As the video game industry continues to flourish, the opportunity to invest in a leading company like Epic Games becomes all the more attractive. With its wildly popular title Fortnite and the versatile Unreal Engine, Epic Games has solidified its position as a major player in the gaming world. But how can you, as an investor, capitalize on this potential goldmine? In this blog post, we’ll discuss the ins and outs of investing in Epic Games stock, from gaining exposure through other companies to the possibilities of a future IPO. Let’s dive in and explore the world of Epic Games investment!

Short Summary

Understand Epic Games and its products before investing in them.

Consider alternative methods to gain exposure to the company until an IPO occurs.

Monitor developments, use no-fee online brokerage accounts, and be prepared for when it goes public.

Understanding Epic Games: A Brief Overview

Epic Games, a privately-owned video game company, was established in 1991 by Tim Sweeney. The company has gained worldwide recognition for creating popular games like Fortnite and the cutting-edge Unreal Engine. The Unreal Engine is a game development software framework that has become an essential tool for game developers across the globe.

In addition to their game development prowess, Epic Games also operates the Epic Games Store, an integrated platform for the development, distribution, and operation of games and other digital content.

As a private company, Epic Games is not publicly traded and does not have a stock symbol or stock price. Instead, the company has relied on major investments from venture capital firms like Tencent Holdings, Lightspeed Venture Partners, and Smash Ventures, as well as early investors like LEGO Group and T. Rowe Price.

With the company’s impressive portfolio and the potential for future growth, investing in Epic Games seems like an attractive proposition – but how can you do it?

Is Epic Games Stock Available for Investment?

Unfortunately, Epic Games stock is not accessible to investors at the moment. As a private company, its shares are not available for purchase on any stock exchange or through a brokerage account.

However, there are ways to gain exposure to Epic Games before it goes public. Investors can acquire shares of Tencent Holdings, invest in the ARK Venture Fund at Titan, or invest in Sony, all of which have a stake in Epic Games.

The initial public offering (IPO) of Epic Games remains uncertain, but it is an event eagerly anticipated by investors who want to buy Epic Games stock directly. Until then, retail investors can explore alternative methods to gain exposure to the company and its growth potential.

Epic Games IPO Possibilities

The possibility of an Epic Games IPO has stirred considerable interest among investors, given the company’s prominent position in the gaming industry and its powerful software, the Unreal Engine. The IPO process typically involves filing an S-1 form with the Securities and Exchange Commission (SEC), followed by an IPO date a month or two later. Alternatively, Epic Games could opt for a direct listing, which allows existing shares to be placed on public markets without raising new capital.

There are potential obstacles to an Epic Games IPO, such as Tencent Holdings owning 40% of the company and Tim Sweeney holding a majority stake, which could make relinquishing control a challenge. Furthermore, market conditions like rising interest rates, a slowing economy, and banking sector issues could cause Epic Games to delay its IPO until the market conditions are more favorable.

For now, investors must keep an eye on any developments and consider alternative ways to gain exposure to Epic Games.

Gaining Exposure to Epic Games Stock

While direct investment in Epic Games is not possible at this time, there are ways for investors to gain exposure to the company before it goes public. Investing in major shareholders like Tencent Holdings or Sony can provide exposure to Epic Games’ growth potential.

Additionally, investors can consider alternative video game stocks as a means to participate in the thriving gaming industry. Let’s explore these options in more detail.

Investing in Tencent

Tencent Holdings is a multinational Chinese conglomerate. It is the world’s largest video game company and holds a 40% stake in Epic Games. By investing in Tencent, investors can indirectly gain exposure to Epic Games’ growth and success. Tencent’s revenue has grown exponentially over the past three years. In 2020, its revenue was $69 billion, which rose to over $100 billion in 2023, illustrating its strong performance.

However, there are risks associated with investing in Tencent. The company has ties to the Chinese Communist Party, which could be a source of moral concern for some investors. Additionally, Tencent has invested in a wide range of companies, including the Chinese super app WeChat and U.S. game developer Activision, which may dilute the direct impact of Epic Games on Tencent’s stock performance.

Investing in Sony

Another option for gaining exposure to Epic Games is by investing in Sony Corporation, a Japanese multinational conglomerate that specializes in electronics, gaming, and entertainment. Sony is a major player in the video game industry, with its popular PlayStation gaming brand dominating the market.

When considering an investment in Sony, it’s crucial to analyze the company’s financial performance, competitive advantages, risks, and challenges. Researching Sony’s current and future products, market share, and potential for growth is recommended. Additionally, investors should take into account Sony’s dividend policy and stock price history.

Alternative Video Game Stocks

For investors seeking exposure to the gaming industry without directly investing in Epic Games, there are alternative video game stocks to consider. Activision Blizzard and Electronic Arts. Arts are two widely-held video game stocks that have demonstrated success and offer a range of investment opportunities in the gaming sector.

Activision Blizzard is known for creating popular gaming franchises like World of Warcraft, Overwatch, Call of Duty, and Candy Crush. The company has experienced growth and offers dividends with a yield of 0.61% in 2022.

Electronic Arts, on the other hand, is famous for titles such as Star Wars, NFL, FIFA, Need for Speed, Apex Legends, The Sims, UFC, Medal of Honor, and NHL. Both companies provide investors with a variety of options to participate in the booming gaming industry.

Assessing Epic Games’ Financial Performance

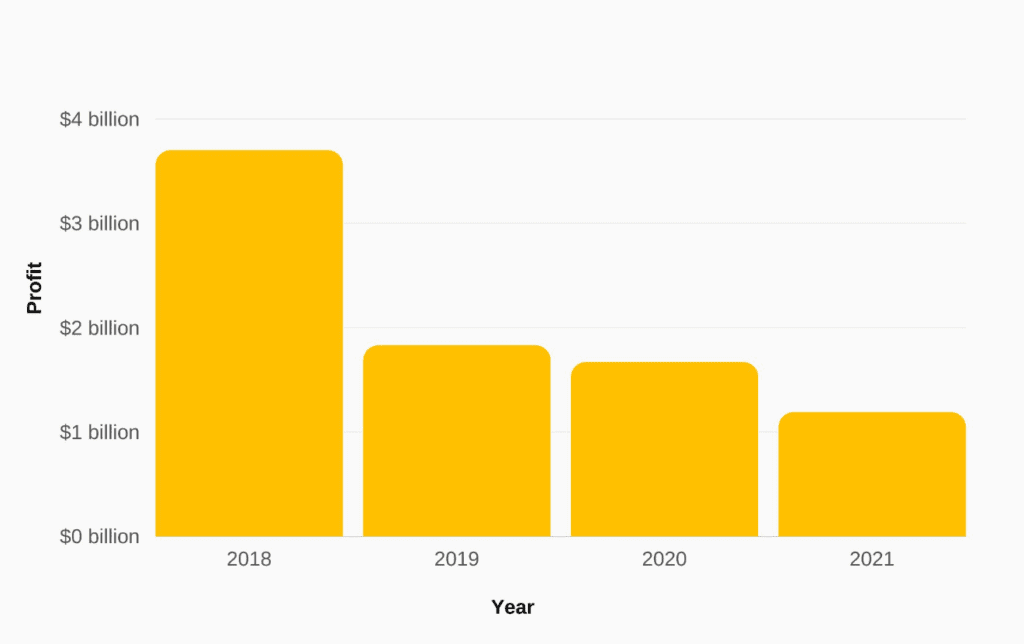

Epic Games gross profit. Source

Information on Epic Games’ finances is limited. However, documents from Apple reveal that the company experienced losses ranging from $100 million to $200 million annually from 2019 through 2021. These losses were due to Epic Games investing heavily in new products and expanding its Epic Games Store.

Despite these losses, the company recorded a gross profit of $1.19 billion in 2021, representing a decrease of -28.74% from the previous year. The projected gross revenue for Epic Games in 2022 is estimated at a staggering $6.27 billion.

With such impressive figures, it’s clear that the company has the potential for growth and profitability in the future. However, the lack of publicly available financial information means investors must carefully weigh the risks and rewards of investing in Epic Games.

Valuation

| June 2012 | $825 million |

| July 2018 | $4.5 billion |

| December 2018 | $15 billion |

| April 2022 | $32 billion |

The Potential of Unreal Engine

The Unreal Engine, developed by Epic Games, is a powerful 3D computer graphics game engine that provides creators with the ability to develop cutting-edge content, interactive experiences, and immersive virtual worlds. Its user-friendly interface and comprehensive set of tutorials have made it a popular tool for game developers worldwide.

But the potential of the Unreal Engine extends beyond video games. The engine can be utilized for various purposes, including film and television production, training and simulation, industrial design, scientific research, medical applications, website design, app development, and engineering. This versatility and adaptability make the Unreal Engine a growing moneymaker for Epic Games and a significant factor in the company’s future success since they can charge businesses and creators to use the application.

Risks and Challenges Facing Epic Games

Epic Games faces several risks and challenges that could impact its growth and profitability. One significant challenge is the ongoing dispute with Apple, which led to the removal of Fortnite from the App Store. While it appears that the removal has not had a notable effect on demand for Fortnite, the long-term impact on Epic Games’ sales remains uncertain.

Another challenge lies in the competitive nature of the video game industry. Consumers in this market have low switching costs, meaning they could quickly switch to a new game when a more popular one is released. To remain successful, Epic Games must continue to innovate and create captivating experiences that keep players hooked and engaged.

Pre-IPO Investment Options for Accredited Investors

For accredited investors in the U.S., investing in Epic Games pre-IPO is possible through the Titan app with a minimum investment of $500. Other pre-IPO investing platforms like EquityZen, Linqto, and Forge Global are also available to accredited investors. These platforms allow investors to invest in pre-IPO options, gaining exposure to Epic Games before it goes public.

It’s important to note that pre-IPO shares are only offered to accredited investors due to the lack of publicly filed financials with regulators, which increases the risk to investors. As such, these investment opportunities are not suitable for everyone and should be carefully considered by those who qualify as accredited investors.

Retail Investor Strategies for Epic Games Investment

Once Epic Games goes public, retail investors can buy its stock using a no-fee online brokerage account like eToro or M1 Finance. Although the exact IPO date is unknown, it’s wise to monitor developments and be prepared to invest once the stock becomes available.

It’s important to remember that wealthy clients at top investment banks typically get access to IPO shares, while lower-demand IPOs may be available to retail investors with participating brokers.

Summary

In conclusion, investing in Epic Games – the powerhouse behind Fortnite and the Unreal Engine – presents a compelling opportunity. While direct investment is not currently possible, there are ways to gain exposure to the company and its growth potential through investments in Tencent Holdings or Sony, as well as exploring alternative video game stocks like Activision Blizzard and Electronic Arts. As the video game industry continues to thrive, investors should keep a close eye on Epic Games and be prepared to seize the opportunity once it becomes available.

Frequently Asked Questions

Is Epic Games a publicly traded stock?

No, Epic Games is not a publicly traded stock. While Epic Games has large investors such as Tencent and Tim Sweeney, the company is still privately held and shares are not available to the general public.

Where can I buy Epic Games stock?

Unfortunately, you cannot purchase Epic Games stock directly as it is not publicly traded. Accredited and institutional investors are the only ones who can invest in the company.

If you qualify, you may be able to find a willing shareholder to trade their shares.

How much does Epic Games make in a month?

With current financial records, it is reported that Epic Games makes about $40 million in revenue per month.

Who owns Epic Games?

Tim Sweeney and Tencent – Epic Games is owned by two entities, its founder Tim Sweeney and Chinese video game company Tencent. Tim Sweeney holds over 50% of the company, while Tencent owns 40%.