Ever thought about investing in the rapidly growing robotics industry? One company that often comes to mind is Boston Dynamics, known for its cutting-edge mobile robots. In this blog post, we’ll explore various ways to invest in this innovative company, even though it’s not publicly traded, and discuss alternative investment opportunities in the robotics and AI space, including the potential of Boston Dynamics stock. Buckle up for an exciting journey into the world of robotics investing!

Short Summary

Investors can gain indirect exposure to Boston Dynamics through investing in its parent companies, Hyundai and SoftBank.

Alternatives to Boston Dynamics in the robotics and AI industry include iRobot Corporation (IRBT) and NVIDIA (NVDA).

Investing in robotics stocks involves potential rewards as well as risks due to the nature of the industry.

Understanding Boston Dynamics

Boston Dynamics, a spin-off from the Massachusetts Institute of Technology, is a world-renowned robotics company that designs advanced mobile robots like Spot and Handle. Established in 1992, the company was acquired by the parent company of Google in 2013 for $100 million, making it a privately owned entity.

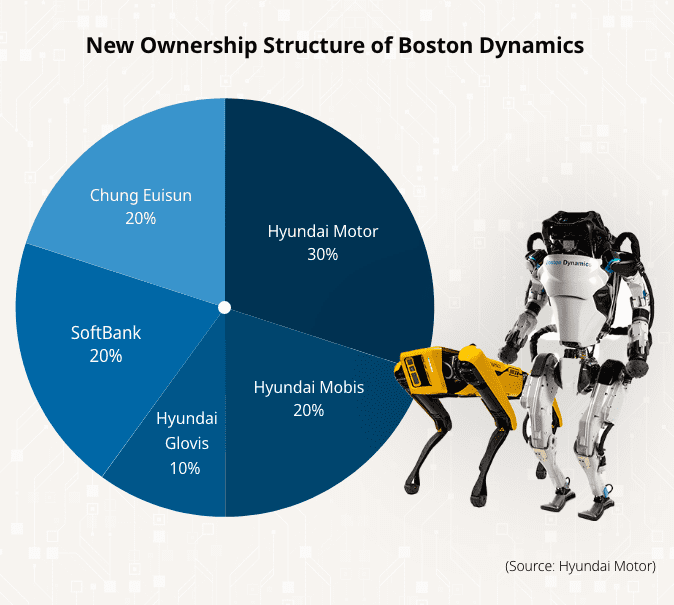

Today, it is co-owned by Hyundai Motor Group and SoftBank, two major players in the automotive and technology industries, respectively. These two companies have contributed significantly to Boston Dynamics’ development of smart logistics solutions and cutting-edge robotics technology. Hyundai Motor Company, a key part of Hyundai Motor Group, holds an 80% stake in the company, while SoftBank owns a 20% stake.

As a result, Boston Dynamics is part of an extensive robotics value chain, which includes robot component manufacturing and mobile robot development.

The Hyundai Motor Group Connection

In 2021, Hyundai Motor Group purchased an 80% ownership in Boston Dynamics for a value of $1.1 billion. This acquisition marked a significant turning point in the trajectory of the company. This acquisition allowed Hyundai to leverage its resources and expertise to further advance the robotics company’s smart logistics solutions. However, since Boston Dynamics is not publicly traded, there is no specific stock price available for investors.

For those interested in indirect exposure to Boston Dynamics, buying Hyundai stock (HYMTF) is an option. As a majority stakeholder, Hyundai’s performance and growth may potentially reflect the progress and success of Boston Dynamics.

SoftBank’s Role in Boston Dynamics

SoftBank, a Japanese investment group, was previously the majority owner of Boston Dynamics and currently holds a 20% stake in the company. Although Boston Dynamics is not publicly traded, investors seeking indirect exposure can consider purchasing SoftBank shares (SFTBF).

By investing in SoftBank, investors may potentially benefit from the growth and success of Boston Dynamics, as well as the numerous other technology companies and startups in SoftBank’s extensive portfolio.

Is Boston Dynamics a Publicly Traded Company?

As exciting as it may sound to buy Boston Dynamics stock, the company is not publicly traded due to its ownership by Hyundai Motor Group and SoftBank. This means there is no Boston Dynamics stock symbol or Initial Public Offering (IPO) date available for potential investors.

Boston Dynamics remains one of the private companies in the robotics industry, focusing on advancing robotics technology and refining their highly capable robots without the additional demands of public shareholders. Unfortunately, this means that individual investors cannot directly buy Boston Dynamics stock.

Indirect Investment Opportunities

Since there is no direct way to buy Boston Dynamics stock, investors can obtain indirect exposure to the company through investing in its parent companies, Hyundai and SoftBank. Both companies are publicly traded, allowing investors to benefit from the growth potential of Boston Dynamics and the broader robotics and AI industry. By keeping an eye on Boston Dynamics stocks, one can stay informed about the company’s progress and make informed investment decisions.

Investing indirectly in Boston Dynamics may appeal to many investors, as the company’s advanced robotics technology and growing market presence make it an attractive investment opportunity. In the following sections, we’ll explore how to invest in Hyundai and SoftBank stocks for indirect exposure to Boston Dynamics.

Buying Hyundai Stock (HYMTF)

Hyundai stock (HYMTF) can be purchased on the over-the-counter market through brokerage or trading applications. By investing in Hyundai, investors gain indirect exposure to Boston Dynamics and its cutting-edge robotics technology.

After purchasing Hyundai stock, investors should closely monitor the stock price and any relevant news pertaining to Hyundai and Boston Dynamics to make informed decisions regarding when to buy or sell. This approach allows investors to potentially benefit from the growth and success of both companies.

Investing in SoftBank (SFTBF)

Another way to indirectly invest in Boston Dynamics is by purchasing SoftBank shares (SFTBF). SoftBank is a major player in the technology and startup investment world, providing potential exposure to a diverse portfolio of companies, including Boston Dynamics, and funding employee stock options for various startups.

Investing in SoftBank shares comes with the same risks and rewards as investing in any other stock. It is crucial to be aware of the potential volatility of the stock, as well as the long-term growth potential.

Pre-IPO Investment Options

For accredited investors, pre-IPO investment opportunities in Boston Dynamics may be available through secondary marketplaces like EquityZen or MicroVentures. These platforms allow investors to purchase pre-IPO shares from existing shareholders, providing early access to potential growth opportunities.

It’s important to note that pre-IPO investments carry their own set of risks, and investors should carefully research and assess the company’s financials, growth potential, and market position before committing to such investments.

Robotics and AI Stock Alternatives

If you’re interested in investing in the robotics and AI industry but are looking for alternatives to Boston Dynamics, there are other publicly traded companies to consider. Companies like iRobot Corporation (IRBT) and NVIDIA (NVDA) offer different perspectives on the robotics and AI market, providing investors with diverse options for industry exposure.

Related Article: How To Invest In OpenAI Stock In 2023

iRobot Corporation (IRBT)

iRobot Corporation (IRBT) is a consumer robotics company, specializing in Roomba vacuums and other household products. Unlike Boston Dynamics, iRobot focuses on consumer robots, offering investors a different perspective on the robotics industry.

NVIDIA (NVDA)

NVIDIA Corporation (NVDA) is a leading supplier of computer chips to companies like Boston Dynamics, positioning itself to benefit from the growth of the robotics industry. NVIDIA’s chips are crucial for the development and operation of advanced robotics and AI systems.

The Future of Boston Dynamics and Potential IPO

The future of Boston Dynamics and its potential Boston Dynamics IPO remains uncertain. However, the company’s valuation and market presence are expected to grow as it continues to develop advanced robotics technology. With a valuation of $1.1 billion, Boston Dynamics has already attracted attention from industry experts who anticipate a significant increase in its valuation by 2023, leading to speculations about the Boston Dynamics stock price.

As the company continues to refine its highly capable robots and advance the robotics industry, the possibility of an IPO may become more likely in the future. For now, investors can consider indirect investment opportunities and alternative robotics stocks to gain exposure to the industry’s growth potential.

Risks and Rewards of Investing in Robotics Stocks

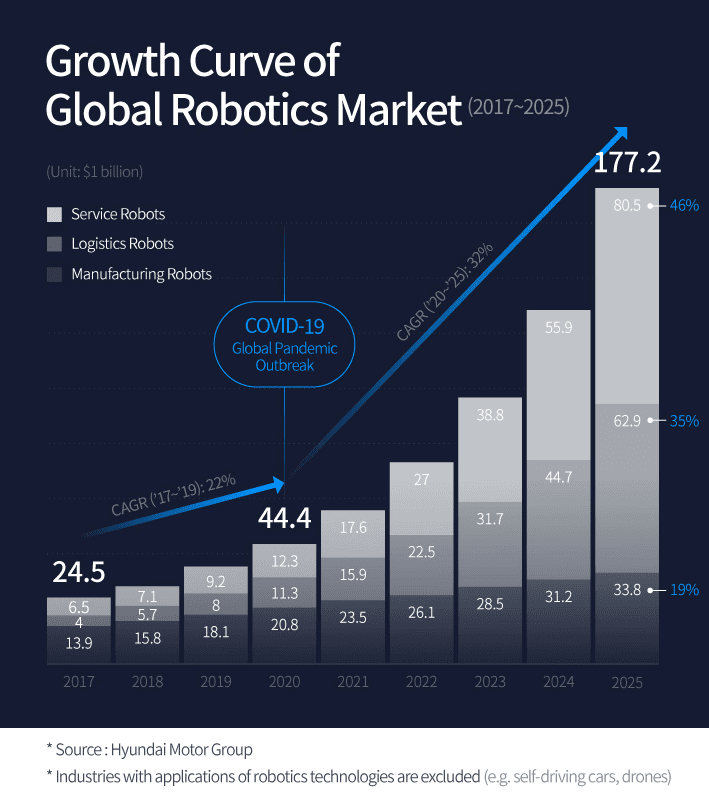

Investing in robotics stocks, including companies like Boston Dynamics, comes with both risks and rewards. The robotics industry is still in its early stages, heavily reliant on research and development, and subject to stock market competition and fluctuations.

On the other hand, the robotics and AI industry has shown tremendous growth potential, with companies like Boston Dynamics creating innovative solutions that could revolutionize various sectors. Investors who are willing to embrace the risks may stand to reap significant rewards as the industry continues to expand and evolve.

Summary

In conclusion, while there is no direct way to buy Boston Dynamics stock, investors can gain indirect exposure through its parent companies, Hyundai and SoftBank, or explore pre-IPO investment opportunities and alternative robotics stocks like iRobot Corporation and NVIDIA. The future of Boston Dynamics and the robotics industry holds both risks and rewards, but for those willing to navigate the uncertainties, the potential for significant returns is undeniable.

Frequently Asked Questions

Is Boston Dynamics on the stock market?

Unfortunately, Boston Dynamics is not available to be bought and sold on the stock market. Equitybee gives accredited investors early access to privately held companies, but Boston Dynamics is still not accessible through traditional markets.

How do I buy shares in Boston Dynamics?

Unfortunately, Boston Dynamics does not currently offer stock for public purchase as the company is privately owned.

However, investors can gain indirect exposure by investing in Hyundai Motor Group (HYMTF) and SoftBank Group Corp. (SFTBF), both of which are publicly traded companies that own Boston Dynamics.

Who owns Boston Dynamics?

Boston Dynamics is currently owned by Hyundai Motor Company, who purchased the robotics firm in December 2020 for $921M. Prior to Hyundai, Boston Dynamics was owned by Alphabet Inc. and Google Inc. from 2013-2020.

How can I indirectly invest in Boston Dynamics?

If you want to invest in Boston Dynamics indirectly, you can buy shares of its parent companies Hyundai (HYMTF) and SoftBank (SFTBF). This will give you exposure to Boston Dynamics without investing directly in it.

What are some alternative robotics and AI stocks to consider?

For those looking to diversify their portfolio with robotics and AI stocks, iRobot Corp (IRBT) and NVDIA (NVDA) may be good alternatives to consider.