Buying blood in the trading world is a common tactic where bulls try to catch knives of falling assets hoping to find a bottom for a reversal. At almost every price level there are some amount of buyers and sellers. An asset reverses course when the bulls overwhelm the bears and vice versa, but finding bottoms and tops with accuracy is very difficult, even for seasoned traders.

Options traders in particular have to be careful because timing of your entry is crucial. Failure to enter at the right time makes or breaks your position and in turn, your profits.

Cheddar Flow provides a way to add confluence to your trades by showing you where and when people are buying options. Even on bloody days, if there is large bullish order flow it can signal large traders are buying in. Additionally, near market tops, puts start flowing in heavy and it’s time to hedge or take the contrarian view from the crowd on an asset.

I’ve said before that Cheddar Flow should be used as an idea generating mechanism; don’t blindly take trades from it. I have three examples for you today, all of which are trades that I took.

McDermott International Inc (MDR)

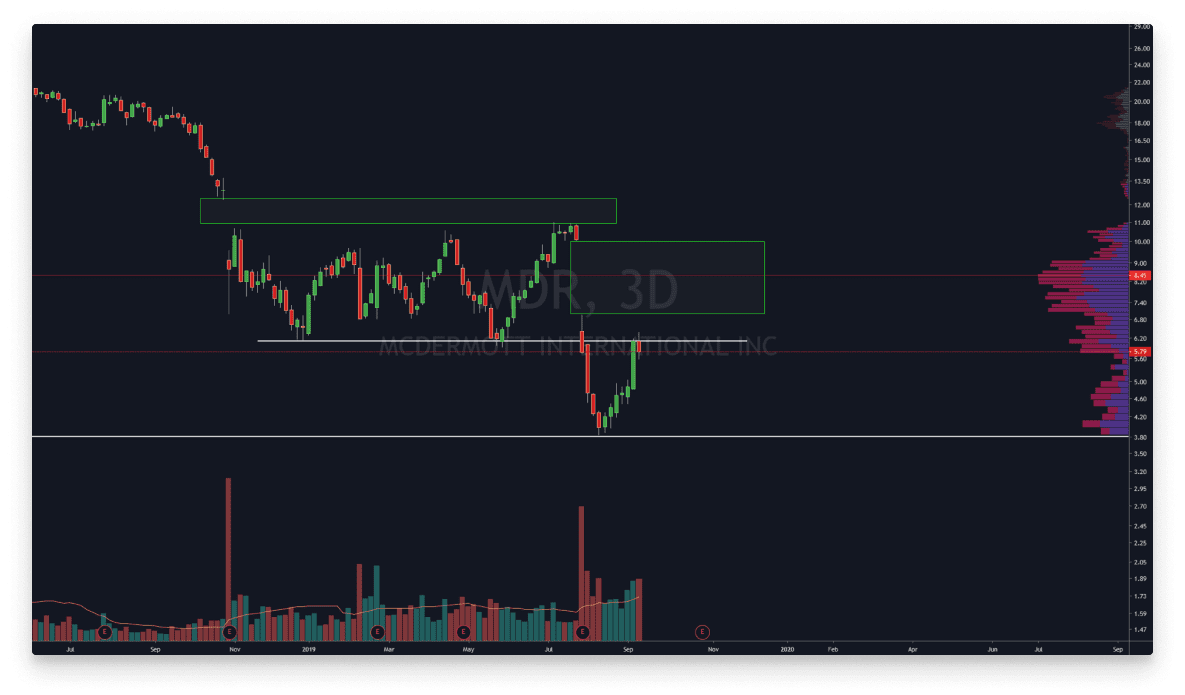

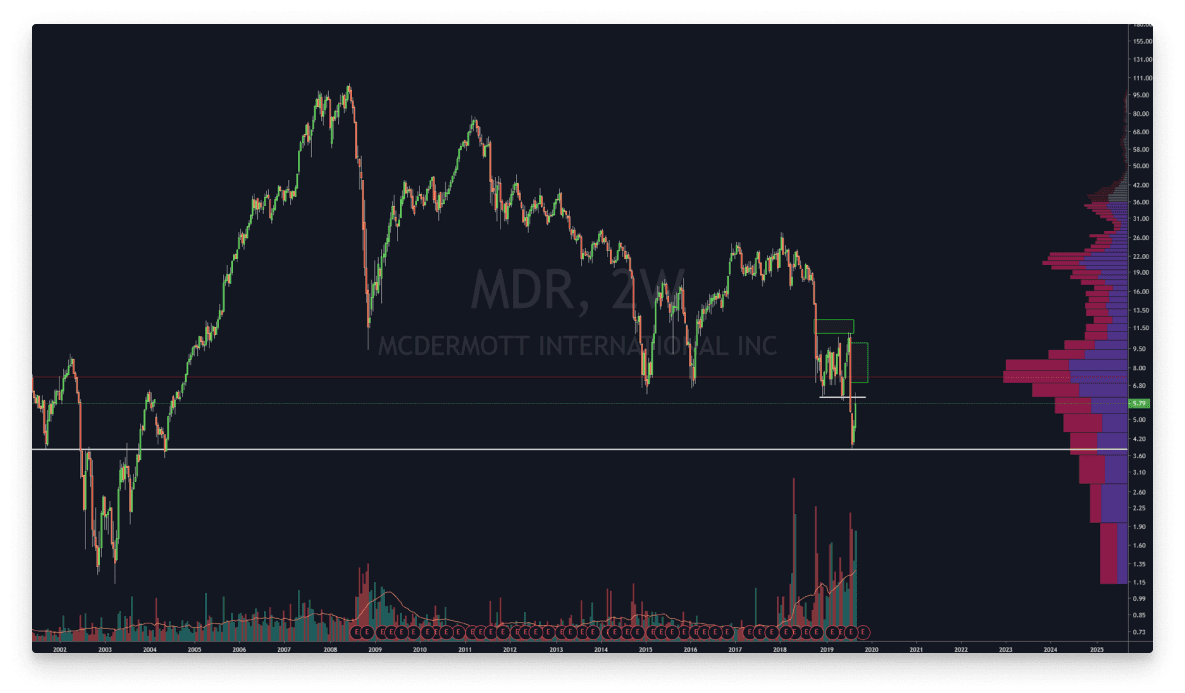

Let’s start with a company called MDR. I mis-timed my puts on it unfortunately, but I was still interested in the chart. Eventually in mid-August I started to see call volume overwhelm the put volume and the price was reflecting that.

I needed a thesis. Why are people buying calls at this level? The volume was turning positive and there are multiple gaps to fill. When in doubt, zoom out.

MDR had touched a support level it had not touched since 2004. Older supports hold big weight for opportunist traders. I was sold and promptly bought $3 and $4 strikes for November. As you can see, they are well in profit at this point.

Mallinckrodt (MNK)

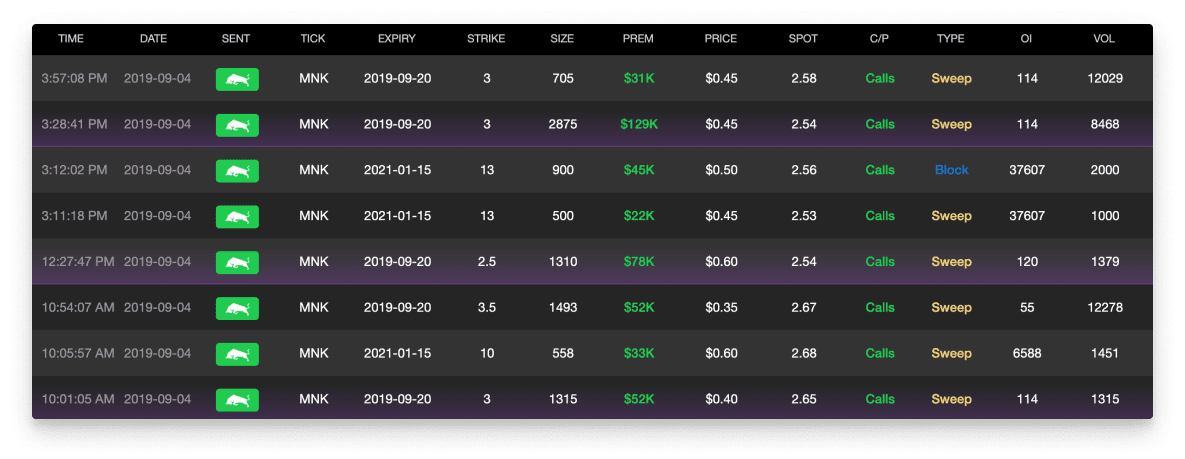

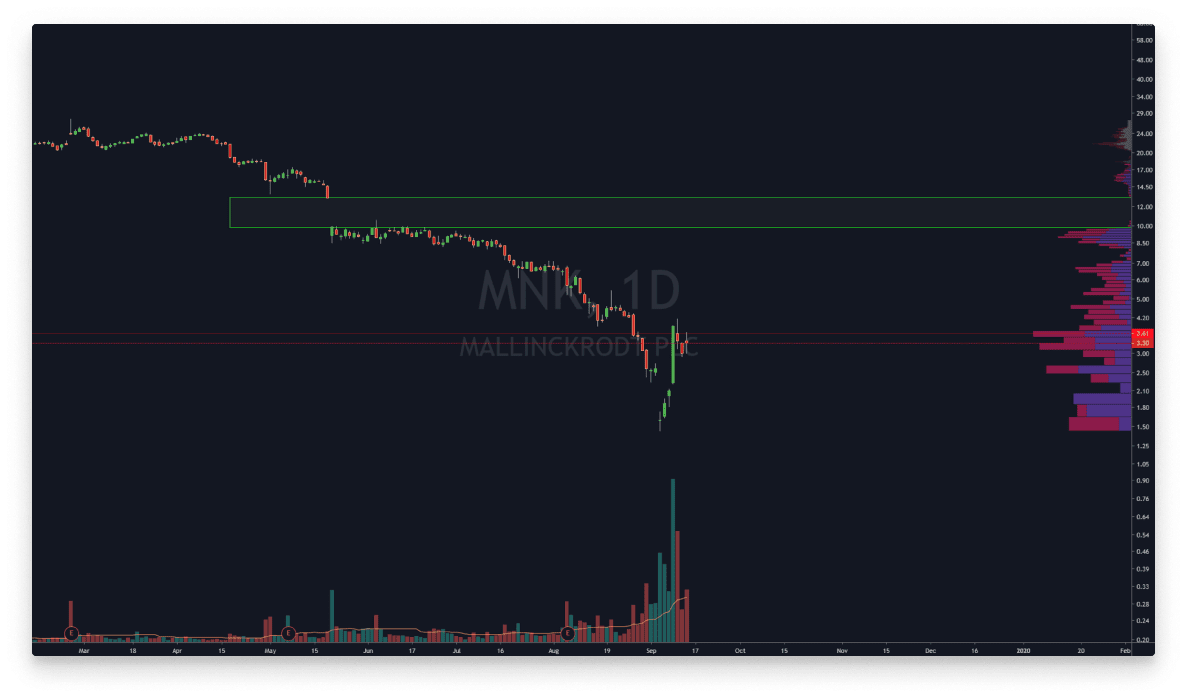

The next play was far higher on the risky side of things and it was a rollercoaster. I would never have found it if not for Cheddar Flow. Nor would I suggest anyone getting into it but I did have fun being on the right side of things.

MNK had been in a steady downtrend since April. They have some connections to opiate related litigation and have been exploring bankruptcy. There was a lot of FUD surrounding the company as a whole and their stock price dumped all the way down to $1.43.

One hundred percent directional order flow can be a big sign of things to come. This kind of flow doesn’t occur that often, but when it does, I like to pay attention. Flow like this often means that a particular stock has hit some technical confluence and institutions are ready to take a position. So, being the wagering man that I am, I bought a few calls for 9/27 expiration.

Everyone who bought these calls was in the red for a few days, but the call option volume increased as the price stopped going down, printing a lovely reversal candle. Followed by a 75% pump in one day.

Of course I exited on that pump since it was pretty strong. MNK still has a gap to fill (above), and I may re-enter if I see more welcoming order flow.

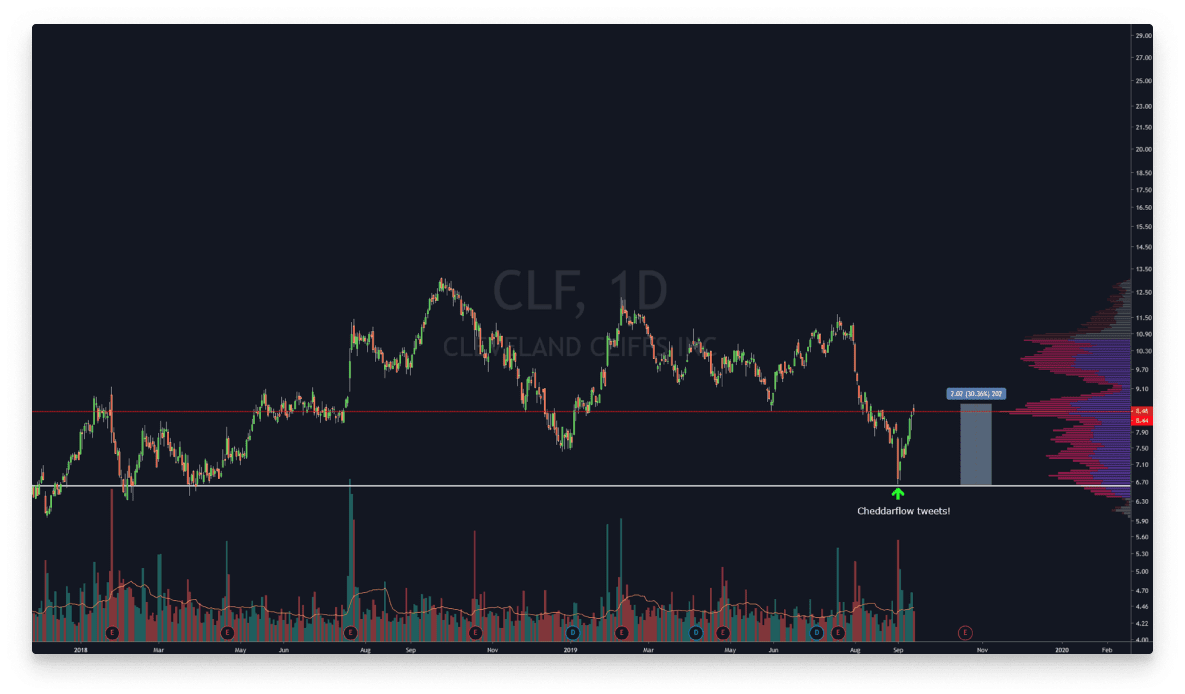

Cleveland-Cliffs Inc (CLF)

The final example of blood buying I want to show is CLF. This was actually a “freebie” from Cheddar Flow’s twitter account, but I still looked it up since it was such a large premium.

Once again, we see large call volume come in at a technical point of interest in the form of a strong 2018 support level. I followed this play and bought a few calls and closed them early as the stock ran on higher. No one ever went broke taking profit, but with options at a 30% run these could have been a big winner for you.

The big takeaway I want you to learn from this, is there are often reasons for traders taking big positions at the “worst” of times. Sometimes it is insider information, and other times it is pure technical analysis.

Either way, institutions have to show their hand on the order flow in order to profit, and Cheddar Flow helps you visualize it. Once you start to become more savvy with technical analysis, you can chart and find points of confluence to go with the order flow in order to find a rationale and take a particular trade.

Follow me on twitter @CryptoParadyme or signup for a free 7 day trial at cheddarflow.com.