Free Unusual Options Flow Data. In Real Time.

Make smarter trading decisions with ease using our unique data tools, enhancing your strategies for increased profitability.

Options Order Flow

Track option contracts that are being traded at a much higher volume than their daily average.

AI Power Alerts

An intelligent signal generator that is powered by a sophisticated computational model.

Dark Pool Transactions

Expose equity orders that are being traded in the shadows and not available to the general public.

Trusted By Over 2,000+

Retail Traders

Precision Order Flow Scanning

Unusual options order flow can be overwhelming. Luckily, with CheddarFlow’s real time data, the system intelligently curates the information and automatically chooses the most significant trades institutions and hedge funds are making.

Cheddar Flow’s sleek data feed provides options order flow traders with high precision, market data to help uncover hidden opportunities. This is your edge!

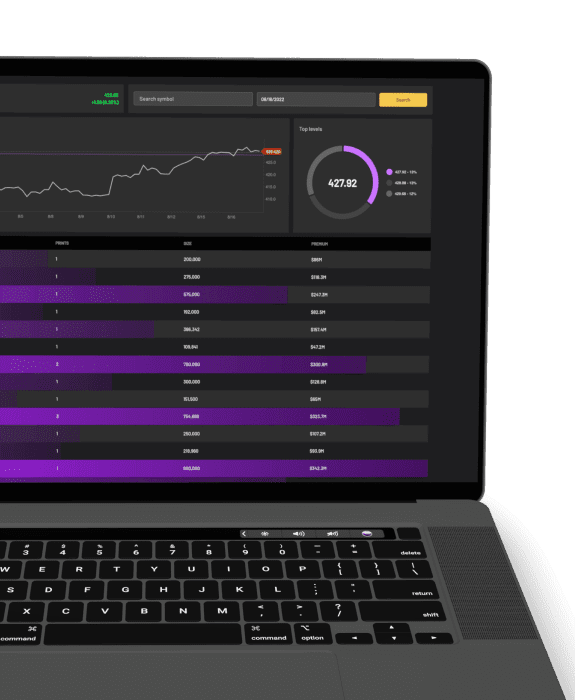

Detailed Dark Pool Data and Analytics

Cheddar Flow’s dark pool data powers you with advanced information to make trading decisions. Monitoring dark pool activity provides insight into the largest orders made through private exchanges.

Combining live charting with support and resistance levels allows you to assess the direction of the stock. The order flow graph allows you to spot institutional volume and premium at each price level.

Trader Mentality

Founder / Head Trader of Trader Mentality

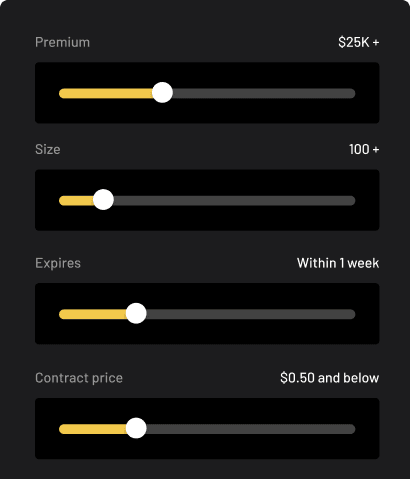

Powerful Options Order Flow Filtering Capabilities

Cheddar Flow’s advanced filters help you find what is most important with ease. With over 30 different sets of filters, it does the work for you by telling you which data is most valuable for your research. Drag the slider controls to adjust your expected premium, contract size, and expiration date.

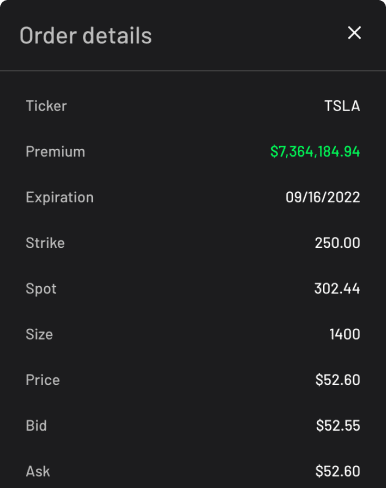

Gain Insight Into Every options Order Flow Trade

Cheddar Flow’s options order flow scanner provides detailed information about each trade that hits the tape. See direct bid and ask prices, understand what sector the stock symbol is in and most importantly, get a high level view of the option contract greeks (Delta, Theta, Vega).