2020 has been off to a rough start as equity markets caught their own form of Corona Virus with SPY plunging from highs at $338 down to $217 at the lowest in futures trading. This volatility wiped out the entire bullish impulse we have seen since December 2018. The panic was real and this downward spiral was felt around the world.

Knowing how to profit from the volatility is not always easy when you’re looking at such strong downward momentum in a fearful environment. Profit often comes from being the contrarian in the face of an overwhelming trend.

The SPY Bottom?

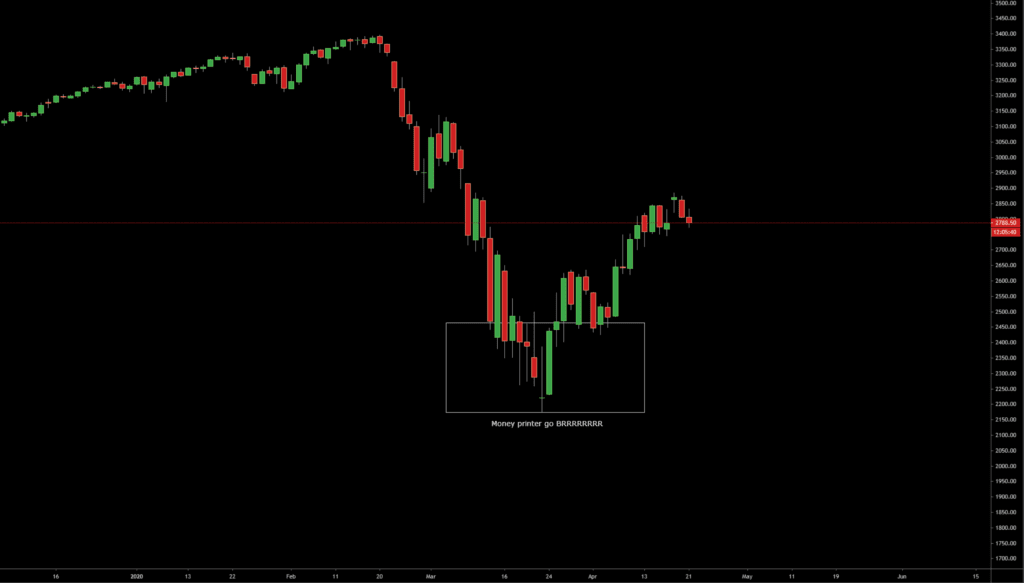

We want to look at a specific date of ranges that I like to refer to as the money printing box. This is the bottom we saw where the Fed started injecting large amounts of funds into the market to stem the bleeding. For now, it worked. The only question now is if this is “the bottom” or do we have more downside coming.

Looking at this chart, we can see that buyers started stepping in after we breached the 100% retracement from the 2018 Christmas dump. If you monitored the flow on Cheddar Flow at this time, there was some unusual orders to take note of.

Highly Unusual Order Flow

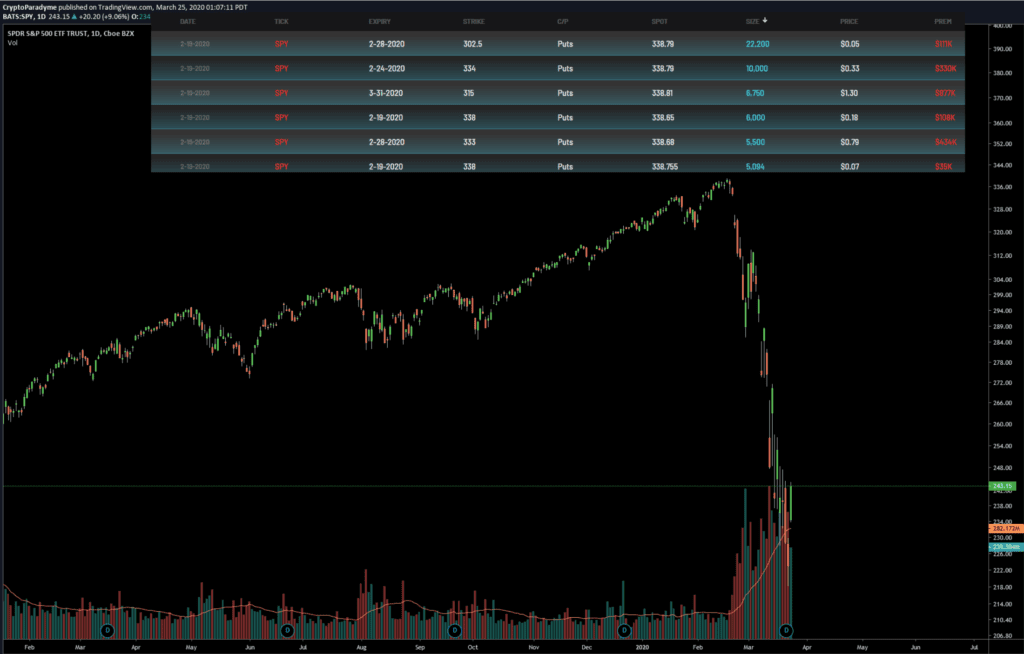

Finding an entry requires vigilance, even for myself it was pretty hard to not be bearish after 2 weeks of punishment and put buying. A casual observation of the highly unusual call flow during the bottoming showed that the flow during this period was signaling a swing in the market.

Cheddar Flow defines highly unusual orders as:

“Highlighted in blue, these are very aggressive orders that have very large size, expire soon and are far out of the money. Similar to unusual orders, these are a very good indicator to understand if it’s more of a pure bullish or bearish bet.“

Assets never go straight down forever, there are always bounces in between. Following this flow would have helped provide you with conviction toward a bottom reversal thesis. Moreover, these also yielded very well, particularly if you covered your downside.

Now if you were looking to short the SPY following the run it had to the start of the year, the highly unusual flow in February would have provided you with an interesting thesis to do so.

Final Thoughts

Spotting volatility setups with CheddarFlow is an art that takes careful consideration and patience. The setups often take time to play out and the flow indicating market direction doesn’t show up all in one day, which is why during bottoming or topping periods it’s important to view multiple days on the historical flow section.

Personally, I tend to review these at market open on Monday and market close on Friday to get a feel for potential direction. Additionally, I like to pay attention to the highly unusual order flow simply because it shows up at major market pivots. It is one of Cheddar Flow’s most useful tools and you wont find a feature like this anywhere else.

Cheddar Flow is free to try for seven days. Follow me on twitter @CryptoParadyme