Imagine a world where electric vehicle (EV) stocks skyrocket, bringing colossal gains for investors. Is it possible for NIO stock, a prominent player in the EV market, to reach $1000 per share? In the ever-evolving landscape of electric vehicles, companies like NIO are striving to make their mark. This article delves into the factors that could propel NIO stock towards the lofty goal of $1000, from China’s booming EV market to innovative products and ambitious global expansion plans. But, can NIO stock reach 1000?

As you embark on this electrifying journey, keep in mind that the path to success is often riddled with challenges. In NIO’s case, intense competition, supply chain disruptions, and government regulations may impede its progress. Nevertheless, understanding these hurdles and the company’s financial performance can provide valuable insights for investors considering NIO as a long-term investment and pondering the question, “can NIO stock reach 1000?”

Short Summary

Investors should consider the potential of NIO stock to reach $1000 per share, taking into account risks and rewards.

China’s rapidly growing EV market presents an opportunity for NIO to capitalize on its innovative products and services.

Investors must weigh long-term growth potential against short term volatility when making investment decisions.

The Potential for NIO Stock to Reach $1000

Source: MarketWatch

The EV market is experiencing unprecedented growth, and NIO is at its forefront. The potential for NIO stock to reach $1000 per share hinges on a variety of factors, such as the expansion of China’s EV market, product innovation, and global expansion. Investors should be aware of the milestones on the path to $1000, such as reaching $500 by 2028 and $100 by 2030, as these milestones are crucial stepping stones in NIO’s growth.

However, reaching $1000 per share is not guaranteed, as investing in NIO stock involves both risks and rewards. To maximize profits and minimize losses, investors must carefully weigh the potential for long-term growth against the likelihood of short-term volatility. Equipped with the knowledge of NIO’s strengths and weaknesses, investors can make an informed decision on whether to buy NIO stock.

China’s Expanding Electric Vehicle Market

The Chinese EV market is rapidly expanding, with electric vehicles currently comprising one-fourth of cars sold in the country. Government support plays a vital role in this growth, as initiatives such as grants, charging infrastructure, and license plate incentives all contribute to a favorable market environment.

According to Mordor Intelligence, the China Electric Vehicles Market size is expected to grow from USD 260.84 billion in 2023 to USD 575.56 billion by 2028, at a CAGR of 17.15% during the forecast period (2023-2028).

As one of the key players in China’s competitive EV market, NIO’s ability to meet consumer demand and maintain a strong market presence can boost investor sentiment. With the Chinese EV market poised for significant growth in the coming years, NIO’s innovative electric vehicle range and unique user experience could propel its stock price upward.

Here are some specific growth figures for China’s EV market:

In 2021, the Chinese EV market grew by 169% year-over-year.

In 2022, the market is expected to grow by 50% year-over-year.

By 2025, it is estimated that the Chinese EV market will reach 15 million units.

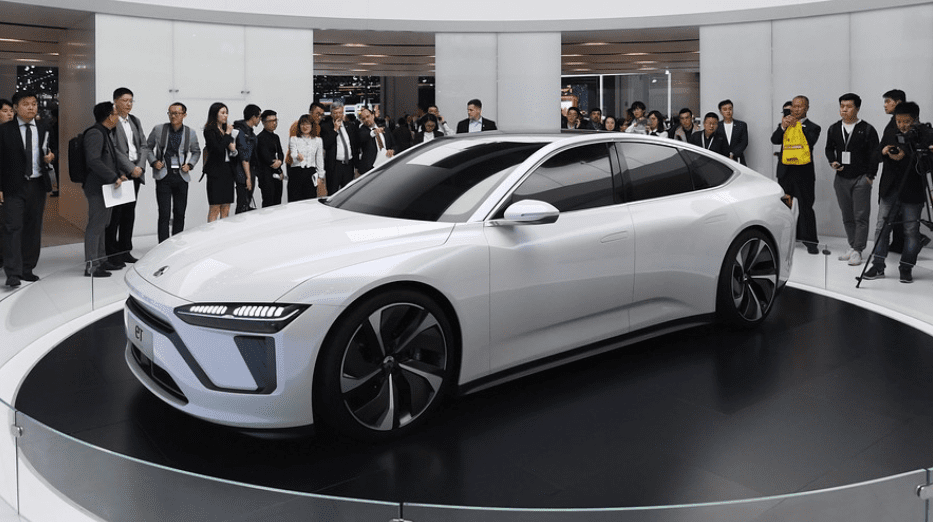

Innovative Products and Services

NIO’s commitment to innovation sets it apart from competitors. The company is currently developing a semi-autonomous SUV and a smaller, more affordable sedan, which can contribute to stock price growth. NIO’s autonomous driving capabilities and battery swapping stations are well-received by consumers, making it an attractive option for investors looking to buy NIO stock.

These unique offerings not only distinguish NIO from other EV manufacturers, but also contribute to its market value. Furthermore, the company has an innovation center in Berlin, focusing on software development for products like autonomous driving, user interface, voice assistance, and more. By staying at the forefront of technology, NIO can continue to attract investors and drive stock growth.

Global Expansion Plans

NIO’s ambitions extend far beyond China. The company has outlined plans to be present in 25 countries and regions by 2025, with its foray into markets like Norway already underway. NIO has the potential to increase their revenue and investor confidence by expanding their customer base and market share. This could eventually bring NIO’s stock price close to $1000 far into the future.

However, global expansion is not without challenges. NIO must adapt to varying government policies and regulations that may impact the EV market in different countries. Successful international expansion will rely on NIO’s ability to navigate these hurdles while capitalizing on its existing product offerings and expertise.

Related article: Rivian Stock Price Predication 2030

Challenges Hindering NIO’s Path to $1000

Source: Electrek

By understanding the potential hurdles NIO may face, investors can make informed decisions about whether to buy NIO stock. In the following sections, we will delve deeper into the specific challenges that could impede NIO’s path to $1000, including competition, supply chain disruptions, and government policies.

Intense Competition in the EV Market

The EV market is fiercely competitive, with prominent companies like Tesla, BYD, and traditional automakers vying for market share. Navigating this landscape effectively is crucial for NIO to maintain and expand its market position. The company’s ability to meet consumer demand and differentiate itself from competitors will play a pivotal role in its stock price growth.

As new entrants from China and other emerging markets challenge Tesla’s market dominance, NIO must continue to innovate and stay ahead of the competition. The company must leverage its unique offerings, such as battery swapping stations and autonomous driving capabilities, to attract consumers and investors alike.

top EV companies that currently dominate the market, based on their market capitalization:

| Rank | Company | Market Cap (USD) |

|---|---|---|

| 1 | Tesla | $753.6 Billion |

| 2 | Volkswagon | $147.8 Billion |

| 3 | BYD | $102.9 Billion |

| 4 | Rivian | $86.5 Billion |

| 5 | NIO | $60.7 Billion |

| 6 | Lucid Motors | $46.2 Billion |

| 7 | Geely | $37.7 Billion |

| 8 | XPeng | $29.8 Billion |

| 9 | Li Auto | $26.8 Billion |

| 10 | Ford | $23.8 Billion |

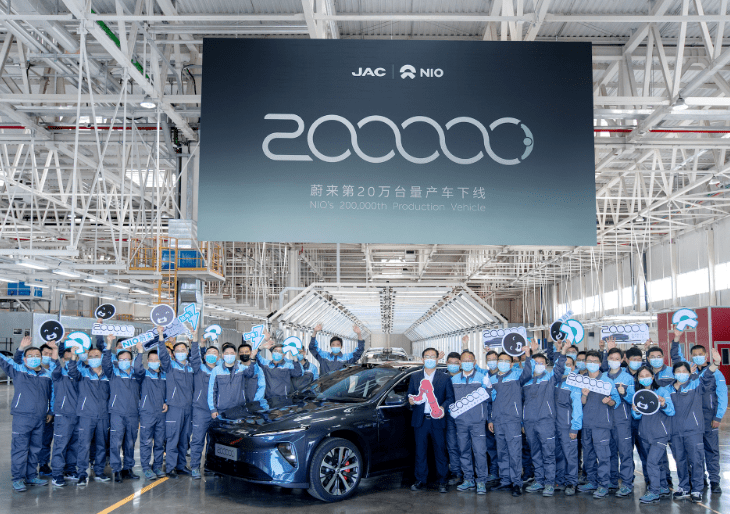

Supply Chain and Production Obstacles

NIO’s journey towards $1000 per share may be impacted by supply chain and production obstacles. The company has experienced challenges related to scaling up production, supply chain volatility, and operation challenges. Factors such as the lineup of multiple models, strict adherence to COVID-19 regulations, and difficulties with suppliers have contributed to these obstacles.

The ability to overcome these challenges is crucial for NIO’s long-term success. By investing in new factories and production lines, broadening its supply chain, and utilizing its current resources and expertise, NIO can concentrate on enlarging its business and augmenting production capacity.

Government Policies and Regulations

Changes in government regulations and policies can have a consequential effect on the EV market, necessitating NIO to make the necessary adjustments. Policies such as anti-corruption laws, hate crime laws, food safety regulations, proposed rules banning noncompete clauses, cybersecurity regulations, civil rights policies, and efficiency-limiting regulations could impede NIO’s progress.

To succeed in an ever-changing regulatory landscape, NIO must adapt its business strategies accordingly. This includes staying informed of policy changes, engaging with local governments, and ensuring compliance with regulations in the countries where it operates.

NIO’s Financial Performance and Profitability

NIO’s financial performance and profitability are crucial factors in determining its stock price potential. The company has exhibited remarkable revenue expansion; however, it has yet to attain consistent profitability. In the following subsections, we will analyze NIO’s revenue growth, earnings, price to sales ratio, and future projections to better understand the company’s financial standing.

By examining these financial metrics, investors can gain insights into NIO’s long-term growth potential and make informed decisions about whether to buy NIO stock. It’s essential to consider that multiple elements can influence the stock price, and conducting independent research is imperative for successful investing.

Revenue Growth and Earnings

NIO’s revenue growth has been impressive, with an 18.6% year-over-year increase for the twelve months ending March 31, 2023. The company’s projected revenue for 2025 is estimated to be $28 billion. However, consistent profitability remains elusive due to high costs and competition.

NIO’s revenue growth from 2019 to 2023:

| Year | Revenue (USD) | Growth Rate |

|---|---|---|

| 2019 | $1.69 Billion | — |

| 2020 | $2.49 Billion | 121.68% |

| 2021 | $5.67 Billion | 127.59% |

| 2022 | $7.14 Billion | 25.97% |

| 2023 | $7.13 Billion | -0.56% |

To achieve consistent profitability, NIO must focus on increasing revenue growth and earnings, as well as maintaining a sound price to sales ratio. By focusing on these financial metrics, NIO can strengthen its financial performance and move closer to the $1000 per share milestone.

Price to Sales Ratio and Future Projections

NIO’s Price to Sales (P/S) ratio is currently 2.90. In this case, the company’s P/S ratio is high relative to its peers. This suggests that investors are expecting the company to experience strong revenue growth in the future. Here are some additional things to consider when evaluating NIO’s P/S ratio:

The company’s growth prospects: NIO is a growing company with ambitious plans to expand its product lineup and enter new markets. If the company can achieve its growth goals, its P/S ratio could be justified.

The company’s profitability: NIO is not yet profitable, but the company is working to reduce its costs and improve its margins. If the company can become profitable, its P/S ratio could decline.

The company’s valuation: NIO is currently trading at a premium to its peers. This suggests that investors are expecting the company to outperform its peers in the future. If NIO does not meet investors’ expectations, its stock price could decline.

Assessing the Risk and Reward of NIO Stock

When evaluating the risk and reward of NIO stock, investors must consider the potential for long-term growth and the potential for short-term volatility. NIO offers long-term growth potential through its innovative products, exposure to China’s expanding EV market, and global expansion plans. However, short-term volatility may arise due to market fluctuations and external factors, such as competition, supply chain disruptions, and government policies.

In the following subsections, we will guide investors on how to assess NIO stock based on their investment goals and risk tolerance. By understanding the balance between long-term growth potential and short-term volatility, investors can make informed decisions about whether to buy NIO stock.

Investment Goals and Risk Tolerance

Investment goals and risk tolerance are essential factors when considering NIO stock as a potential investment. Investment goals refer to the desired outcomes when investing in a particular asset, while risk tolerance is the level of risk an investor is willing to assume when investing in a particular asset.

When assessing NIO stock, investors should consider their personal investment objectives and risk tolerance. Those with a high-risk tolerance and long-term investment goals may find NIO stock to be a suitable option, while those with lower risk tolerance may opt for investments with lower risk and returns. As they make their decision, investors might wonder about the potential for NIO stock reach in terms of growth and value.

Long-term Growth Potential vs. Short-term Volatility

NIO’s long-term growth potential is promising, with the nio stock forecast projecting a range from $40 to $80 in the next 24 months. Additionally, NIO’s presence in China, the world’s largest automobile market, is seen as a potential catalyst for growth. However, it should be noted that there are some concerns about the company’s long-term potential and its current stock performance.

On the other hand, short-term volatility should be expected due to market fluctuations and external factors. Investors must weigh the potential rewards of NIO’s long-term growth against the risks associated with short-term volatility when making investment decisions.

Milestones on the Road to $1000: $500 and $100 Targets

NIO’s journey to $1000 per share, which some investors speculate could see NIO stock reach 1000, may involve reaching intermediate milestones, such as the $500 and $100 targets. Achieving these milestoneswill require the company to focus on business expansion, navigating the competitive landscape, and refining its financial performance, all of which could contribute to reaching roughly the market cap needed for NIO stock to thrive.

Reaching $500 by 2028

Here are some of the factors that could contribute to NIO’s stock price reaching $500 by 2028:

Continued growth in the global electric vehicle market. The global electric vehicle market is expected to grow at a CAGR of 29% from 2022 to 2028. If this growth continues, it would create a large market for NIO’s products.

NIO’s expansion into new markets. NIO is currently only selling its cars in China, but it plans to expand into new markets, such as Europe and the United States. This expansion would give NIO access to a larger market and could boost its sales.

Overall improvement in the Chinese economy. The Chinese economy is currently facing some challenges, but it is expected to improve in the coming years. This improvement could help NIO’s business and could lead to higher stock prices.

The Path to $100

Here are some of the factors that could contribute to NIO’s stock price reaching $100 by in the near-term :

The release of new and innovative models. NIO has a strong track record of releasing new and innovative models. In the next few years, the company plans to release a number of new models, including the ET7, ET5, and ES7. These new models could help NIO attract new customers and boost its sales.

Positive earnings reports. NIO has been profitable in recent quarters. If the company continues to be profitable, it would boost investor confidence and could lead to higher stock prices.

Increased production capacity. NIO needs to increase its production capacity in order to meet the growing demand for its cars. The company is currently expanding its production facilities, and it is also looking to partner with other manufacturers to increase its production capacity.

Summary

The potential of NIO stock reaching $1000 per share is an exciting prospect for investors. From China’s expanding EV market to innovative products and global expansion plans, numerous factors could propel NIO’s stock price towards this milestone. However, challenges such as intense competition, supply chain disruptions, and government policies may impede its progress. By understanding these factors and assessing their investment goals and risk tolerance, investors can make informed decisions about whether to buy NIO stock.

Ultimately, the journey to $1000 per share is paved with intermediate milestones and potential obstacles. By staying informed of market trends, NIO’s progress, and conducting independent research, investors can navigate the ever-evolving landscape of electric vehicles and make the most of their investments.

Frequently Asked Questions

What will NIO stock be worth in 10 years?

based on the factors mentioned above, it is possible that NIO stock could reach $100 or even higher $1000 in 10 years. The company has a strong track record of innovation and growth, and it is well-positioned to benefit from the growing demand for electric vehicles.

How high is NIO stock expected to go?

NIO stock is currently trading at around $10 per share, with experts predicting it to reach a high of between $35 and $45 by 2024. Analysts’ forecasts for the next 12 months average out to a median target of $11.58, with a high estimate of $20.82 and a low estimate of $6.32.

What factors could propel NIO stock towards the $1000 milestone?

NIO’s success could be propelled by China’s expanding EV market, product innovation, and global expansion plans, allowing it to reach its $1000 milestone.

These factors could be the key to NIO’s success, as they provide the company with the opportunity to capitalize on the growing EV market in China, as well as the potential to expand its product offerings and reach new markets.

What are some of the challenges NIO may face on its path to $1000?

NIO is likely to face challenges such as intense competition, supply chain disruptions, and government policies on their path to $1000.

These challenges could include the need to innovate quickly, develop new products, and adapt to changing market conditions. Additionally, NIO must be able to navigate the complexities of the global economy and the ever-changing regulatory landscape.

How can NIO’s financial performance impact its stock price potential?

NIO’s financial performance is key in determining its stock price potential, as it impacts factors like revenue growth, earnings and price to sales ratio.