO: Everything You Need To Know

Triller’s Financials: Analyzing Profitability and Losses

While Triller’s projected revenue for 2023 is estimated to be over of $250 million, the company has yet to become profitable and incurred a net loss of more than $700 million in the previous year following a series of acquisitions. These losses include $496 million of stock compensation expenses. Despite these setbacks, Triller has secured venture capital funding of more than $300 million over the past few years, which has helped fuel its growth and expansion efforts.

In addition to financial challenges, Triller is currently facing legal disputes and contractual licensing costs, which are having a negative effect on its profitability. As we delve deeper into the company’s financials, it becomes apparent that Triller’s path to profitability is fraught with obstacles. Still, the company remains undeterred in its pursuit of market dominance.

Revenue Growth and Challenges

Triller’s revenue growth trends are not publicly disclosed. However, the company’s CEO and Chairman, Mahi de Silva, has stated that Triller is on track to exceed $100 million in revenue this year. With recent acquisitions, Triller has shown impressive growth. However, it also faces challenges in achieving profitability, particularly given its legal and licensing hurdles.

In light of these challenges, Triller’s ability to maintain its revenue growth and overcome obstacles is crucial to the success of its IPO. As the company continues to face an increasingly competitive landscape, its ability to adapt and innovate will be fundamental in determining its long-term viability and profitability.

Legal Battles and Contractual Licensing Fees

Triller is no stranger to legal battles, with a current lawsuit from Universal Music Group concerning unpaid licensing fees. In response, the company removed Sony Music Entertainment, Warner Music Group, Universal Music Group, and Merlin’s song catalogs from its video app. Moreover, Triller is in a minor contractual dispute with Sony Music Entertainment for over $2 million, a matter that will be resolved in the court system.

These legal challenges and contractual licensing fees undoubtedly have an impact on Triller’s financials. As the company prepares for its IPO, it must navigate these obstacles and find a proper venue to mitigate their effect on its profitability. The outcome of these legal battles and the company’s ability to manage licensing costs will play a crucial role in shaping Triller’s future prospects in the market.

Triller’s Competitive Landscape: TikTok Rivalry and Market Position

As a short-video application, the Triller app finds itself in a competitive environment, with TikTok as its primary competitor. The company has experienced significant growth on both iOS and Android platforms, particularly in the wake of calls to ban TikTok in the U.S. Triller’s CEO has expressed concerns about the detrimental impact of TikTok on the creator ecosystem and users, further highlighting the rivalry between the two platforms.

Despite the intense competition with TikTok, Triller has managed to carve out a niche for itself in the short-video app market. Its focus on music and entertainment, combined with its efforts to recruit talent from TikTok, has helped the company strengthen its position and grow its user base.

As Triller prepares for its IPO, its ability to maintain and improve its market position will be essential in determining the success of its public debut.

Poaching TikTok Employees

Triller has implemented a strategy to attract personnel from TikTok, which includes providing financial incentives, equity, and roles within the organization. In addition to offering attractive compensation packages, Triller focuses on empowering creators and providing growth opportunities, equipping creators with the necessary tools and resources to reach their potential.

This approach has enabled Triller to bolster its foothold in the market as it continues to recruit top talent from its main competitor, including TikTok employees indicating engineers. By leveraging the expertise of these former TikTok employees, Triller is better positioned to innovate, improve its platform, and effectively compete in the fast-paced world of social media.

Comparing Features and User Base

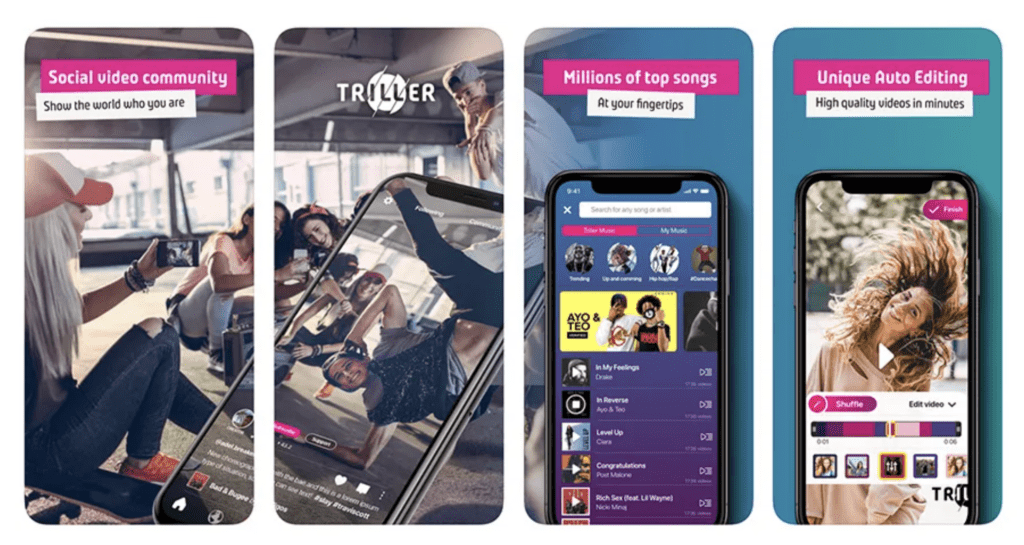

A comparison of Triller and TikTok’s features and user base reveals several similarities and differences between the two platforms. Triller enables users to create more sophisticated videos, ideal for sharing on other social media and provides a variety of editing tools and effects to make their videos unique. In comparison, TikTok edits videos manually and leverages AI to display content based on the user’s engagement and viewing habits.

In terms of user base, Triller has a comparatively smaller user base than TikTok, though it is expanding quickly. Triller’s user base is more concentrated on music and entertainment, whereas TikTok’s user base is more varied and encompasses a broad range of interests. This distinction highlights the different market segments each platform caters to and underscores the importance of Triller’s continued growth and expansion efforts as it prepares for its IPO.

Triller’s Expansion Strategy: Acquisitions and Partnerships

Triller’s growth strategy hinges on expanding its market presence through acquisitions and partnerships. In recent times, the company has acquired the Fangage platform, a fan engagement and monetization solution for creators and influencers. Additionally, Triller has launched Triller Fight Club, a live-event platform in collaboration with renowned rapper Snoop Dogg.

These acquisitions and partnerships not only strengthen Triller’s market presence but also diversify its offerings, enabling the company to cater to a broader audience and maintain its competitive edge. As Triller continues to grow and expand its reach, these strategic moves will play a crucial role in determining the success of the company’s IPO and its future growth prospects.

Key Players in Triller’s IPO: Management and Investors

Co-founder Ryan Kavanaugh

The success of Triller’s IPO will largely depend on the efforts and support of its management team and investors. Co-founders Ryan Kavanaugh and Bobby Sarnevesht lead the company’s management team, steering Triller towards its ambitious goals. Meanwhile, investors such as Proxima Media, Pegasus Tech Ventures, Mahi de Silva, Lowercase Capital, and Carnegie Technologies have provided crucial funding for the company, enabling Triller to grow and expand its offerings.

These key players will play a vital role in Triller’s public debut as they continue to support and guide the company through the IPO process and beyond. Their collective expertise, financial backing, and strategic insights will be instrumental in ensuring Triller’s success in the competitive social media landscape.

Triller IPO Timeline: When to Expect the Public Debut

The timeline for Triller’s IPO remains uncertain, with a confidential filing with the SEC and potential delays due to volatility in capital markets. As it stands, only accredited investors can invest in pre-IPO shares of Triller, a private company. The company’s listing is expected to depend on market conditions once the SEC’s review process is completed.

While the exact timeline for Triller’s IPO remains unclear, the company’s continued growth and expansion efforts, coupled with its strategic moves in the competitive landscape, provide a strong foundation for its public debut. As investors and market-watchers eagerly await updates on Triller’s IPO, the company’s ability to navigate the challenges and uncertainties that lie ahead will be crucial in determining its success.

Related Article: What Is Capital Markets? An Overview Of Instruments, Examples, And How It Works

Market Volatility and Delays

Market volatility, the degree of fluctuation in the price of a security over a period of time, may cause delays in Triller IPO date as the company waits for more favorable conditions. This volatility serves as an indicator of the level of risk associated with investing in a given security, which could impact investor confidence and the overall success of the IPO.

Summary

Triller’s journey towards its IPO has been a rollercoaster ride, with twists and turns that have tested the company’s resilience and adaptability. From a failed merger to a shift in listing strategy, Triller has demonstrated its determination to carve out its own path and secure a strong position in the competitive social media landscape. As the company prepares for its public debut, its ability to navigate the challenges and uncertainties that lie ahead, including market volatility, legal battles, and shifting market dynamics, will be crucial in determining its success.

As we await further updates on Triller’s IPO, it’s clear that the company’s journey is far from over. With a strong management team, committed investors, and a steadfast focus on growth and expansion, Triller is well-positioned to make its mark in the world of social media. As the company continues to innovate and evolve, the future of Triller’s IPO and its stock, ILLR, remains a captivating story that’s sure to keep us all on the edge of our seats.

Frequently Asked Questions

Will Triller ever go public?

Triller, co-founded by Ryan Kavanaugh and Bobby Sarnevesht, is set to possibly go public in 2023, although uncertain, and is said to be the most anticipated event of the year. Triller will eventually go public, making it a reality for all investors.

What happened to Triller IPO?

Triller is facing a lawsuit from Universal Music Group due to unpaid licensing fees. The IPO is now facing an uncertain future.

Is Triller a public company?

Triller is set to go public in 2023, indicating that it will be a public company. Co-founded by Ryan Kavanaugh and Bobby Sarnevesht, Triller distinguishes itself from other social media platforms.

What is the ticker symbol for Triller?

The ticker symbol for Triller is ILLR. The company was expecting a listing on the Nasdaq in 2022, but it didn’t arrive.

What was Triller’s initial plan for going public?

Triller’s initial plan for going public was to utilize a reverse merger through a special purpose acquisition company (SPAC). This strategy has recently become increasingly popular, as it allows companies to go public without the need for a traditional IPO.