To kick off our new series, we’d like to discuss combining options order flow with a channel pattern. This pattern is one of the easiest techniques to implement and one of the most overlooked. Let’s quickly define two main characteristics of this pattern that we enjoy seeing.

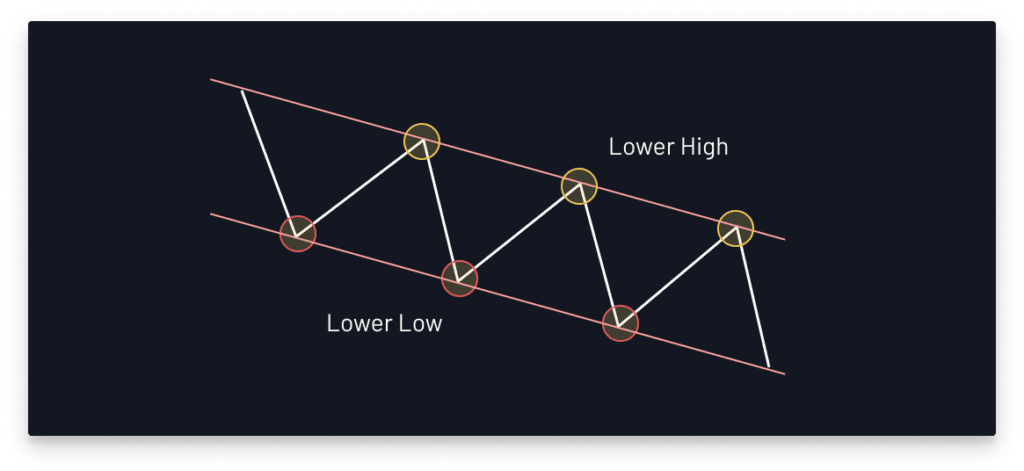

Descending Channel

Also known as a “bearish channel”, the idea here is that the stock is in a general bearish trending pattern that is creating consecutive lower highs and lower lows. Look for a potential breakout to the upside or downside by penetration of either the upper or lower trend line. When drawing this pattern, make sure the trend lines run parallel together in a downward sloping channel.

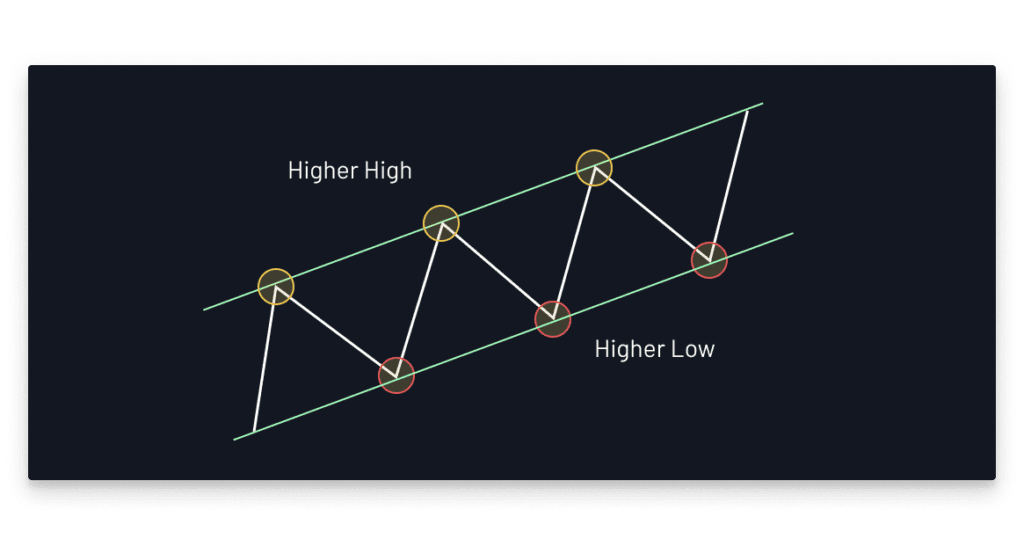

Ascending Channel

Also known as a “rising channel”, the idea here is that the stock is in a general bullish trending pattern that is creating consecutive higher highs and higher lows. Look for a potential breakout to the upside or downside by penetration of either the upper or lower trend line. When drawing this pattern, make sure the trend lines run parallel together in an upward sloping channel.

Descending Channel & Options Flow

Smart money loves to come into this pattern when they are looking for a bullish breakout to the upside. In order to watch for these types of signals, closely monitor the options order flow activity and get validation on any potentially strong bullish moves.

For example, Sea limited (SE) was in a 3-month descending pattern and looked prime to have a strong rip to the up side. The month of October showed the greatest sign of a bullish reversal play. We noticed an incredible amount of unusual call activity coming in on Oct 8 and Oct 22 at the time the stock was teetering on the lower trend line. It was evident that smart money was positioning themselves for a strong move to the upside, signaling the validation we were looking for.

The momentum continued and once again, we saw strong call sweep activity on Oct 29 which resulted in a powerful bullish break out of the descending channel.

Ascending Channel & Options Flow

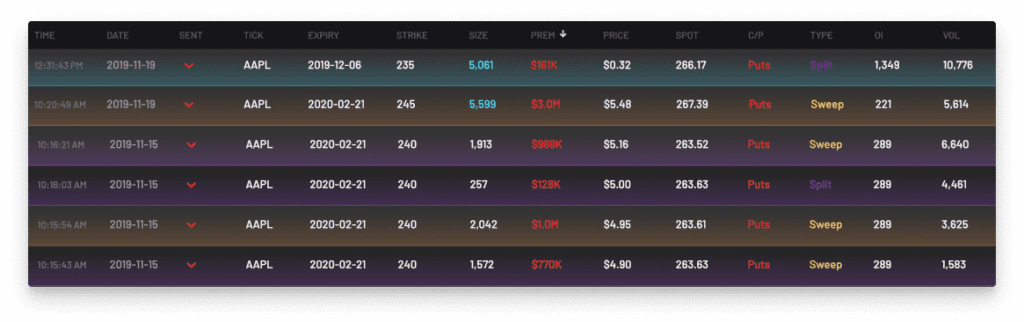

In the month of November, Apple (AAPL) had a very strong bullish run for a little more than 2 weeks that put it in a perfect rising channel pattern. After such a strong push to the upside, it was only a matter of time before we would see bears take control and hammer this stock down.

November 15th saw very large and unusual put activity starting to come in that we haven’t seen since the start of the month. On the 19th, when the stock reached the upper trend line, we saw a very large $3 million put order come in that gave us validation of a possible hard reversal and channel breakdown.

Final Thoughts

The purpose here is to demonstrate a general understanding of how powerful technical analysis and order flow can be together. Never follow order flow blindly. Put a plan together with whatever strategy you use to increase your chances of a winning trade.

Additionally, pattern setups like the ones we mentioned can help create a more narrow focused watchlist. Stay patient and wait for validation with order flow. If you’re looking for charts that automatically draw this pattern for you, head over to Finviz or Thinkorswim.