Ever thought of investing in a fast-fashion giant that’s taking the world by storm? Shein, the rapidly growing Chinese fast-fashion retailer, is planning to go public through an Initial Public Offering (IPO) in the near future. With its innovative business model and controversies surrounding it, this upcoming IPO could be a game-changer in the fashion and retail industry. In this comprehensive guide, we’ll delve into Shein’s journey, the stock offering details, its competitive landscape, and the pros and cons of investing in Shein.

Key Takeaways

Shein is in the process of a highly anticipated IPO, despite facing various obstacles along its journey.

The company has achieved impressive growth and a high valuation through investments from major investors, making it an attractive investment opportunity for potential investors.

Investors must remain vigilant regarding Shein’s progress while considering associated risks, such as labor violations, before investing in this fast fashion retailer.

Shein’s Journey to IPO

Shein’s remarkable journey began as a small online retailer selling wedding dresses and has now evolved into a fast-fashion powerhouse, boasting over 200 million active users. Thanks to its direct-to-consumer approach, the company has managed to grow at an astonishing rate, and projects its revenue will more than double to nearly $60bn by 2025.

Nevertheless, it is not surprising. Shein’s path to a public listing through an IPO has been strewn with obstacles, including controversies and the market turbulence instigated by persistent geopolitical uncertainties. Despite being a private company, Shein has attracted significant investments from major venture capital firms.

The company achieved a valuation of $100 billion in 2022 and successfully raised $2 billion during a private funding round. As the Chinese government has not yet granted permission for domestic companies to go public abroad, the Shein stock IPO remains far from being finalized.

Shein, one of the leading Chinese companies, has initiated measures to diminish its Chinese footprint by setting up a headquarters in Singapore and designating Donald Tang as executive vice chairman.

Related Article: Investing In Red Bull Stock

Shein’s Business Expansion

Exploiting its robust supply chain and e-commerce platform, Shein has seen quick business growth, securing a substantial portion of the fast-fashion market. The company’s innovative strategy is to manufacture limited quantities of garments, ranging from 50-100 per item, and assess their success before producing more. This approach has allowed Shein to quickly adapt to fashion trends and minimize inventory costs, giving it a competitive edge in the industry.

Shein’s target audience is primarily Gen Z, utilizing social media platforms like TikTok and influencer culture to attract younger buyers. This strategy has paid off, with Shein’s revenue increasing by a staggering 398% between 2019 and 2021. The company has also made efforts to rebrand its image, launching a ‘sustainably sourced’ clothing line called evoluSHEIN. However, critics argue that Shein’s business model still contributes to landfill overcrowding and environmental degradation.

| Year | Revenue ($Billion) |

|---|---|

| 2016 | 0.61 |

| 2017 | 1.55 |

| 2018 | 1.99 |

| 2019 | 3.15 |

| 2020 | 9.81 |

| 2021 | 15.7 |

| 2022 | 30 |

Funding and Valuation

Shein has drawn considerable investments from prominent investors such as:

IDG Capital

Sequoia Capital China

Tiger Global Management

Greenwoods Asset Management

As previously mentioned, in 2022, the company raised $2 billion in a private funding round and was valued at a staggering $100 billion.

However, recent reports indicate that Shein’s valuation has been cut to $64 billion as it prepares for a potential IPO in 2023. Despite the reduced valuation, Shein remains an attractive investment opportunity due to:

Its robust financial position

Impressive growth

In 2022, the company generated $23 billion in revenue, rivaling established retailers like Zara and H&M.

As Shein prepares for its upcoming IPO, global investors will be keenly observing the company’s advancements and awaiting the chance to invest in this fast-fashion behemoth.

| Year | Valuation ($Billion) |

|---|---|

| 2019 | 5 |

| 2020 | 15 |

| 2021 | 47 |

| 2022 | 100 |

| 2023 | 64 |

Inside Shein’s Stock Offering

With the Shein stock IPO nearing, investors are keen to gather more information about the company’s stock offering, including the listing venue, projected date, stock price, and symbol. However, these details are not currently available, as Shein remains a private company and the Chinese government has not yet granted permission for domestic companies to go public abroad.

For now, investors must stay vigilant about Shein’s progress and the overall trends in the fast-fashion industry.

Listing Venue and Expected Date

It is possible that Shein may consider an IPO in the future, but there is no indication that the company is currently planning to list in the second half of 2023 or anytime soon. Originally, the company planned to list in the US in 2022, but it had to suspend its IPO plans due to market volatility resulting from the ongoing Russian incursion into Ukraine.

As the geopolitical landscape continues to evolve, Shein’s IPO plans may be subject to further changes. However, the company’s strong financial position and rapid growth make it a highly anticipated listing for investors worldwide. With the listing venue set and the expected date drawing closer, all eyes will be on Shein as it makes its way towards becoming a publicly traded company.

Stock Price and Symbol

Since Shein is currently a privately held company, its stock price and symbol are yet to be determined and will be revealed closer to the IPO date.

As the IPO approaches, investors will need to closely monitor the company’s developments and any announcements regarding its initial public offering to make informed decisions about potential investments.

The Controversies Surrounding Shein

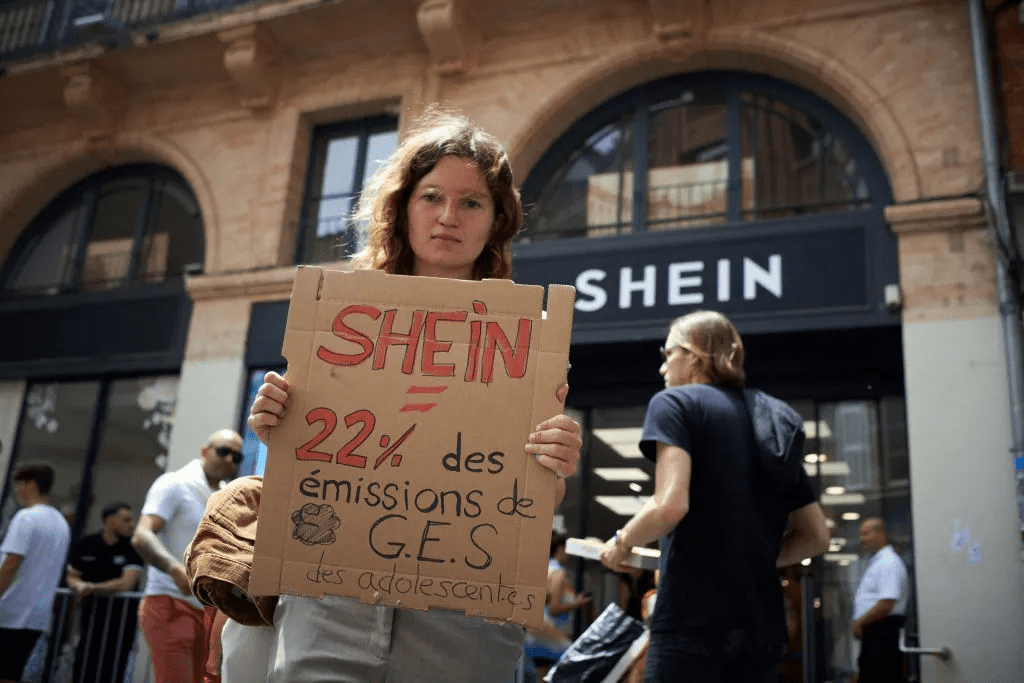

Like any rapidly expanding company, Shein has grappled with its share of controversies. These controversies primarily revolve around its fast fashion practices and labor violations in China, which may impact investor sentiment. Public Eye, a Swiss watchdog group, uncovered some stark realities about Shein’s manufacturers; employees endured hazardous conditions and even 75-hour workweeks.

Furthermore, critics have raised concerns about Shein’s clothing’s short lifespan, a common issue within the fast-fashion industry. To preserve its reputation and appeal to socially conscious investors, Shein must address these controversies and demonstrate its commitment to ethical and sustainable practices.

Fast Fashion Practices

Shein’s fast fashion practices have sparked debates about sustainability and their impact on the environment. Critics argue that the company’s business model contributes to landfill overcrowding and environmental degradation. Additionally, Shein has faced accusations of design theft, further tarnishing the company’s image.

In an effort to improve its reputation, Shein launched evoluSHEIN, a ‘sustainably sourced’ clothing line. However, this initiative has not fully quelled the concerns surrounding the company’s fast fashion practices.

Addressing these controversies is crucial for Shein as it moves towards its IPO. Investors will be closely examining the company’s commitment to ethical and sustainable practices, and its ability to adapt and grow in an increasingly environmentally conscious market.

Labor Violations

In addition to concerns about fast fashion practices, Shein has faced criticism for labor practices in China, including forced labor, long work hours, and low wages. These labor violations have led to negative publicity and may impact investor sentiment.

A Bloomberg investigation in November 2022 revealed that Shein’s garments had cotton sourced from Chinese labor camps in the Xinjiang region. This raises the issue of forced labor being used to source the clothing.

As Shein prepares for its IPO, addressing these labor violations and demonstrating a commitment to ethical labor practices will be crucial for attracting potential investors. The company must take proactive steps to rectify these issues and ensure that its supply chain and labor practices align with international standards and investor expectations.

Shein’s Competitive Landscape

In the realm of fast-fashion, Shein contends with fierce competition from the likes of:

Zara

H&M

FashionNova

Boohoo.com

ASOS

PrettyLittleThing

Zaful

Despite this competitive landscape, Shein has managed to secure a significant market share and continues to grow rapidly.

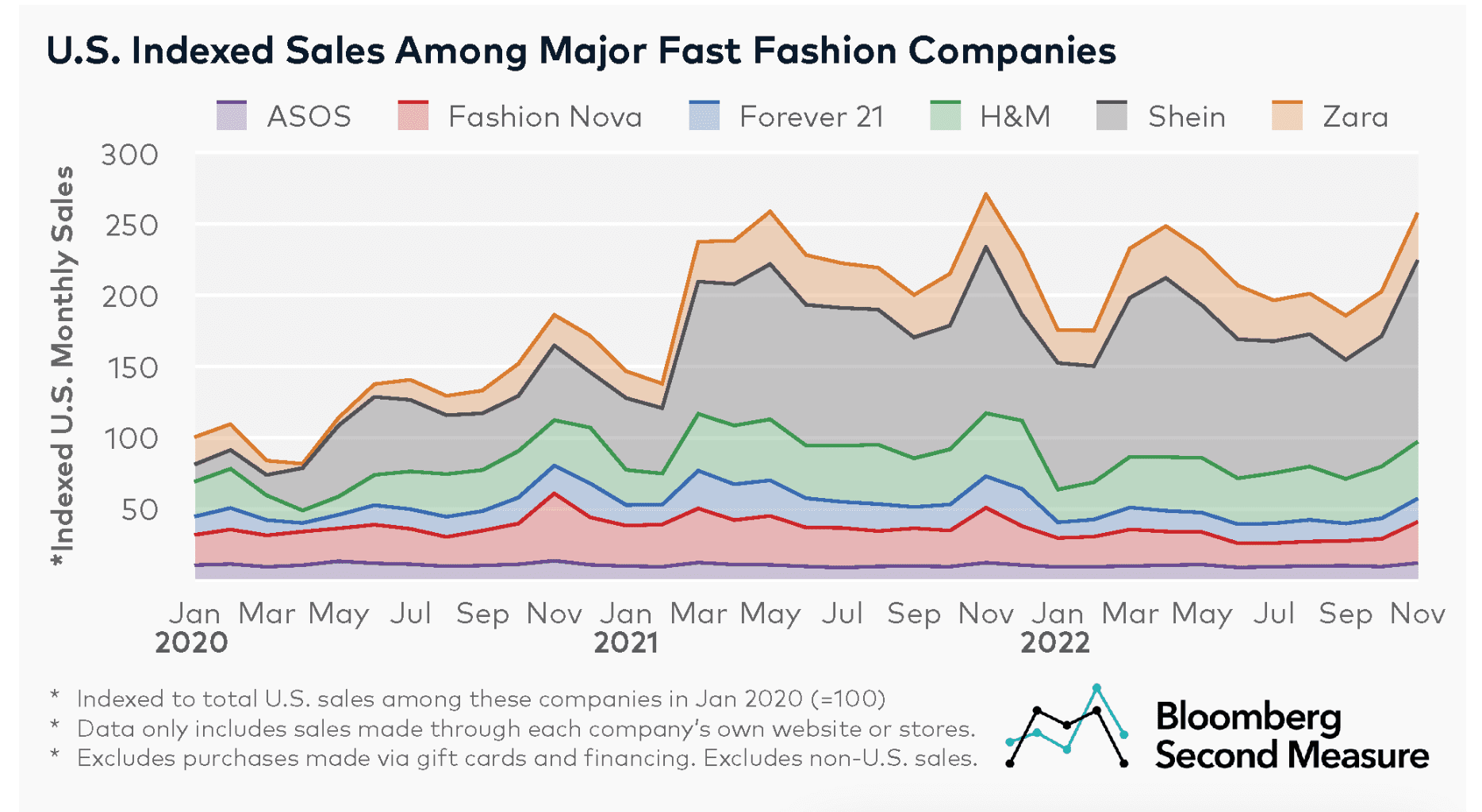

The company’s innovative business model, ability to quickly adapt to trends, and competitive pricing have helped it capture a large portion of the market, making it one of the leading fast fashion companies in the industry.

Major Competitors

As mentioned above, Shein has many large competitors in the industry. Each of these companies offers a unique value proposition and target audience, making the fast-fashion market a highly competitive landscape.

Despite the competition, Shein has managed to carve out a niche for itself, leveraging its supply chain and e-commerce platform to offer a wide variety of products at competitive prices. Its rapid growth and popularity among Gen Z have enabled the company to hold its own against these established fashion retailers and continue to expand its market share.

Market Share and Growth

Shein’s market share in the United States more than doubled between March 2020 and March 2022, going from approximately 18 to 40 percent and surpassing many established brands in the industry. The company’s ability to quickly adapt to trends and offer cost-effective products has played a significant role in securing this market share.

As Shein continues to grow and expand its presence in the fast-fashion industry, investors will be eager to see how the company can maintain its competitive edge and capitalize on its market position.

Investing in Shein: Pros and Cons

Investing in Shein brings along its unique blend of perks and drawbacks. On one hand, the company’s rapid growth, popularity among Gen Z, and innovative business model make it an attractive investment opportunity. On the other hand, the controversies surrounding its fast fashion practices, labor violations, and potential regulatory hurdles may give investors pause.

In this section, we’ll explore the reasons to invest in Shein and the risks and concerns that potential investors should be aware of.

Reasons to Invest

Shein’s swift expansion and its appeal among the Gen Z demographic form the primary factors for investing in it. The company’s innovative direct-to-consumer approach has allowed it to grow at an impressive rate. Additionally, Shein’s user-friendly e-commerce platform and extensive selection of fashion items at competitive prices have contributed to its success.

Furthermore, Shein has demonstrated its ability to adapt to changing market conditions and address controversies surrounding its fast fashion practices and labor violations. As the company prepares for a possible IPO, it will be crucial for Shein to maintain its growth trajectory and continue to innovate in the fast-fashion industry to attract potential investors.

Risks and Concerns

Despite Shein’s remarkable growth and success, potential investors must also consider the risks and concerns entailed in investing in the company. Some of these risks and concerns include:

Controversies surrounding its fast fashion practices and labor violations in China, which may impact investor sentiment and the company’s reputation.

Potential regulatory hurdles, such as inherent political risks and unfavorable market conditions.

Anti-Chinese sentiment that could damage the company’s reputation.

Data privacy concerns.

As Shein moves towards its IPO, investors will need to weigh the pros and cons of investing in the fast-fashion giant. By closely monitoring the company’s developments, controversies, and competitive landscape, investors can make informed decisions about whether to invest in Shein shares.

Alternative Investment Options

For those intrigued by the fashion and retail sector but wary about investing in Shein due to its controversy and risks, alternative investment choices are available.

In this section, we will explore two prominent companies in the retail and e-commerce space that offer potential investment opportunities: Amazon and Walmart.

Amazon (NASDAQ: AMZN)

Amazon presents a robust alternative to Shein, courtesy of its extensive market share, sprawling infrastructure, and diversified revenue sources. With a 37.8% share of the US e-commerce market and over 3 billion monthly visits in 2022, Amazon dominates the online retail space. The company’s various revenue streams, including Amazon Web Services (AWS), Amazon Prime, and its extensive fulfillment center network, contribute to its robust financial position.

Warren Buffett has referred to a company with advantages, like Amazon’s sizable share of the US retail e-commerce market, as having a “moat.” This competitive edge, combined with the company’s strong financial position, makes Amazon an attractive alternative for investors seeking exposure to the retail, e-commerce, and the stock market.

Walmart Inc. (NYSE: WMT)

Walmart, a commanding entity in the retail sector, provides a less risky investment alternative to Shein. Here are some reasons why:

Walmart has a commanding position in the retail industry, including a 25.2% share of the US grocery market in 2021.

Walmart has a significant presence in online fashion.

Walmart offers a diverse range of products and services.

Operating the fourth largest US online fashion store, Walmart has demonstrated its ability to compete in the fast-fashion market. Investors seeking exposure to the retail and e-commerce sectors may find Walmart an attractive alternative to Shein, thanks to its established market position and diversified revenue streams.

Summary

In conclusion, Shein’s possible future IPO presents a unique investment opportunity for those interested in the fast-fashion industry. While the company has experienced rapid growth and boasts an innovative business model, potential investors must also consider the controversies surrounding its fast fashion practices and labor violations in China. By closely monitoring Shein’s developments, competitive landscape, and alternative investment options such as Amazon and Walmart, investors can make informed decisions about whether to invest in Shein shares and navigate the dynamic world of fast fashion.

Frequently Asked Questions

Did Shein have an IPO?

Shein has previously denied the rumors of filing for an IPO on the New York Stock Exchange as well as a Reuters report suggesting they have confidentially filed.

Therefore, Shein has not had an IPO yet.

Who owns Shein?

Chris Xu, founder and billionaire, is the primary owner of Shein. The company leverages a real-time retail business model where fashion trends are quickly turned into products available for shopping online.

Xu has developed proficient skills in search engine optimization, which has underpinned his success.

How much money is Shein worth?

Shein was valued at $100 billion in 2022 after a successful fundraising round, however the current estimated worth of the company is $64 billion.

What controversies surround Shein?

Shein’s fast fashion practices, lack of sustainability and environmental concerns, and labor violations in China have all caused controversy and raised ethical concerns.