Options are something many retail investors don’t mess with. Either from impatience, losses, lack of knowledge, or it doesn’t fit their personal risk parameters.

Even if you don’t trade options you are able to see observable trends with the proper tools pulling data from options markets. Every trading day billions of dollars of options trade hands between bulls, bears, and people just hedging their bets.

But every market has their pump days and their dump days. Eventually a market reaches it’s elevator down moment after a series of weeks of escalator up. In order for institutions and smart traders to profit they do have to show their hand by moving order books for options in a significant way. Someone has to buy an option to profit or lose from it.

The last eight months of $SPY has seen consistent volatility with sizable movement occuring every few months with recovery soon after.

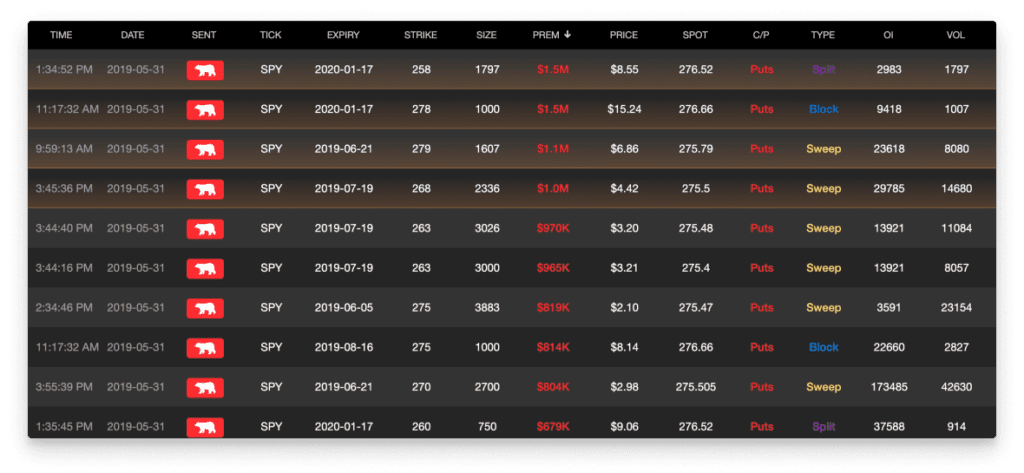

You have a trade setup or at minimum a direction of a chosen asset. You’re now looking for confluence on your trade. Visualizing large option order flow to ride the predicted trends of institutions can help you attain this goal. Let’s go back in time a bit to 5/31/19 and 6/1/19. The early summer dump that took many by surprise after months of uninterrupted gains riding SPY and other indexes.

Cheddar Flow allowed a very simple visualization of the incoming price action. The options order flow was clear: the options market was ready for volatility. 76% of the $SPY options purchased on those two days were bearish. Simply looking at the premiums and expirations spoke volumes about the market sentiment for the coming weeks.

What we see in this picture is millions of dollars in options orders coming in on 5-31 with large premiums being paid. Even you as a retail investor could see easily see this, with some patience, you can position yourself either in volatility stocks, get short, or buy some puts on SPY.

There is one particular player that Cheddar Flow has been keeping an eye on for some time as they pop up at the most interesting times. For those not familiar, UVXY is a futures ETF for the VIX volatility (fear) index. When the market sees downward movement UVXY goes up along with VIX. Meaning that buying calls on these could be very profitable in the event of a serious market move down.

It’s unclear if it’s one player or multiple. It’s possible they’re actively selling these calls on each dip or just buying them to manipulate the market sentiment. Buying low strike calls on such an asset at high premium usually means that big money is being placed on large volatility. The option chain for UVXY seems to indicate they are selling due to current day absence of these calls after several months of activity. They are too large to go unnoticed by other option traders and have been something Cheddar Flow have kept a steady eye on for months. Odd contracts like this are much easier to seek out with the right tools.

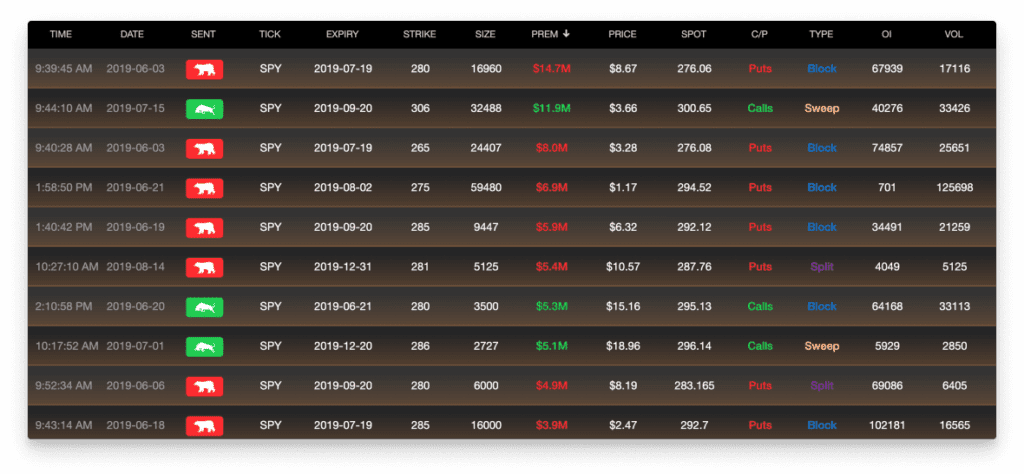

This scanner can be used to see major market shifts in either direction. Since June to present day (8/16) we can see the majority of order flow is leaning bearish on $SPY. The market price action has reflected this order flow.

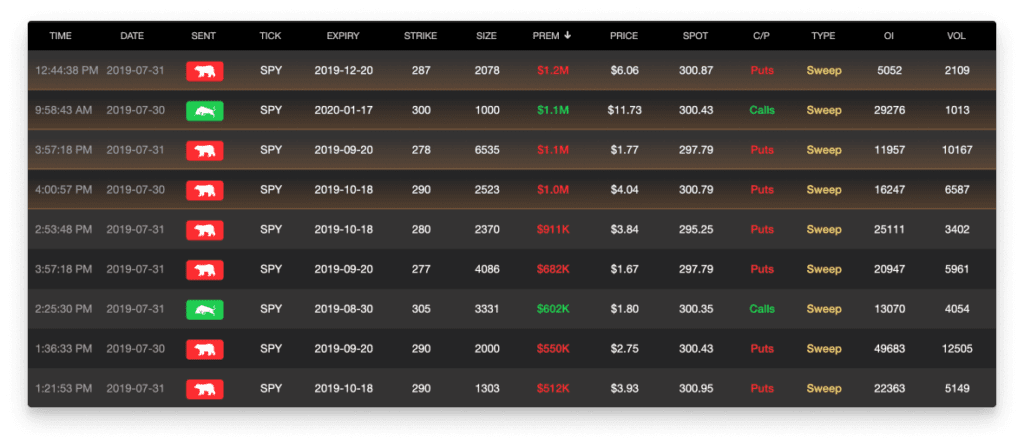

Maybe June 1st was just a fluke and users got lucky? We saw the same pattern again for July 2019 volatility.

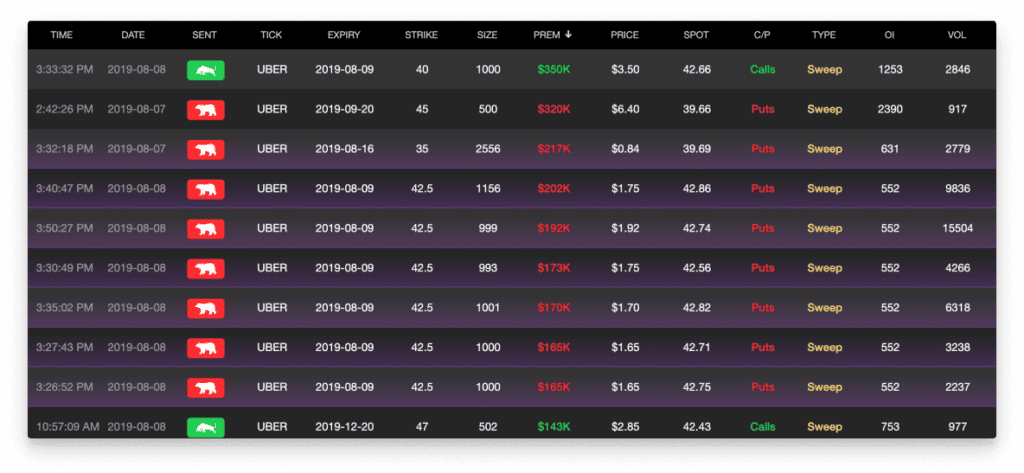

You can obviously continue to trade using technicals and sentiment but tools like this platform allow for a strong picture of where bets are being placed, or even where big money is being placed for earnings on individual stocks.

With UBER we saw a 72% put buying bonanza right before earnings. As you can see, some very unusual activity (highlighted in purple) was coming in right before the closing bell. Stock cratered the next day.

You may be wondering at this point if Cheddar Flow is right for you. You should not use it to blindly take trades. That will just burn your capital.

I mainly use this service as an idea generation mechanism. If I see technicals that back up the proposition a particular set of option order flow is showing, I take the trade and get out if prices goes the opposite direction within my risk tolerances.

Follow me on twitter @CryptoParadyme or signup for a 7 day trial at cheddarflow.com