As an active options trader, you know that knowledge is power. The more you understand about the market dynamics and trends driving your trades, the better equipped you are to make informed decisions. That’s why we’re thrilled to introduce our new Advanced Order Details feature, designed to provide you with deeper insights and analytics for your options trades.

Effortlessly Access Crucial Trade Data

With our new Advanced Order Details, accessing key information about your options trades has never been easier. Simply click on the expiration date in the main table or the three-dot icon at the end of each row, and you’ll instantly see a wealth of data at your fingertips. The data updates in near real-time, approximately every minute, ensuring you always have the most current information. If you don’t see data right away, just give the system a moment to populate the details.

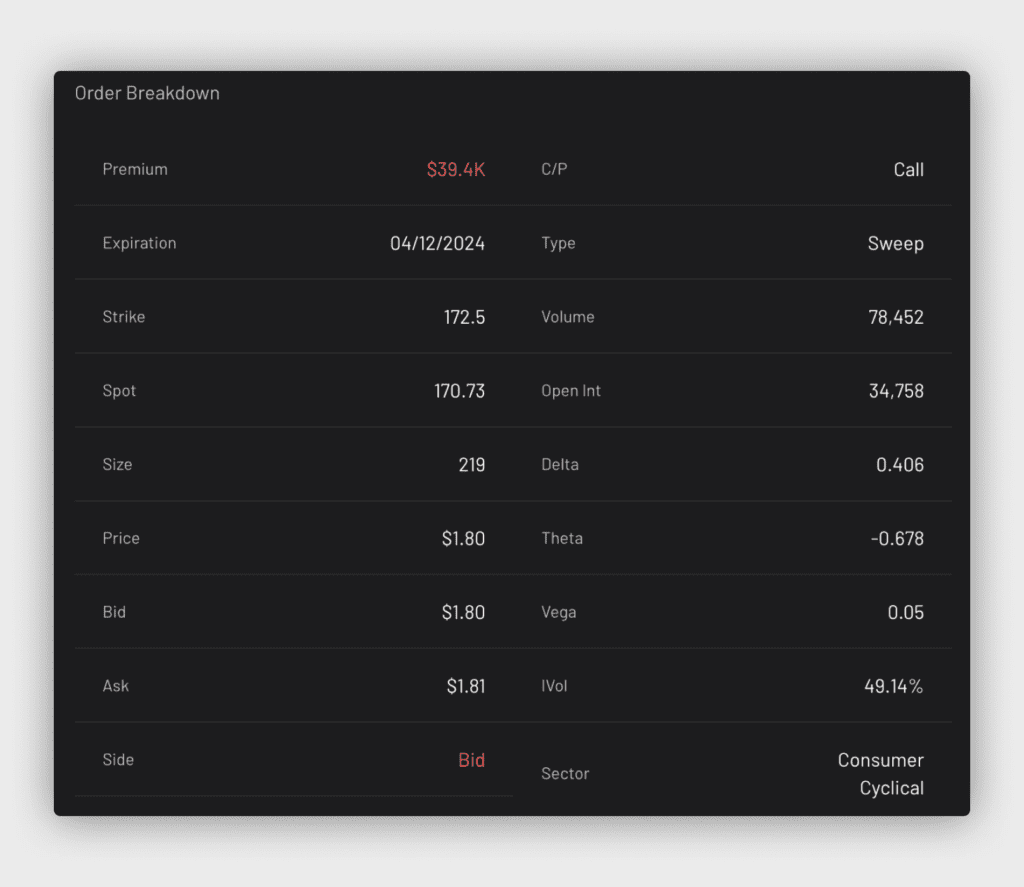

Understand Your Trade with the Order Breakdown

The Order Breakdown section offers a clear overview of the essential details for your selected options trade. This at-a-glance summary allows you to quickly grasp the key elements of the trade processed by our system, empowering you to stay informed and in control.

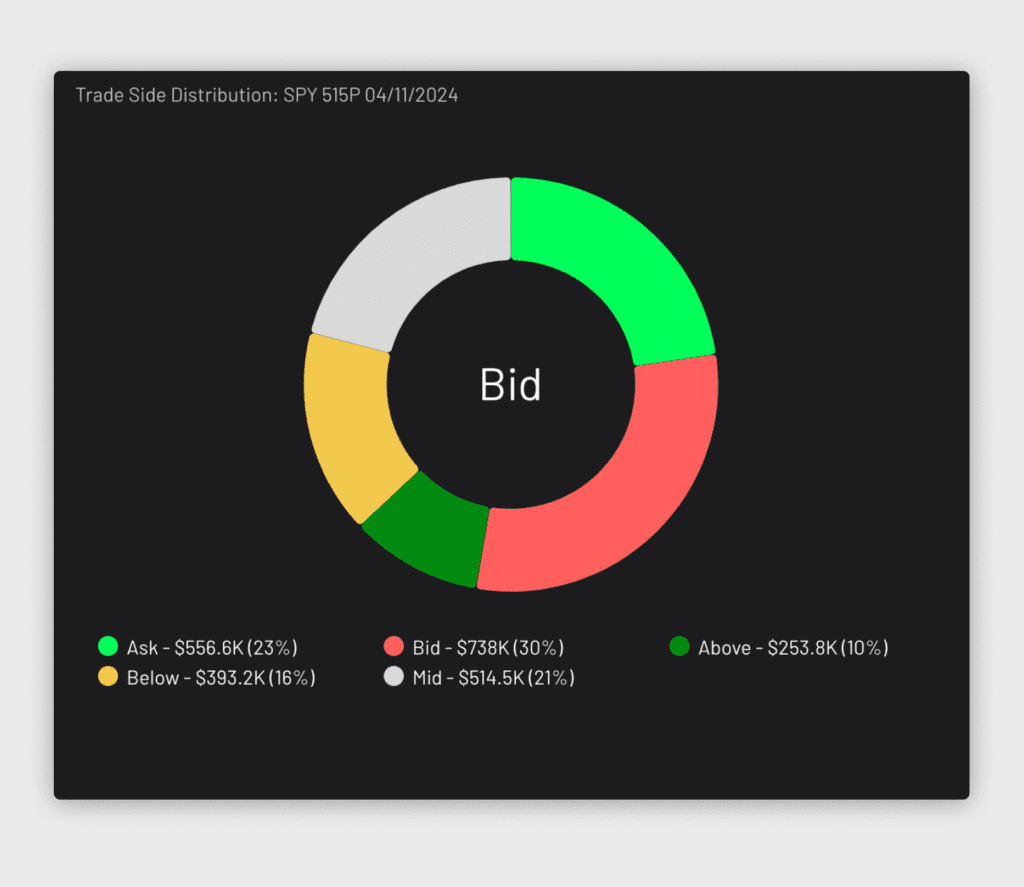

Visualize the Trade Side Distribution

The Trade Side Distribution pie chart delivers a visually intuitive breakdown of the premium distribution across all trades for your chosen options order. Instantly identify which side (Ask side, bid side etc) is experiencing the heaviest trading activity. This visual representation makes it simple to spot concentrations and potential imbalances in trade side distribution.

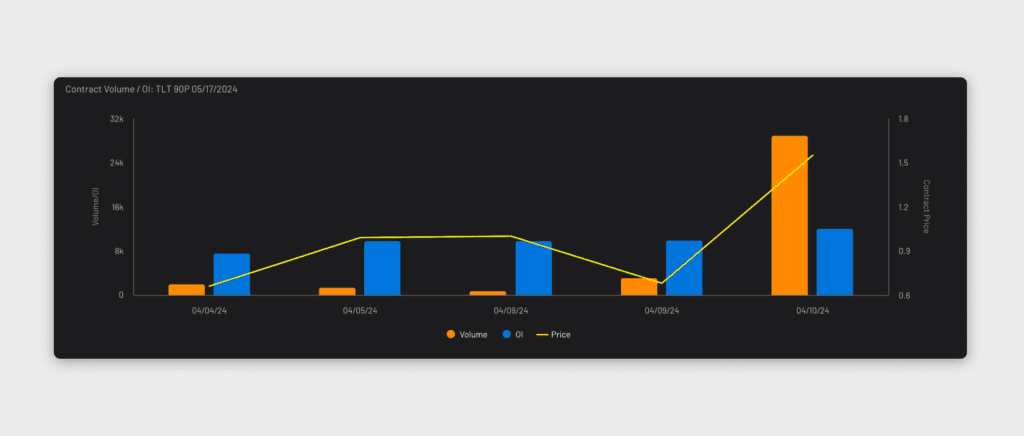

Track Volume and Open Interest Over Time

The Contract Volume and Open Interest chart provides a 5-day view of the total options volume for the contract you’ve selected. In addition to volume, you can track changes in open interest and the contract’s price movement over this period. Monitoring these key indicators over time offers valuable context for your trading decisions. Identify momentum, spot emerging trends, and gauge the strength behind price moves.

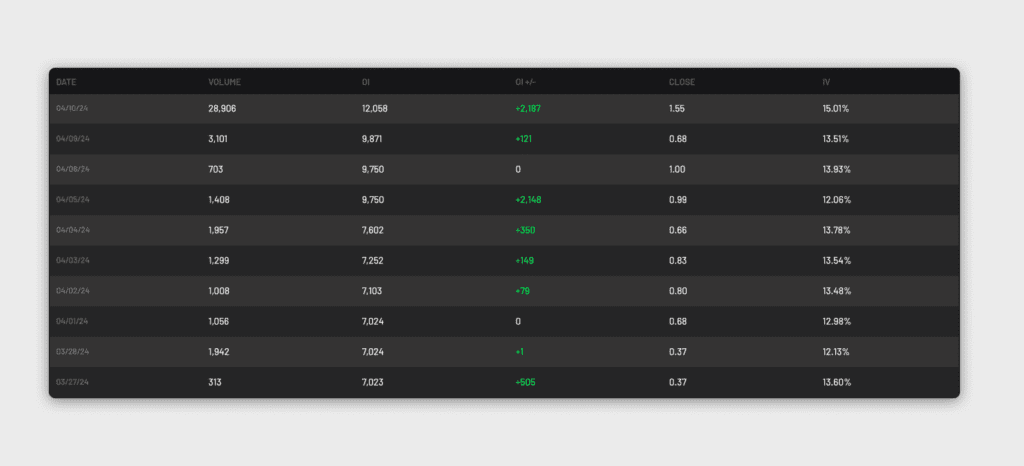

Dive into Historical Data

For an even deeper analysis, the Historical Data table presents an expanded 2-week view of your selected options contract. Trace changes in volume and open interest, review closing prices, and examine implied volatility over this extended timeframe. Armed with this historical context, you’ll be better prepared to interpret current market conditions and anticipate potential future developments. Identify patterns, compare current activity against prior periods, and extract actionable insights.

How to Use this Information

This data is really useful for determining if an options contract is being bought or sold. Look for the following:

Volume

- If volume is significantly higher than the existing open interest, it signals that intraday trading is occurring, with positions being opened and closed within the same day.

- If volume is around the same level as existing open interest, it may suggest that most of the trading activity is opening new positions.

Open Interest

- If open interest is increasing along with rising volume, it indicates that new positions are being opened and contracts are being bought.

- If open interest is decreasing or remains flat while volume spikes, it suggests existing positions are being closed, so contracts are being sold.

Implied Volatility

- Increasing implied volatility along with rising volume and open interest suggests contracts are being bought, especially call options.

- Decreasing implied volatility with high volume but flat or declining open interest points to contracts being sold.

Closing Price

- If the closing price of an option is moving higher with increasing open interest and volume, it confirms contracts are likely being purchased.

- The opposite is true if the closing price trends lower on high volume without much change in open interest – it indicates more selling pressure.

Open interest and volume are the most important metrics to focus on. Rising open interest and volume signal buying pressure, while high volume alone with flat or declining open interest suggests more selling.

However, options data doesn’t show the exact number of contracts bought vs sold. Every trade has both a buyer and seller. So these metrics provide clues and overall sentiment, but not precise buy/sell numbers. Analyzing price trends and implied volatility changes can provide additional context on whether traders are more actively buying or selling their positions in a particular options contract.

Empowering You to Trade Smarter

At Cheddar Flow, we’re committed to delivering the tools and resources you need to succeed as an options trader. We understand that in today’s fast-paced markets, you need to be able to quickly access and interpret complex data. That’s precisely what our new Advanced Order Details feature is designed to do. By putting powerful analytics and visualizations at your fingertips, we aim to empower you to make more informed trading decisions with greater speed and confidence.