JPMorgan Chase, headquartered in New York, is one of the largest global banks with a market cap of $544 billion and assets of $3.88 trillion as of 2024. It employs over 309,000 people and operates 5,117 branches in the U.S. Founded from over 1,200 predecessor institutions starting in 1799, JPMorgan Chase offers a broad range of financial services, including asset management, banking, and investment services, making it a pivotal force in the financial industry.

Table of Contents

- Interesting facts: JP Morgan

- Overview of JPMorgan Chase

- What services does the JPMorgan Chase offer?

- JPMorgan Chase Market Capitalization

- JPMorgan Chase Revenue

- Total Assets Under Management (AUM) of JPMorgan Chase

- JPMorgan’s Top 10 Largest ETFs

- Overview of JPMorgan Chase Investments and Acquisitions

- JPMorgan Chase Ownership Overview

- How many employees in JPMorgan Chase?

- Where is the Headquarters of JPMorgan Chase?

Interesting facts: JP Morgan

- JPMorgan recently recorded the highest annual profit for a US bank, with a current revenue of $155.29 billion.

- As of April 2024, JPMorgan Chase has a market cap of $544.00 Billion.

- As of 2023, JPMorgan Chase’s total assets under management (AUM) amounted to $3.88 trillion, representing a 5.72% growth from 2022.

- JP Morgan Chase has made 19 acquisitions, the most recent being First Republic Bank, which it acquired on May 1, 2023.

- As of the end of 2023, the company employed 309,926 people worldwide, marking a 5.52% increase from the previous year, when the employee count stood at 293,723.

- JPMorgan Chase’s main office is located at 383 Madison Ave, New York, United States, and the company operates from 171 other locations.

- As of June 2023, JPMorgan Chase Bank was the top bank in the United States, boasting 5,117 branches nationwide.

Overview of JPMorgan Chase

| JPMorgan Chase | Details |

|---|---|

| Type of Industry | Financial services |

| Type of Company | Public |

| Official banking Name | JPMorgan Chase |

| Year Dated | December 1, 2000 |

| Founders | – William B. Harrison Jr. |

- Douglas A. Warner III | | Headquarters | 383 Madison Avenue New York, U.S.A | | Area served | Worldwide | | Key people | – Jamie Dimon (Chairman & CEO)

- Daniel E. Pinto (President & COO) | | Products | – Asset management

- Banking

- Commodities

- Credit cards

- Equities trading

- Insurance

- Investment management

- Mortgage loans

- Mutual funds

- Exchange-traded funds

- Index funds

- Private equity

- Risk management

- Wealth management | | Revenue | $155.29 billion (2023) | | Market Cap. | $544.00 billion (April, 2024) | | Total assets | $3.88 trillion (2023) | | Number of employees | 309,926 (2023) | | Divisions | – Asset and Wealth Management

- Consumer and Community Banking

- Commercial Banking

- Corporate and Investment Banking | | Subsidiaries | – Chase Bank

- J.P. Morgan & Co.

- One Equity Partners

- First Republic Bank | | Website | jpmorganchase.com |

What services does the JPMorgan Chase offer?

JPMorgan Chase has its roots in over 1,200 predecessor institutions. Its oldest predecessor is the Manhattan Company, founded in 1799. JPMorgan Chase’s modern form results from consolidating several large U.S. banking companies since 1996, including Chase Manhattan Bank, J.P. Morgan & Co., Bank One, Bear Stearns, and Washington Mutual.

Today, JPMorgan Chase is one of the largest banks in the United States and a leading global financial institution. In 2022, its market capitalization was around 393 billion U.S. dollars, making it the largest bank in the world. With over 4,800 branches and over 270,000 workers, it’s a substantial presence in the US banking landscape.

- Among the “big four” banks in the United States are JPMorgan Chase, Bank of America, Citigroup, and Wells Fargo.

- In 2021, JPMorgan Chase had the largest market capitalization and was the leader in total assets and domestic deposits.

In 2021, it ranked seventh among the largest U.S. banks regarding female workforce representation. Its female board representation was 36.4%, ranking sixth among the leading U.S. banks.

On the bright side, the bank excelled in racial diversity: It had the highest share of racial minorities in its workforce and was among the top five banks with the most racially diverse executive and senior-level employees.

Source: Statista

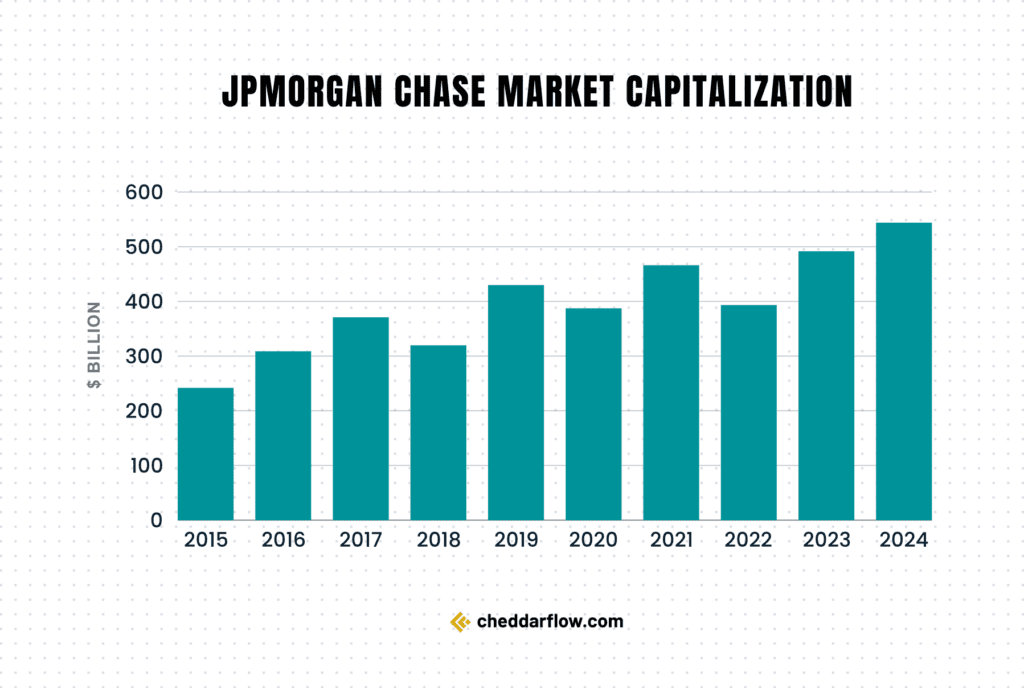

JPMorgan Chase Market Capitalization

They have secured a significant market cap of approximately $544.00 Billion, demonstrating their substantial influence and strong standing within the global financial industry.

| Year | Market Cap | Change |

|---|---|---|

| 2024 (Apr.) | $544.00 billion | 10.62% |

| 2023 | $491.76 billion | 25.02% |

| 2022 | $393.34 billion | -15.63% |

| 2021 | $466.19 billion | 20.36% |

| 2020 | $387.33 billion | -9.9% |

| 2019 | $429.91 billion | 34.44% |

| 2018 | $319.78 billion | -13.82% |

| 2017 | $371.05 billion | 20.17% |

| 2016 | $308.76 billion | 27.64% |

| 2015 | $241.89 billion | 4.06% |

| 2014 | $232.47 billion | 5.83% |

| 2013 | $219.65 billion | 31.33% |

| 2012 | $167.25 billion | 32.38% |

| 2011 | $126.34 billion | -23.83% |

| 2010 | $165.87 billion | 0.98% |

| 2009 | $164.26 billion | 39.58% |

| 2008 | $117.68 billion | -19.94% |

| 2007 | $146.98 billion | -12.09% |

| 2006 | $167.19 billion | 20.82% |

| 2005 | $138.38 billion | -0.25% |

| 2004 | $138.72 billion | 84.91% |

| 2003 | $75.02 billion | 56.4% |

| 2002 | $47.96 billion | -33.46% |

| 2001 | $72.08 billion |

Source: Companies Market Cap

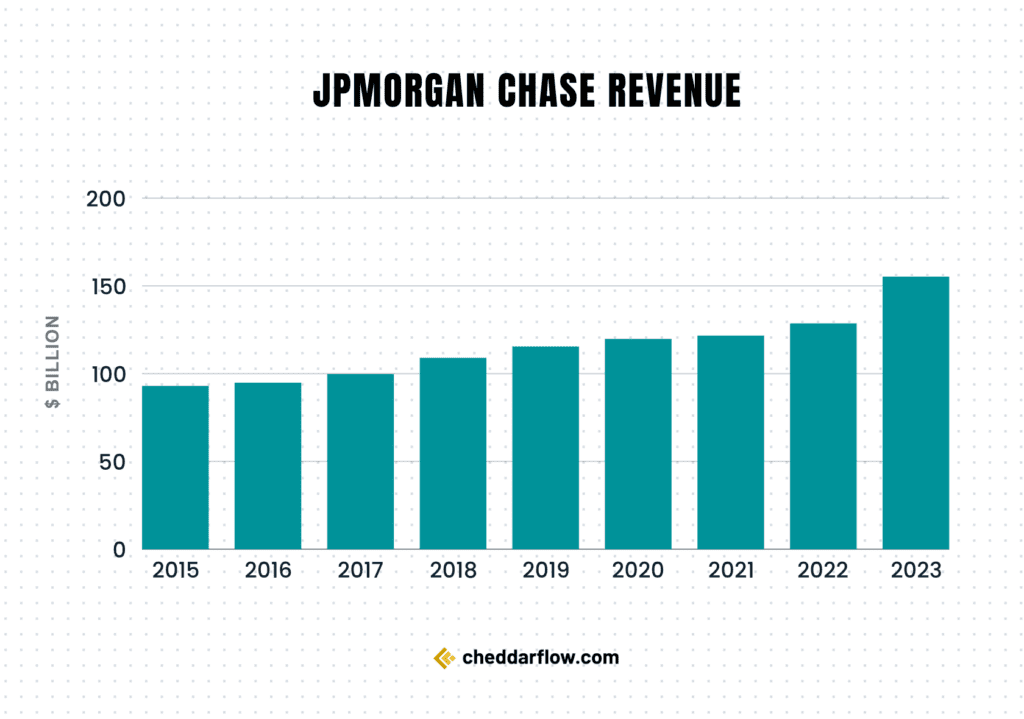

JPMorgan Chase Revenue

JPMorgan has recently set a record for the highest annual profit ever achieved by a US bank. As per JPMorgan Chase’s most recent financial reports, the company’s current revenue (TTM) is $155.29 billion.

- In 2022, the company generated a revenue of $128.64 billion, marking an increase from the $121.68 billion revenue of 2021.

- This revenue represents the total income generated by the company through the sale of goods or services.

| Year | Revenue | Change |

|---|---|---|

| 2023 | $155.29 billion | 20.72% |

| 2022 | $128.64 billion | 5.72% |

| 2021 | $121.68 billion | 1.6% |

| 2020 | $119.77 billion | 3.71% |

| 2019 | $115.49 billion | 5.93% |

| 2018 | $109.02 billion | 9.3% |

| 2017 | $99.75 billion | 4.27% |

| 2016 | $95.66 billion | 2.84% |

| 2015 | $93.02 billion | -1.94% |

| 2014 | $94.87 billion | -1.79% |

| 2013 | $96.60 billion | -0.44% |

| 2012 | $97.03 billion | -0.21% |

| 2011 | $97.23 billion | -5.32% |

| 2010 | $102.69 billion | 2.25% |

| 2009 | $100.43 billion | 49.34% |

| 2008 | $67.25 billion | -5.77% |

| 2007 | $71.37 billion | 15.54% |

| 2006 | $61.77 billion | 14.11% |

| 2005 | $54.13 billion | 25.72% |

| 2004 | $43.06 billion | 29.49% |

| 2003 | $33.25 billion | 12.3% |

| 2002 | $29.61 billion | 1.69% |

| 2001 | $29.12 billion | – |

Source: Bloomberg, Companies Market Cap

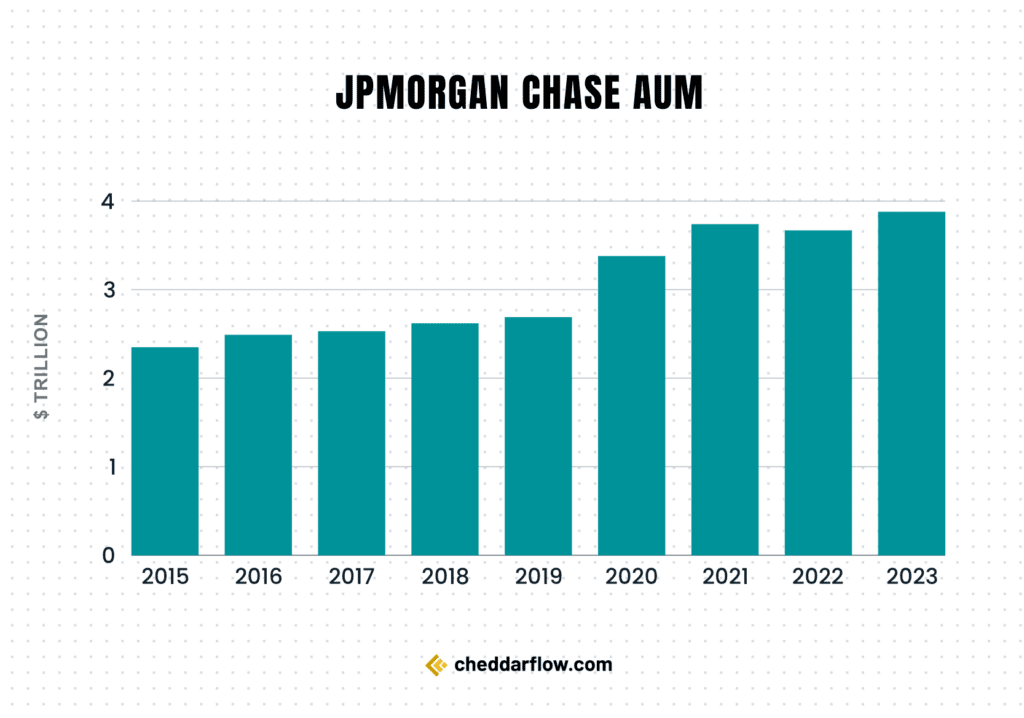

Total Assets Under Management (AUM) of JPMorgan Chase

| Year | JPMorgan Chase Total AUM |

|---|---|

| 2023 | $3.88 trillion |

| 2022 | $3.67 trillion |

| 2021 | $3.74 trillion |

| 2020 | $3.38 trillion |

| 2019 | $2.69 trillion |

| 2018 | $2.62 trillion |

| 2017 | $2.53 trillion |

| 2016 | $2.49 trillion |

| 2015 | $2.35 trillion |

| 2014 | $2.57 trillion |

| 2013 | $2.41 trillion |

| 2012 | $2.40 trillion |

| 2011 | $2.30 trillion |

| 2010 | $2.10 trillion |

| 2009 | $2.03 trillion |

JPMorgan Asset Management, rated Above Average, managed over $3.67 trillion in assets under management (AUM) as of 2022. The firm has diverse asset classes and robust investment teams. Despite well-priced funds, it faces competition from similar-sized peers. It also explores environmental, social, and governance-focused areas and direct indexing through the 55iP acquisition and a joint venture in China.

- As of the first quarter ending in March 2024, JPMorgan Chase’s total assets have grown to an impressive $3.88 trillion, showing a significant 5.72% increase from the previous year.

- This growth continues the positive trend seen in 2023 when the assets were also $3.88 trillion, marking a 5.72% increase from 2022. Interestingly, 2022 saw a slight dip of 2.08% in total assets, dropping to $3.67 trillion from $3.74 trillion in 2021.

However, 2021 was a good year for JPMorgan Chase with a robust 10.6% increase in total assets from 2020. This financial growth story underscores JPMorgan Chase’s strong position in the banking industry.

Source: Macrotrends

Assets under management (AUM) at JPMorgan Chase by region

JPMorgan Chase has experienced an overall growth in assets under management (AUM) across all areas despite a notable decrease in 2022.

| Year | North America | Europe/Middle East/Africa | Asia-Pacific | Latin America/Caribbean |

|---|---|---|---|---|

| 2022 | $1,992 billion | $487 billion | $218 billion | $69 billion |

| 2021 | $2,219 billion | $561 billion | $254 billion | $79 billion |

| 2020 | $1,905 billion | $517 billion | $224 billion | $70 billion |

| 2019 | $1,646 billion | $428 billion | $192 billion | $62 billion |

| 2018 | $1,378 billion | $366 billion | $162 billion | $51 billion |

| 2017 | $1,429 billion | $384 billion | $160 billion | $61 billion |

| 2016 | $1,294 billion | $309 billion | $123 billion | $45 billion |

| 2015 | $1,253 billion | $302 billion | $123 billion | $45 billion |

| 2014 | $1,243 billion | $329 billion | $126 billion | $46 billion |

| 2013 | $1,114 billion | $305 billion | $132 billion | $47 billion |

- North America stood out, with AUM exceeding $1.9 trillion in 2022.

- In addition, North America boasted the highest value of client assets, surpassing $2.9 trillion in the same year.

- Coming in second place for the highest value of AUM was the combined region of Europe, the Middle East, and Africa.

Source: Statista

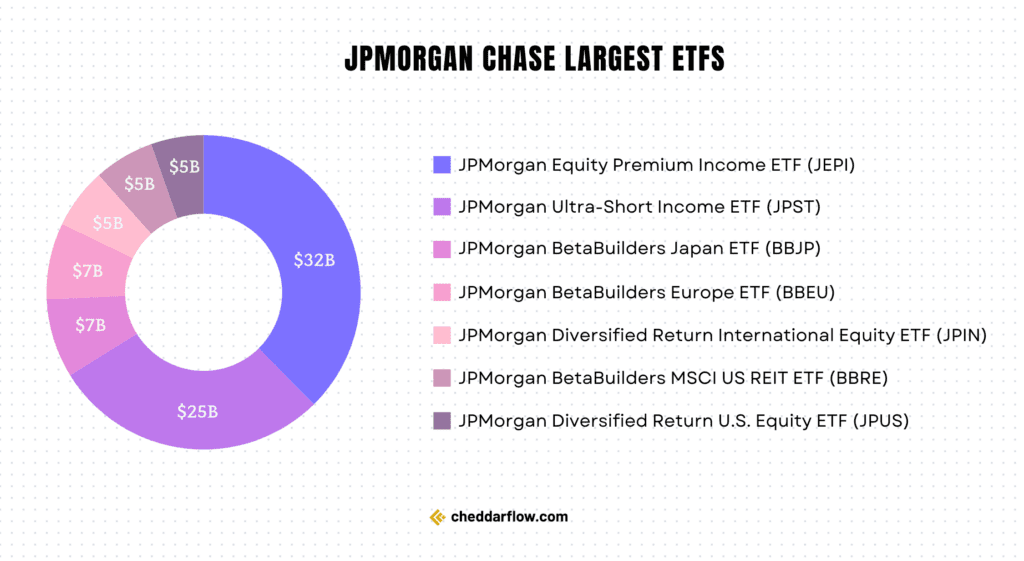

JPMorgan’s Top 10 Largest ETFs

The JPMorgan Equity Premium Income ETF (JEPI) stands out as the largest JPMorgan ETF with $32.44 billion in assets, recently overtaking the JPMorgan Ultra-Short Income ETF (JPST) which has $24.6 billion. JEPI is an actively managed fund that holds blue-chip dividend stocks but also employs a covered call options strategy to generate additional income, resulting in a high 7.9% dividend yield.

| Rank | ETF Name | Ticker | Assets (in billions) |

|---|---|---|---|

| 1 | JPMorgan Equity Premium Income ETF | JEPI | $32.44 |

| 2 | JPMorgan Ultra-Short Income ETF | JPST | $24.60 |

| 3 | JPMorgan BetaBuilders Japan ETF | BBJP | $7.02 |

| 4 | JPMorgan BetaBuilders Europe ETF | BBEU | $6.79 |

| 5 | JPMorgan Diversified Return International Equity ETF | JPIN | $5.37 |

| 6 | JPMorgan BetaBuilders MSCI US REIT ETF | BBRE | $5.35 |

| 7 | JPMorgan Diversified Return U.S. Equity ETF | JPUS | $4.66 |

| 8 | JPMorgan Ultra-Short Municipal Income ETF | JMST | $3.39 |

| 9 | JPMorgan Diversified Return Emerging Markets Equity ETF | JPEM | $3.38 |

| 10 | JPMorgan Diversified Return Global Equity ETF | JPGE | $3.31 |

Source: Bloomberg

Overview of JPMorgan Chase Investments and Acquisitions

JPMorgan Chase Funding (Funding Rounds)

JP Morgan Chase successfully generated $3 million in funding in just one round, which was completed on April 18, 2019.

| Announced Date | Transaction Name | Money Raised |

|---|---|---|

| Apr 18, 2019 | Grant – JP Morgan Chase | $3 million |

Source: CrunchBase

JPMorgan Chase Funding (Funds Raised)

JP Morgan Chase has successfully amassed $1.1 billion through 2 funds.

Their most recent fund, JP Morgan European Corporate Finance Institutional Investors V, was announced on August 29, 2014, and raised $82.4 million.

| Announced Date | Fund Name | Money Raised |

|---|---|---|

| Aug 29, 2014 | JP Morgan European Corporate Finance Institutional Investors V | $82.4 million |

| Aug 11, 2014 | J.P. Morgan Digital Growth Fund II | $1 billion |

Source: CrunchBase

JPMorgan Chase Investments

JP Morgan Chase has made a total of 213 investments. The latest one was on April 16, 2024, when Homewise raised $1 million.

| Announced Date | Organization Name | Lead Investor | Funding Round | Money Raised |

|---|---|---|---|---|

| Apr 16, 2024 | Homewise | Yes | Grant – Homewise | $1 million |

| Apr 11, 2024 | Arcadia | Yes | Debt Financing – Arcadia | $30 million |

| Apr 8, 2024 | Chart Industries | Yes | Post-IPO Debt – Chart Industries | $1.3 billion |

| Mar 26, 2024 | Capital Connect | Yes | Grant – Capital Connect | $250,000 |

| Mar 20, 2024 | Ecopetrol | — | Post-IPO Debt – Ecopetrol | $1.2 billion |

| Mar 12, 2024 | OYO | Yes | Debt Financing – OYO | ₹2 billion |

| Feb 21, 2024 | Warby Parker | — | Post-IPO Debt – Warby Parker | $120 million |

| Feb 8, 2024 | Florida Memorial University | Yes | Grant – Florida Memorial University | $1 million |

| Feb 7, 2024 | Pagaya | — | Post-IPO Debt – Pagaya | $280 million |

| Jan 31, 2024 | WELL Health Technologies | Yes | Post-IPO Debt – WELL Health Technologies | $300 million |

Source: CrunchBase

JPMorgan Chase Acquisitions

JP Morgan Chase has made a total of 19 acquisitions. The most recent one was First Republic Bank, which they acquired on May 1, 2023.

| Acquiree Name | Announced Date | Price | Transaction Name |

|---|---|---|---|

| First Republic Bank | May 1, 2023 | — | First Republic Bank was acquired by JP Morgan Chase |

| Aumni | Mar 22, 2023 | — | Aumni acquired by JP Morgan Chase |

| Global Shares | Mar 2022 | — | Global Shares acquired by JP Morgan Chase |

| FROSCH | Feb 17, 2022 | — | FROSCH acquired by JP Morgan Chase |

| Frank Financial Aid | Sep 21, 2021 | $175M | Frank Financial Aid acquired by JP Morgan Chase |

| The Infatuation | Sep 9, 2021 | — | The Infatuation acquired by JP Morgan Chase |

| cxLoyalty Group-Global Loyalty business | Dec 28, 2020 | — | cxLoyalty Group-Global Loyalty business acquired by JP Morgan Chase |

| InstaMed | May 17, 2019 | — | InstaMed acquired by JP Morgan Chase |

| WePay | Oct 17, 2017 | $400M | WePay acquired by JP Morgan Chase |

| J.P. Morgan Cazenove | Nov 19, 2009 | — | J.P. Morgan Cazenove acquired by JP Morgan Chase |

Source: CrunchBase

JPMorgan Chase Ownership Overview

JPMorgan Chase is predominantly owned by institutional shareholders, making up 71.63%. JPMorgan Chase & Co insiders hold 2.31%, while retail investors account for 26.05%.

The individual with the most significant stake in the company is James S. Crown, who owns 35.36M shares, which equates to 1.23% of the company.

Source: Wall Street Zen

Who founded JPMorgan Chase?

JPMorgan Chase, a leading global financial institution, has a rich history dating back to the late 18th century. Its inception resulted from mergers and acquisitions, with roots in multiple founding entities.

- One of the earliest, The Manhattan Company, established by Aaron Burr in 1799, started as a water supply company before swiftly transitioning into banking.

- Key figures such as John Pierpont Morgan and John Thompson also played significant roles. Morgan founded J.P. Morgan & Co. in 1871, and Thompson established Chase National Bank in 1877.

- These institutions, among others, eventually amalgamated into the present-day JPMorgan Chase. Each merger integrated diverse visions and leadership approaches, which influenced the bank’s foundational development and operational evolution, merging the legacies of its key founders into a unified institution.

The 2000 merger of Chase Manhattan and J.P. Morgan & Co. signified the pinnacle of this historical journey, officially creating JPMorgan Chase & Co. This merger fused Chase Manhattan’s robust commercial banking with J.P. Morgan & Co.’s potent investment banking operations, positioning the bank as a formidable force in the global financial arena.

Source: Business Insider

JPMorgan Chase Leadership

JPMorgan Chase & Co. is renowned for its great leadership structure, characterized by a distinguished Board of Directors and a dynamic Operating Committee, all underpinned by a cadre of other key corporate officers.

Each member of this governance framework brings a wealth of experience and expertise, guiding the firm through the complexities of the financial services industry.

Board of Directors

The Board of Directors at JPMorgan Chase & Co. is composed of 12 esteemed members.

- Linda B. Bammann – Known for her profound insights and extensive experience in risk management.

- Todd A. Combs – Brings a sharp analytical mind to the board, honed through years in the investment sector.

- Alicia Boler Davis – Offers a unique perspective on global manufacturing and operations.

- James Dimon – As Chairman and CEO, he provides strategic leadership and vision.

- Timothy P. Flynn – Recognized for his expertise in auditing and financial services.

- Alex Gorsky – Brings leadership in healthcare and innovation.

- Mellody Hobson – Noted for her acumen in investment management and financial literacy advocacy.

- Michael A. Neal – Offers depth in global banking and financial services.

- Lee R. Raymond – Provides invaluable insights from the energy sector.

- Mark A. Weinberger – Known for his expertise in tax and economic policy.

Operating Committee

The Operating Committee is integral to the company’s day-to-day management and strategic direction.

It includes:

- James Dimon – Chairman and CEO.

- Ashley Bacon – Brings expertise in risk management.

- Jeremy Barnum – Oversees finance as the CFO.

- Lori A. Beer – Guides global technology initiatives.

- Mary Callahan Erdoes – Manages asset and wealth management.

- Stacey Friedman – Serves as General Counsel.

- Takis Georgakopoulos – Heads global payments.

- Teresa Heitsenrether – Oversees securities services.

- Robin Leopold – Leads human resources.

- Douglas B. Petno – Focuses on commercial banking.

- Jennifer A. Piepszak – Directs consumer banking.

- Daniel E. Pinto – Co-President and COO, also heads the corporate & investment bank.

- Troy Rohrbaugh – Leads global markets.

Other Corporate Officers

Supporting the governance structure, several key officers manage critical corporate functions:

- John H. Tribolati, Secretary

- Lou Rauchenberger, General Auditor

- Joseph M. Evangelisti, Corporate Communications

- Mikael Grubb, Investor Relations

- Elena Korablina, Controller

This leadership team collectively ensures JPMorgan Chase & Co. remains at the forefront of the financial industry, upholding its commitment to integrity, innovation, and client service.

How many employees in JPMorgan Chase?

JPMorgan Chase has a substantial global presence, operating in over 60 countries with a workforce exceeding 300,000 employees.

As of the end of 2023, the company employed 309,926 people worldwide, marking a 5.52% increase from the previous year, when the employee count stood at 293,723.

| Year | JPMorgan Employees Headcount |

|---|---|

| 2023 | 309,926 employees |

| 2022 | 293,723 employees |

| 2021 | 271,025 employees |

| 2020 | 255,351 employees |

| 2019 | 256,981 employees |

| 2018 | 256,105 employees |

| 2017 | 252,539 employees |

| 2016 | 243,355 employees |

| 2015 | 234,598 employees |

| 2014 | 241,359 employees |

| 2013 | 251,196 employees |

| 2012 | 258,965 employees |

| 2011 | 260,157 employees |

| 2010 | 239,831 employees |

| 2009 | 222,316 employees |

Source: Macrotrends

Where is the Headquarters of JPMorgan Chase?

The main office of JPMorgan Chase is located at 383 Madison Ave, New York, United States, and the company operates from 171 other locations.

| Country | City | Address |

|---|---|---|

| United States | New York | 383 Madison Ave HQ |

| United States | Atlanta | 3424 Peachtree Road NE Monarch, Tower, 24th Floor |

| United States | Austin | 221 W 6th St 2nd Floor |

| United States | Baltimore | 650 S Exeter St Floor 9 |

| United States | Baton Rouge | 451 Florida St 6th Floor |

| United States | Birmingham | 480 Pierce St 2nd floor, suite 250 |

| United States | Boca Raton | 240 E Palmetto Park Rd #2nd |

| United States | Boston | 50 Rowes Wharf 3rd Floor |

| United States | Charlotte | 4350 Congress St Suite 150 |

| United States | Chicago | 10 S Dearborn St 8th floor |

Source: Craft

How many banking branches does JPMorgan Chase have?

As of June 2023, JPMorgan Chase Bank was the top bank in the United States, boasting 5,117 branches nationwide. Wells Fargo Bank and Bank of America followed, with 4,521 and 4,029 branches, respectively.

Source: Statista