Earnings season is always exciting for the trading world. The results of this time of year often dictate the future price movements of stocks for weeks or months to come. They set the tone for a company’s profitability and performance. But there is one aspect that appeals to many traders. Volatility. The kind of moves that can pay for six months of rent in ten minutes or leave you utterly, “rekt”.

It’s impossible to know what a company’s earnings are looking like without insider information. Traders will spend days or weeks gleaning over all available data for some kind of hint about which direction a stock will move after their earnings are released. It’s a ritual that has been hardened in the trading psyche of Wall Street at this point. Take positions, wait for earnings release, and see what happens in the next trading session and after hours/pre-market. Volatility goes both ways and it can result in your position becoming compromised or provide you with wealth.

With options there is a greater appeal since you have to risk relatively little to profit. Buying $1,000 of options on a position versus buying a $50K position. If a stock moves against you then you are out big if you’re holding the actual stock. I’ve fallen into this before, as I am confident that many others have.

There are wizards out there showing their hand prior to earnings. “Someone always knows something.” Cheddar Flow has been instrumental in identifying where the market thinks a stock is going. Before I sing their praise, there is one big thing to understand.

Seeing a large option buy for a stock doesn’t mean blindly follow it. Cheddar Flow is picking up on all option flows, including large institutional orders. This means that a 10,000 call order you just saw might be a hedge on a mammoth short position. Look for confluence, multiple buys indicating direction, and pay attention to the flow that is directly contrary to sentiment. It also doesn’t hurt to review prior earnings reports (sec.gov) to see what comments were left during the last earnings about the company’s future growth.

US Steel Earnings

US Steel (X) has been in a massive downtrend since the trade war began. It’s down ~75% from the peak in 2018. Earnings was coming up for the end of October and as US Steel tested Its oldest monthly support, Cheddar Flow picked up contrary sentiment (marked “unusual”) that was completely against the trend. Every bear on the market wanted to short US Steel because that has been the trend for the last two years.

As we can see, these were counter trend and overlapped with the earnings date. Additionally, there was a setup from a technical analysis perspective and the trade talks “seemed” to be making some headway. Ergo, some people decided it was time to gamble on the opposite direction of trend. US Steel beat earnings and the stock rallied.

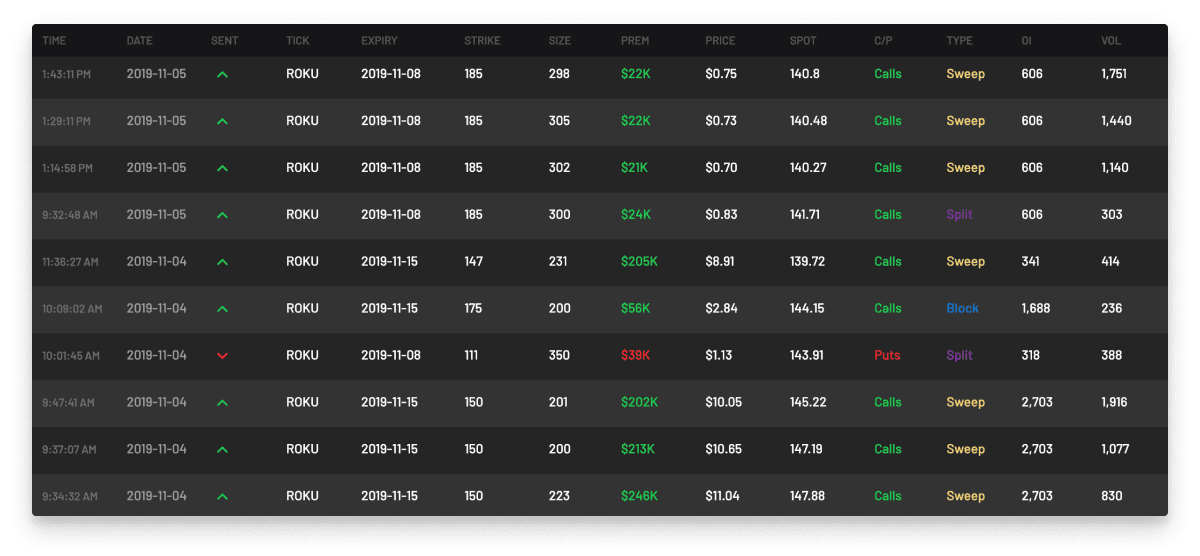

Roku Earnings

Roku (ROKU) has been everyone’s favorite stock over the last couple months as it soared to new highs. Eventually all stocks have a bad day and Roku had theirs gapping down 16%. Unfortunately, when we looked at the flow, it didn’t really give us a correct direction. Sometimes it pays to be a contrarian when everyone is long. In the week leading into earnings, the order flow was overwhelmingly bullish and no bearish plays were standing out. This was a tough play.

But reading through the flow you can see how bullish the grand population was and the bears were ready to capitalize on it. Cheddar Flow is an excellent sentiment gauge and can show you when a trade is getting too crowded. So when reading through the tape, you need to apply some critical thinking and entertain the opposite sentiment case as well.

GrubHub Earnings

Grubhub (GRUB) had some very bad earnings. They gapped down 25%. “Oof” is an understatement. No one saw it coming….except for these wise guys who were caught in the flow buying puts prior to earnings. They made off quite well. Another win for Cheddar Flow users.

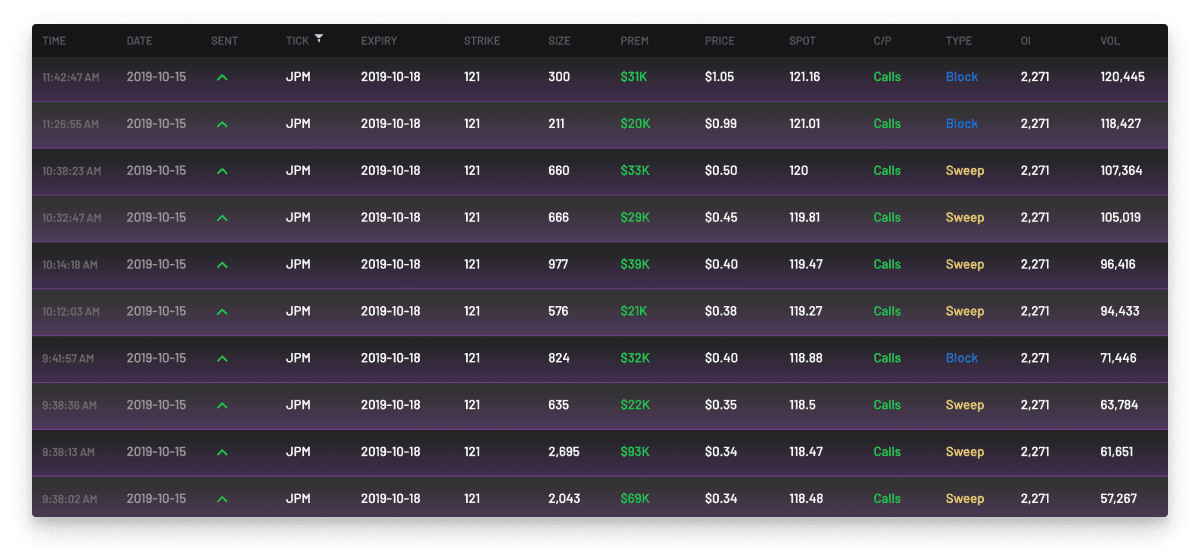

JPMorgan Earnings

JPMorgan Chase (JPM) was one of my best trades this month. Casual observation on the monthly chart showed a range that was prime for a breakout. The flow showed us the way…

These were “unusual” calls that were big time bullish. “Unusual” is defined on Cheddar Flow as size and or volume being greater than the open interest with the trades having increased implied volatility. Implied volatility is very important when examining earnings options plays and should not be ignored as it can show you what the market is pricing in. JPM is up 14% from earnings and on the day after, there was a nice 4% jump netting all of the bulls some excellent profits.

Hopefully these examples have shown you some perspective for your earnings plays. Big players always have to show their hands to profit and Cheddar Flow allows you to visualize sentiment, and possible price targets to explore. However, always remember to do your homework going into any trade and dont just blindly follow option order flow. You can try Cheddar Flow for free for 7 days!