With a rich history and undeniable worldwide brand value, the Lego Group has proven itself as a powerhouse in the toy industry. Have you ever wondered about the possibility of investing in this iconic company? In this blog post, we’ll explore the ins and outs of Lego’s stock availability, market success, and other investment opportunities related to Lego stock. Get ready to dive deep into the world of plastic building blocks and uncover the potential of investing in Lego and other toy companies.

Short Summary

Lego is a privately held company, and therefore its stock is not publicly available for purchase.

Investors can invest in Lego products by purchasing collectible sets and storing them properly to increase their value on the resale market.

Alternative toy company stocks such as Hasbro (NASDAQ: HAS), Mattel (NASDAQ: MAT) and Roblox (NYSE: RBLX) offer investors diverse opportunities for portfolio diversification.

Is Lego Stock Available?

If you’re contemplating investing in Lego, there’s a crucial piece of information you need to know. Lego is a privately held company, which means that its stock is not available for purchase on any stock exchange. The Kristiansen family and the Lego Charitable Foundation own 75% and 25% of the stocks respectively, making it hard to imagine them giving up control.

So, what does this mean for those looking to invest in this popular toy brand? Investing in Lego is not an option, but there are still ways to benefit from the company’s success. For example, you can invest in companies that produce Lego-compatible products, or you can invest in companies that are related to the toy industry. You can also invest in companies that are doing well.

The Lego Group’s Ownership Structure

The ownership structure of the Lego Group consists of KIRKBI A/S, a holding company owned by the Kirk Kristiansen family, holding 75% of the stocks, and the Lego Foundation holding the remaining 25%. This means that the Kristiansen family, who established the company in 1932, still retains control over the business.

With such a strong family influence, it’s unlikely that they would be willing to relinquish control by taking the company public.

Lego Stock IPO Possibilities

There are no plans for an Initial Public Offering (IPO) for Lego as of the current ownership structure. Therefore, no IPO is forthcoming in the near future. While an IPO could potentially provide increased liquidity, broader access to capital for expansion and product development, and an opportunity for the Kristiansen family to diversify their investments, it seems that maintaining control over the company is a higher priority for the family.

As a result, those looking to invest in Lego will have to consider alternative avenues.

Lego’s Market Success

Despite the lack of stock availability, Lego’s market success is undeniable. The company has reported significant growth in recent years, with consumer sales increasing by 22% between 2020 and 2022, and revenues growing by 27% during the same period.

This impressive growth, fueled in part by the COVID-19 pandemic, has placed Lego in the 92nd position in Forbes’ Top 100 Most Valuable Brands in the World for 2020. But what factors have contributed to this success?

Iconic Partnerships

One key contributor to Lego’s market success is its ability to form iconic partnerships with popular franchises such as Star Wars, Harry Potter, and Marvel. These collaborations have allowed Lego to adapt its product offerings to align with popular culture, ensuring that the brand remains relevant and appealing to consumers.

As a result, Lego has been able to maintain its position as a top toy company, even in the face of increased competition and changing consumer preferences.

Digital Innovations

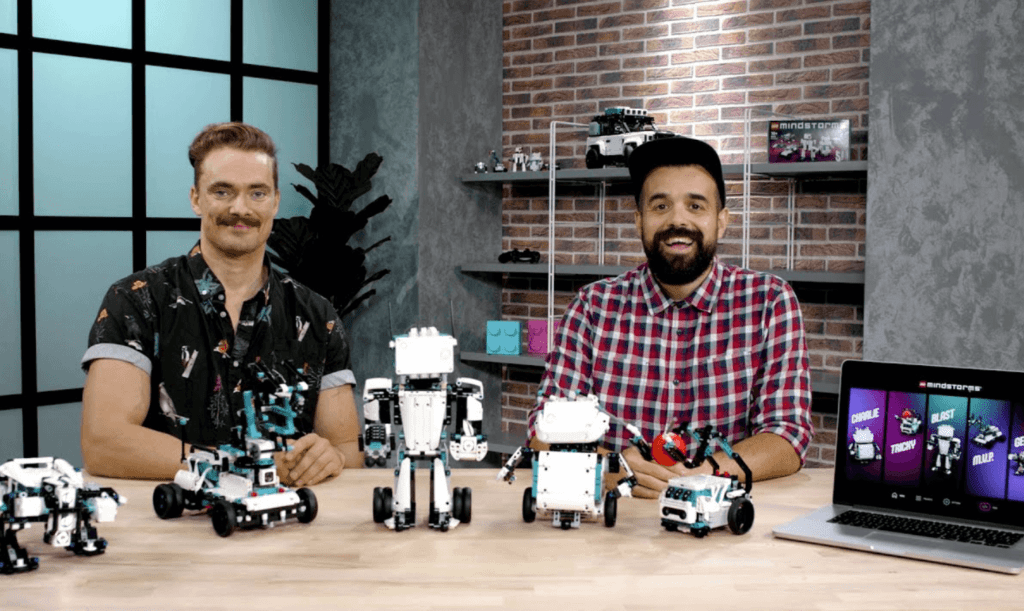

In addition to its iconic partnerships, Lego has also embraced digital innovations to maintain its market success. The company formed an alliance in 1984 with the MIT Media Lab at the Massachusetts Institute of Technology. This was to investigate the possibility of incorporating intelligence and behavior into play. This partnership brought together the Lego building system with robot technology to develop Mindstorms in 1998. It was an intelligent Lego brick that combined these elements for the first time.

By continually embracing new technology, Lego has been able to stay ahead of the curve and maintain its position in the ever-evolving toy industry.

Investing in Lego Products

While investing in Lego stock may not be an option, there is another way to invest in the company: by purchasing Lego products themselves. Collectible Lego sets can be highly profitable investments, as their value in the resale market often increases significantly after they are retired.

By identifying valuable sets and storing them properly, investors can potentially maximize their profits when selling their Lego collectibles.

Identifying Valuable Sets

To identify valuable Lego sets, it’s important to consider factors such as age, rarity of pieces, and condition of the set. Additionally, researching the current market value of the set can provide valuable insight into its worth and potential for profit. Websites like BrickLink and BrickSet can be useful tools in determining the value of sets by offering information on historical sales prices and current market prices for new and used sets.

By carefully selecting sets with high potential for profit, investors can increase their chances of success in the Lego resale market.

Storing and Selling Lego Collectibles

Proper storage of Lego collectibles is crucial in maintaining their condition and value. It’s advisable to keep sets in a cool, dry place away from direct sunlight, and to store them in their original packaging if possible.

When it comes to selling Lego collectibles, researching the current market value and listing the set on a reliable marketplace, such as eBay or BrickLink, can help investors maximize their profits. By following these best practices for storing and selling Lego collectibles, investors can effectively capitalize on the potential value of their Lego investments.

Alternative Toy Company Stocks

For those interested in investing in the toy industry but unable to purchase Lego stock, there are alternative toy company stocks to consider. Companies like Hasbro (NASDAQ: HAS), Mattel (NASDAQ: MAT), and Roblox (NYSE: RBLX) offer opportunities for investment in the stock market. Each of these companies has its own unique strengths and potential for growth, making them attractive options for investors looking to diversify their portfolios.

Hasbro (NASDAQ: HAS)

Hasbro, a major toy manufacturing corporation, owns popular franchises such as Transformers and My Little Pony. The company’s stock (NASDAQ: HAS) has experienced varying levels of fluctuation over the past year, but its diverse product offerings and well-known brands make it an appealing option for investors interested in the toy industry.

By investing in Hasbro, investors can gain exposure to a wide range of popular toy brands and potentially benefit from the company’s continued success.

Mattel (NASDAQ: MAT)

Another alternative toy company stock is Mattel (NASDAQ: MAT), a publicly traded corporation that manufactures iconic toys such as Barbie and Hot Wheels. Mattel’s portfolio also includes well-known brands like Fisher Price, American Girl, and Mega Blocks.

With a stock price of $18.08 as of June 4th, 2023, and a market capitalization of $6.4 billion, Mattel offers investors an opportunity to invest in a diverse range of popular toy brands with a strong market presence.

Roblox (NYSE: RBLX)

A fast-growing platform with over 202 million monthly active users, Roblox (NYSE: RBLX) presents a unique investment opportunity in the toy industry. Often considered the digital equivalent of Lego or the Lego of the future, Roblox offers family-friendly content in a Massive Multiplayer Online Game (MMOG) where users can create virtual worlds and participate in user-generated games.

By investing in Roblox, investors have the potential to reach a large, young, and family-friendly customer base similar to that of Lego, providing an exciting opportunity for growth.

Summary

In conclusion, while investing in Lego stock may not be possible due to the company’s privately held status, there are still opportunities for investment in the toy industry. By investing in Lego products or alternative toy company stocks like Hasbro, Mattel, and Roblox, investors can tap into the potential growth and success of these popular brands. As the toy industry continues to evolve and adapt to changing consumer preferences and technological advancements, savvy investors can capitalize on these opportunities to diversify their portfolios and potentially generate significant returns.

Whether you choose to invest in Lego products or alternative toy company stocks, it’s clear that the toy industry offers a wealth of opportunities for growth and profit. As you embark on your investment journey, remember to carefully consider your options, research the market, and make informed decisions that align with your financial goals. Happy investing!

Frequently Asked Questions

Can you invest in Legos?

Yes, you can invest in LEGOs. Studies have indicated that the market prices of retired LEGO sets have consistently grown at least 11% annually, surpassing the average returns for gold and other investments.

This makes investing in LEGOs an attractive option for many investors.

Is LEGO private or public?

LEGO is a private company, owned by the Kirk Kristiansen family since its founding in 1932.

Is lego publicly traded?

Lego is not publicly traded, as it is owned privately by the Kristiansen family and the Lega Charitable Foundation. There is no Lego stock price available since the company is not listed on any stock exchange.

However, investors can still purchase stocks of other companies in the toys market such as Hasbro, Mattel and Walt Disney.