The gaming world is abuzz with excitement, and Wall Street is taking notice as Discord, the popular communication platform, is gearing up for its highly anticipated Initial Public Offering (IPO) – the Discord IPO. The company’s impressive growth and expansion beyond the gaming community have piqued the interest of investors and tech enthusiasts alike. So, what exactly can we expect from the Discord IPO, and how can one prepare to invest in this thriving platform?

In this blog post, we’ll delve into the key information and expectations surrounding the Discord IPO, explore its growth from a gaming-centric platform to a mainstream communication tool, discuss its business model and competitors, and provide insights into the company’s equity owners and institutional investors. Strap in and get ready to learn all about Discord’s journey to the public market.

Short Summary

Discord’s highly anticipated IPO is expected to take place in 2023, with potential listing on the NYSE or Nasdaq.

Notable investors such as Tencent and Dragoneer Investment Group have shown confidence in Discord’s potential through their investments.

Analysts anticipate significant growth for Discord due to its expansion into non-gaming sectors. Investors should consider risks before investing in the upcoming IPO.

Discord IPO: Key Information and Expectations

Discord’s IPO is highly anticipated, with potential listing on the New York Stock Exchange (NYSE) or Nasdaq. However, the exact date and stock price remain unknown due to various factors. While we eagerly await Discord’s IPO date, it’s crucial to keep in mind that the company is still a privately held entity and has not yet disclosed an official IPO date or stock price. That said, the IPO is expected to take place in 2023, provided that the current S&P 500 bear market recovers.

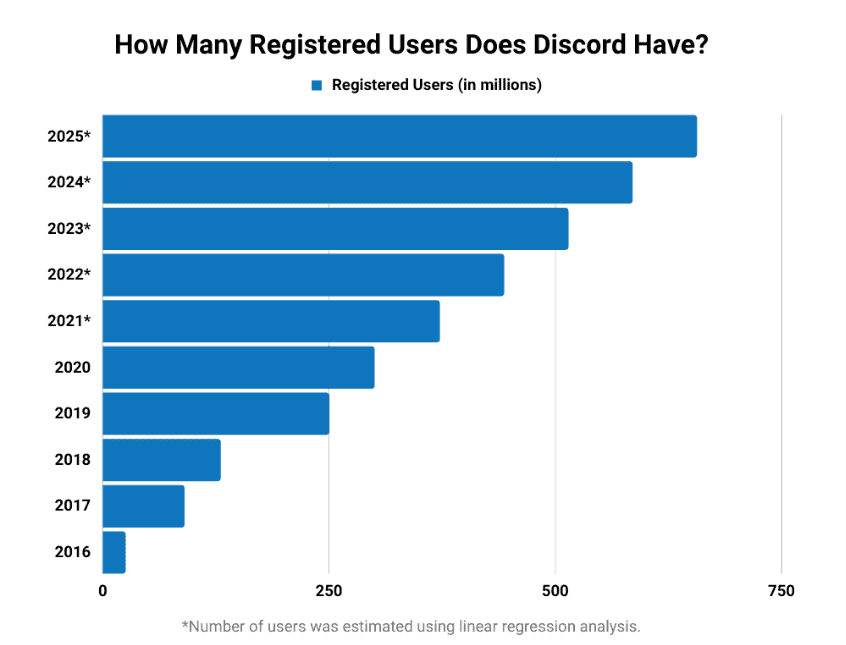

The hype surrounding Discord’s IPO is well-founded, considering the platform’s extraordinary growth in recent years. As of January 2023, Discord boasted around 563 million registered users, including both gaming and non-gaming Discord accounts. The growth and popularity of Discord among gaming and non-gaming communities have made it a highly anticipated IPO for 2023.

Potential Listing on NYSE or Nasdaq

Although no official confirmation has been made, Discord is expected to list on either the New York Stock Exchange (NYSE) or the Nasdaq exchange, both prestigious public exchanges catering to various investors. This potential listing signifies the company’s remarkable progress and its readiness to enter the public market, offering an exciting opportunity for investors looking to capitalize on Discord’s success.

Discord’s journey towards becoming discord publicly traded through listing on a public exchange would be a major milestone for the company.

The Growth of Discord: From Gaming to Mainstream

Image Source: Bankmycell

Founded in 2015 by Jason Citron, Discord initially aimed to resolve “discord in the gaming community”. Fast forward to today, and the platform has evolved beyond gaming, attracting non-gamers and experiencing a surge in popularity during the COVID-19 pandemic. This expansion has allowed Discord to tap into a broader market, fueling its growth and increasing its appeal to potential investors.

Discord’s user base has grown exponentially, boasting over 150 million monthly active users. The platform has been adopted by various communities, such as crypto traders and anime fans, for their interests. With this diverse user base, Discord’s market share is expected to continue growing, making it an attractive prospect for investors in the upcoming IPO.

| Year | Monthly Active Users |

|---|---|

| 2023 | 560 million MAU |

| 2022 | 560 million MAU |

| 2021 | 560 million MAU |

| 2020 | 300 million MAU |

| 2019 | 250 million MAU |

Expansion Beyond Gaming

In 2020, 70% of Discord’s users were utilizing the platform for purposes other than gaming. This impressive shift can be attributed to the company’s efforts to broaden its user base beyond video games. Discord has procured additional financing and undertaken a significant redesign initiative in 2020 to eliminate gaming terminology from its homepage.

As Discord continues to cater to various communities outside of gaming, its potential for growth remains strong. The platform’s ability to diversify and adapt to the needs of different users has positioned it as a promising investment in the tech industry.

Impact of the Pandemic on Discord’s Popularity

The pandemic significantly boosted Discord’s user base, reaching 150 million monthly active users and increasing revenue by 188% in 2020. As lockdowns forced people to stay at home and seek new ways to connect with others, Discord stepped up as a reliable communication platform for both gamers and non-gamers alike.

The company’s ability to thrive in such challenging times indicates its resilience and adaptability, making it an attractive investment opportunity among private companies, including tech companies, with many investors seeking its stock symbol.

Discord’s Business Model and Competitors

Discord generates revenue primarily through its subscription service, Nitro, which offers enhanced features and account customization for subscribers. However, despite its success, Discord faces competition from other platforms like Slack, TeamSpeak, and Telegram. Understanding Discord’s business model and how it stacks up against its competitors is crucial for investors considering participating in the upcoming IPO.

As a freemium platform, Discord offers a basic set of features for free while enticing users to upgrade to Nitro for additional benefits. This business model has proven successful, as evidenced by Discord’s $130 million revenue in 2020, an 188% increase from the previous year.

How Discord Generates Revenue

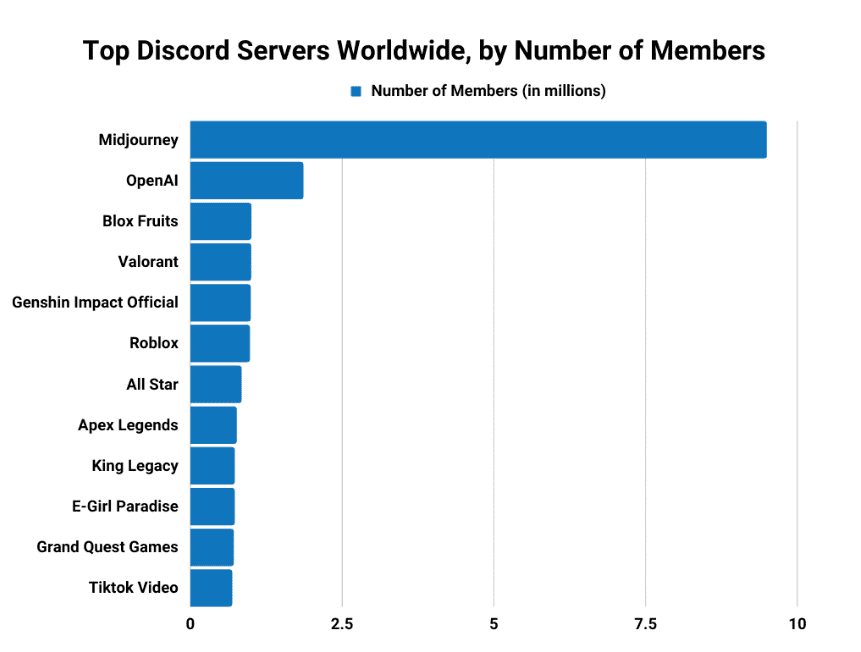

Image Source: Statista

Discord’s Nitro subscriptions offer enhanced features and account customization, contributing to the company’s revenue growth. Subscribers enjoy perks like higher-quality video, custom emojis, and improved file upload limits.

This subscription-based model has played a significant role in Discord’s financial success, with the company generating over $200 million in estimated revenue in 2021.

| Year | Discord Nitro Sales |

|---|---|

| 2023 | $207 million |

| 2022 | $208 million |

| 2021 | $173 million |

| 2020 | $120 million |

| 2019 | $70 million |

Key Competitors

Discord differentiates itself from competitors like Slack, TeamSpeak, and Telegram with its server-based communication system and low-latency Voice over Internet Protocol (VoIP). This unique approach to communication has given Discord an edge in the market, allowing it to attract a diverse user base and maintain a strong position among its competitors, making discord stock a topic of interest.

Equity Owners and Institutional Investors

Discord founder Jason Citron

Discord’s equity is held by a variety of stakeholders, including founders, employees, and notable investors such as Tencent and Dragoneer Investment Group. The company has raised over $994 million in funding, with a current valuation of $15 billion.

| Year | Valuation |

|---|---|

| 2023 (EST.) | $15 billion |

| 2022 | $10 billion |

| 2021 | $14.7 billion |

| 2020 | $7.3 billion |

| 2019 | $2.5 billion |

| 2018 | $2.05 billion |

As a private company, exact ownership percentages for Discord remain unknown. However, it’s worth noting that founders Jason Citron and Stanislav Vishnevskiy hold a substantial portion of the company’s equity. This information can help investors gauge the level of commitment and involvement of Discord’s founders in the company’s success.

Notable Investors

Discord’s notable investors include:

Tencent

Sony

Dragoneer Investment Group

Index Ventures

Franklin Templeton

Fidelity Investments

Accel

These investments have contributed to the company’s impressive $994 million in funding and its $15 billion valuation. The backing of such prominent investors is a testament to Discord’s potential and can instill confidence in potential investors looking to participate in the upcoming IPO.

Employee and Founder Ownership

Discord is a private company, so exact ownership percentages are not known. Transparency is something that companies, both public and private, strive for, but privacy is often paramount. However, it’s clear that founders Jason Citron and Stanislav Vishnevskiy possess a significant portion of the company’s equity.

Preparing for Discord’s IPO: How to Buy Shares

Investors can prepare for Discord’s IPO by exploring pre-IPO stock purchasing options and post-IPO trading platforms. While the exact date of the IPO remains uncertain, being prepared and informed about the process of buying shares can help investors seize the opportunity when it arises.

Before participating in Discord’s IPO, it’s essential for investors to understand the different options available for purchasing shares. In the following subsections, we’ll discuss the processes of pre-IPO stock purchasing and post-IPO trading.

Pre-IPO Stock Purchasing

Pre-IPO stock purchasing can be done through brokers offering access to pre-placement shares. These brokers facilitate investments in a company before its initial public offering, providing investors with an opportunity to invest in Discord before its IPO.

It’s important to research and select a reputable broker with access to pre-placement shares to ensure a smooth and successful investment process.

Post-IPO Trading

After Discord’s IPO, investors can participate in post-IPO trading through various platforms, such as Contract for Difference (CFD) trading accounts or spread betting platforms. These platforms allow investors to buy and sell shares of Discord once it becomes publicly traded.

By familiarizing oneself with post-IPO trading options, investors can be well-prepared to capitalize on Discord’s public market debut.

Analysts’ Outlook on Discord’s Future

Analysts project continued growth for Discord, but potential risks and challenges should be considered before investing. With its expansion into non-gaming sectors and strong ties to the gaming market, Discord is poised for success in the future. However, it’s essential for potential investors to:

Conduct thorough research

Consider market conditions

Evaluate competition

Assess potential risks

Growth Projections

Discord’s expansion into non-gaming sectors and strong ties to the gaming market contribute to its growth potential. With an impressive increase in registered users and a significant jump in revenue in recent years, analysts expect Discord to have a bright future.

This growth potential makes Discord an attractive investment opportunity in the upcoming IPO.

Potential Risks and Challenges

Investors should conduct thorough research and consider market conditions, competition, and potential risks before investing in Discord’s IPO. Some challenges that Discord faces include:

Privacy concerns

Security issues

Exposure to inappropriate content

Possibility of bullying and harassment

Summary

In conclusion, Discord’s IPO presents an exciting opportunity for investors to capitalize on the platform’s impressive growth and expansion beyond the gaming community. With a strong business model, notable investors, and a diverse user base, Discord is well-positioned for success in the public market.

However, potential investors should also be mindful of the risks and challenges associated with investing in Discord’s IPO. By conducting thorough research and considering market conditions, competition, and potential risks, investors can make informed decisions and seize the opportunity when Discord’s IPO finally arrives.

Frequently Asked Questions

Is Discord going to IPO?

Given its huge popularity and acquisition offers from major tech companies, it is clear that Discord is planning to go public eventually.

Can I buy shares of Discord?

Unfortunately, it is not currently possible to directly buy shares of Discord. However, it may become available in the future, as it is in the process of being acquired by a publicly traded company.

Therefore, investors should keep an eye on the market for changes in the near future.

Who owns discord?

Discord was founded by Jason Citron and Stanislav Vishnevskiy, and is currently owned by Discord Inc. As a privately held company, the majority ownership of Discord likely lies in the hands of its founders.

How much is discord worth?

Discord is currently estimated to be worth around US $15 billion, an impressive $5 billion increase from last year.

Its user base is projected to grow exponentially over the coming years, making Discord a potentially lucrative investment for the future.

Is discord publicly traded?

Discord is not a publicly traded company. It has been backed by private investors and venture capitalists since its inception, and remains privately held.

However, there are still ways to invest in Discord via platforms such as Equitybee.