What is After-Hours Options Trading?

After-hours options trading is a type of trading where options contracts are bought and sold outside of regular market hours.

This can be done either through:

Is it possible to trade options after hours?

Yes, you can trade options after hours. However, it is not as common as trading during regular market hours. The most common options trading hours are from 9:30 AM to 4:00 PM EST.

Some brokerage firms offer extended trading hours (after 8:00 PM EST).

When you trade options after hours, you are essentially trading with other traders who are also willing to trade after hours.

This means that:

Liquidity may be lower.

Spreads may be wider than they are during regular market hours.

Though: You may be able to get better prices — if you are willing to take on more risk.

How late you can trade options

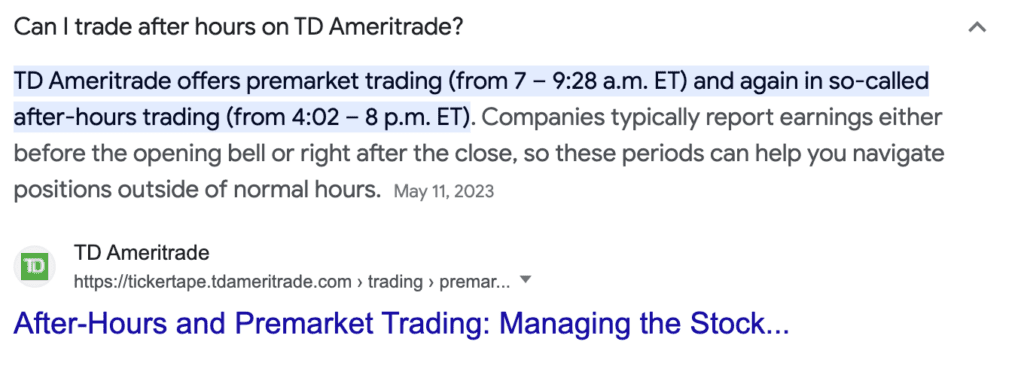

Most firms offer extended trading hours until 8:00 PM EST. However, they vary from one firm to another.

We recommend to first contact your brokerage firm to confirm their hours of operation.

These firms offer extended trading hours:

Charles Schwab

TD Ameritrade

E*TRADE

Fidelity

Interactive Brokers

Can I buy options before markets open?

Yes, you can buy options before the market opens. This is called pre-market trading.

Pre-market trading typically starts around 7:25 AM EST.

It usually runs until 9:30 AM EST.

Related Article: How many trading days in a year

Pre-market trading is a good opportunity to get an early start on your trading day.

Keep this in mind when you buy options before markets open:

The liquidity is lower in the pre-market, so it may be more difficult to get filled at your desired price.

The spreads are wider in the pre-market, so you will pay more in commissions.

There is less price transparency in the pre-market, so it is more difficult to get a good idea of what the market is doing.

Can options be exercised after hours?

Yes, options can be exercised after hours. The process may vary depending on the brokerage firm. In general, you will need to contact your brokerage firm after hours to exercise your options. They will then work with the options clearinghouse to process your request.

After-Hours Trading: Pros & Cons

Is it even worth trading after hours? Let’s have a look.

Below is our quick list of pros and cons of trading options after markets close.

Pros

More flexibility: You can trade options when it is convenient for you, even if you are not available during regular market hours.

Potential for better prices: If you are willing to take on more risk, you may be able to get better prices after hours.

Cons

Lower liquidity: The liquidity may be lower after hours, which means that it may be more difficult to get filled at your desired price.

Wider spreads: The spreads may be wider after hours, which means that you will pay more in commissions.

Increased risk: The risk may be higher after hours, as the market is less liquid and there is less price transparency.

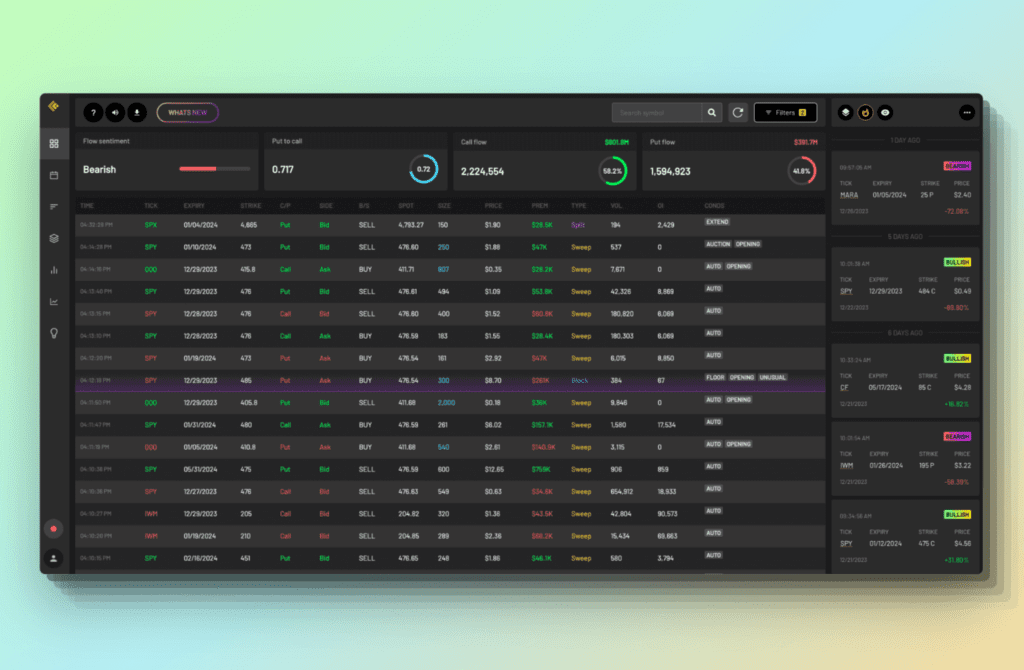

Trade after-hours with the right tool

Now you know what after-hours trading is… But are you ready to start trading? Cheddar Flow has your back.

After-Hours Trading Challenges:

Markets move quickly and there’s no time to waste.

Need for real-time data and advanced analysis tools.

Importance for Traders:

Access to current market trends and movements.

Make informed decisions outside standard trading hours.

Cheddar Flow: A Solution for Traders

Provides comprehensive options flow data and market insights.

Intuitive platform for monitoring real-time options trading activity.

Helps traders understand market sentiments and potential price movements.

Essential for staying ahead in after-hours trading.

Equips traders to navigate market complexities effectively.

So, what are you waiting for? Join us, and let’s make trading easier and more fun.