If you’ve ever looked at an option chain, you’ve likely seen some strange words attached to the contracts you’re looking at. Delta, Theta, Gamma, and Vega with some numbers that don’t make much sense to you. Why are they included? Do they do anything for my trading?

Many options traders completely ignore the greeks and simply look for the strike and timeline they’re interested in. But some dive deep into the greeks and pick the best contracts possible to maximize profit and minimize losses. These seemingly random numbers are a metric to examine the sensitivity of an option to price action. Understanding what they mean can be very useful for mapping out your trade and measuring risk.

Let’s go through these just to get a grasp on what they all mean.

Delta

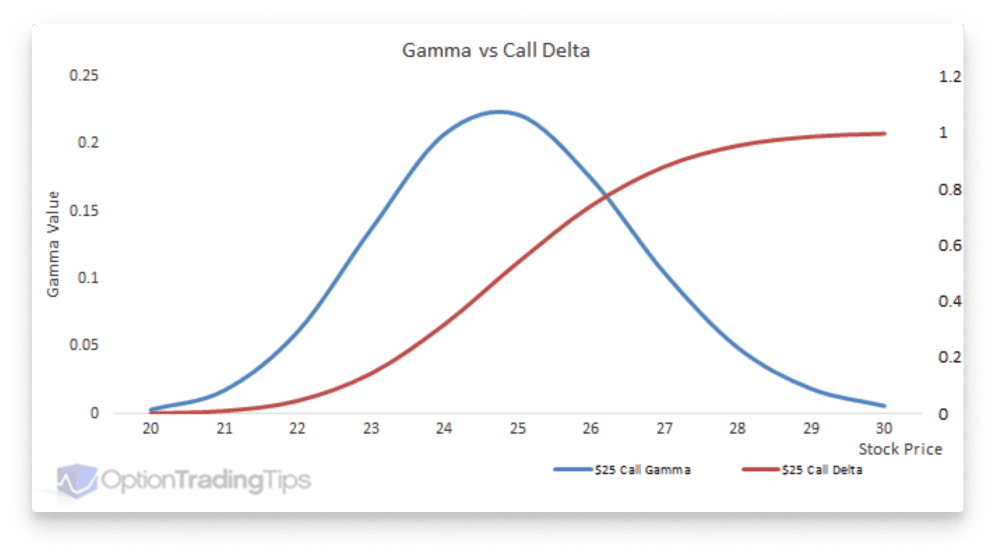

Delta is a theoretical measure of how much an option price will move with an asset. These values will be between 100 and -100 depending on if it’s a call or a put. Delta’s are usually displayed as a decimal such as a SPY call with a Delta of 0.35. Essentially the closer this number is to 100 (or 1.0) the stronger the price will move with each dollar move.

Delta’s change with prices so a contract with a 0.1 Delta may eventually move up to 0.5 resulting in greater profits as the asset moves up. Once your option is trading deep in the money, the Delta will be one and each positive move on the stock will essentially be 1:1 profit wise.

Some traders will exclusively buy options with strong Delta’s. If you’re trading shorter term options, having a higher Delta can help you lock in profits sooner since the price movement is your favor and will be more profitable faster. Higher Delta options typically sell for more in return.

Personally, I like to lock in Deltas of 0.4 or higher but there are many roads to take for your own trading strategy. For example, the GameStop (GME) calls I am in right now have a Delta of 0.496 which is perfect for my long term outlook on that particular stock. If GameStop (GME) rises from here, I should make $49.6 per dollar assuming if the stock rises and the contracts delta stays constant, which it won’t.

So let’s look into how Delta changes……

Gamma

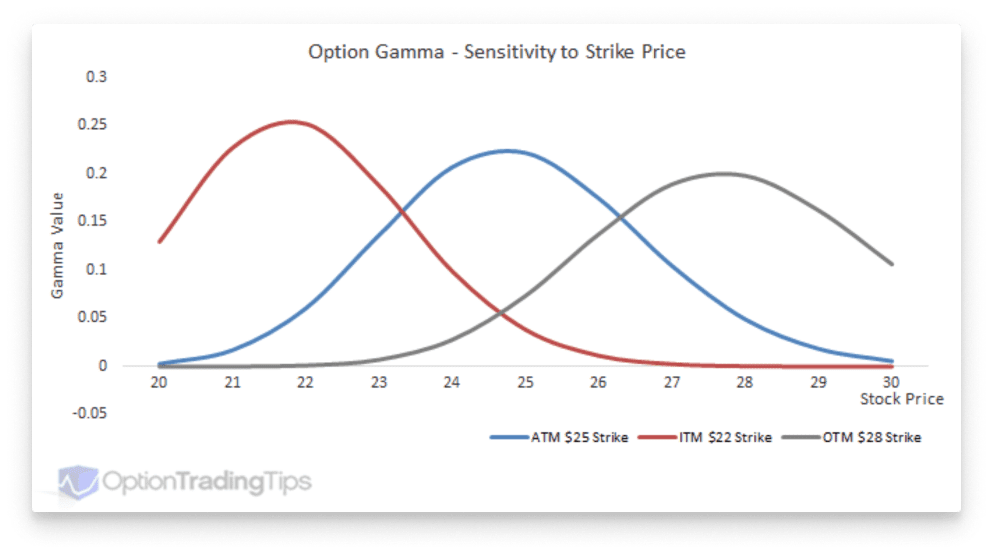

Gamma is delta’s cousin in the greek world. It’s a measure of the change in delta for each tick. It tends to top out when the asset in question is near your strike price. Options deep in or out of the money have Gamma’s closer to zero typically.

Let’s say for a stock is trading at $49, there is a $50 call option selling for $3. Assuming it has a Delta of 0.3 and a Gamma of 0.1. If the stock price moves up by $1 to $50, then the Delta will be adjusted upwards 10 percent from 0.3 to 0.4.

Theta

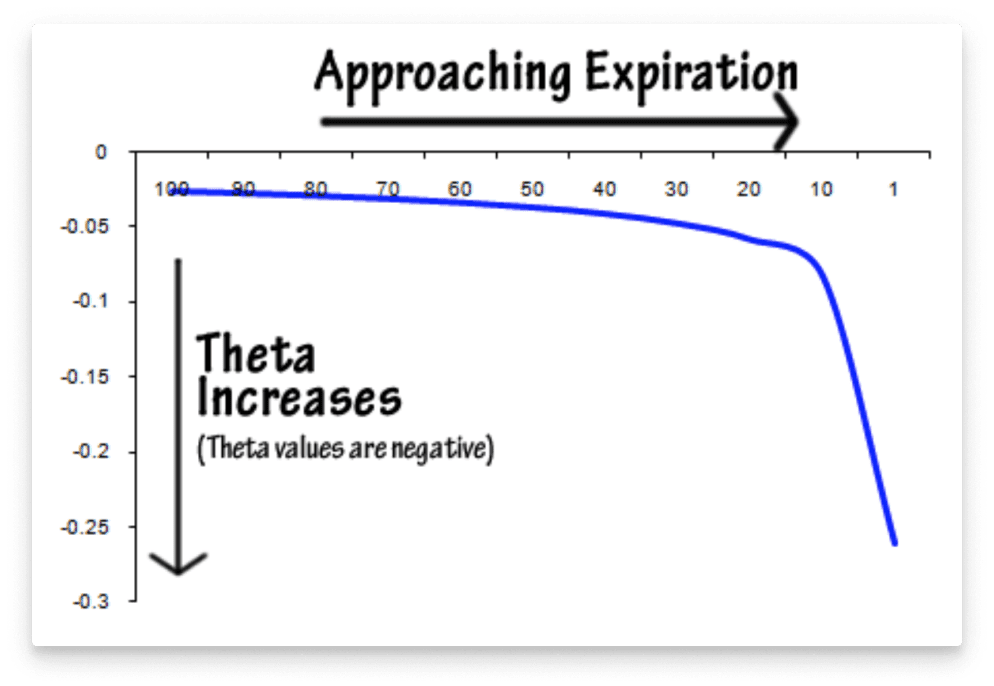

Theta is the 5,000 pound greek in the room that all option traders must pay attention to. Unlike stocks, holding onto options for longer periods of time reduces profitability. Theta is the rate of decay on premium. Theta Decay will ruin your winning positions if you fail to take profits soon enough. This is also why longer term options tend to carry higher premiums since they allow you the luxury of a larger window to be within your trade. A Theta value on an option chain will show you the dollar amount a contract will lose each day with the passage of time.

Theta is the easiest of the Greeks to understand as it simply means buy long expirations, or monitor your positions closely for decay. If your option expiry is a month out, closing it ~21 days later would be in the interest of your theta decay. The closer you get to expiration, the faster the Theta begins to decay.

Vega

Vega is a measure of the changes in underlying volatility. Admittedly it is the greek I pay the least attention to. It’s one of the hardest greeks to understand for newer options traders. Options are more expensive when Vega is high, but it tends to trend down with time. Vega measures an option price’s value relative to changes in implied volatility of an underlying asset. It’s intended to represent the amount that a contract’s price changes with a 1% change in the implied volatility of the asset. If a stock is actively moving, vega will be too.

If you’re looking at calls that expire in a few months. Your Vega is 0.17

The option contract price will increase $0.17 with a 1% increase in implied volatility. When price goes up, implied volatility increases.

Final thoughts

These are a basic primer to understanding greeks and Cheddar Flow does show you most of them. When examining potential plays to follow, considering the option greeks can really help you decide if an asset is worth the risk/reward. The most crucial greeks to watch in my humble opinion are theta and delta. You can view the greeks on almost any online option chain as well.

Try out Cheddar Flow for 7 days free and put some of what you’ve learned to use.