This week is crucial, as the Federal Open Market Committee (FOMC) is set to meet on Wednesday. The Fed is expected to reduce interest rates by 25 basis points, reflecting the favorable economic conditions they’ve observed.

However, it’s worth noting that these developments have already been factored into market expectations. The current short covering rally seems to indicate this. Despite my bearish outlook for the mid to long term, the market has been experiencing a short-term bullish trend. It’s important to highlight that the key trendline that previously marked strong rejections at the end of March and middle of August has been breached.

Some investors are optimistic about the continuous upward trend, following the break of the trendline. However, I must stress that the mid to long term outlook remains bearish. There has yet to be a significant impact on earnings, despite the Fed’s actions over the past year.

Tesla squeezing

Regarding Tesla, the stock has been gradually climbing, and many of the shorts have been squeezed out. However, we must be cautious as Tesla is now approaching a key supply range that could act as a resistance.

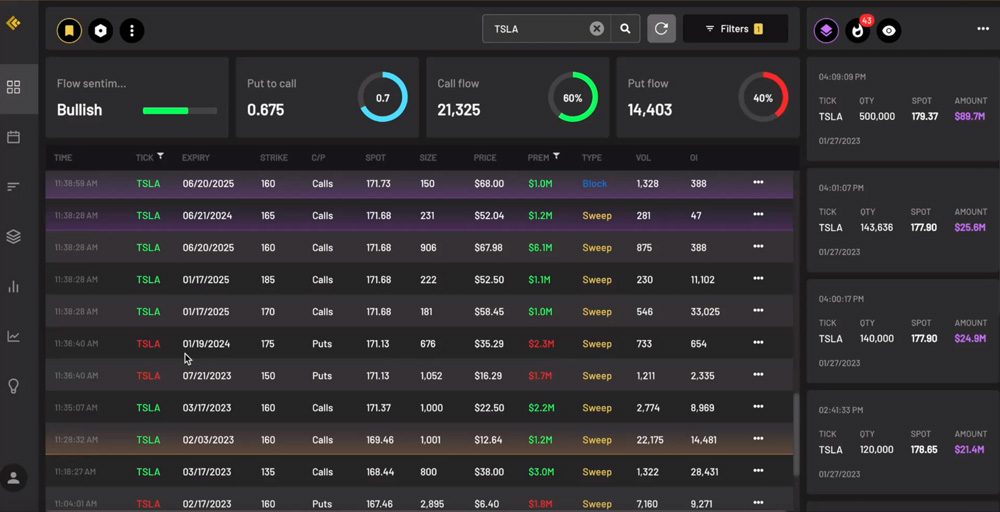

When analyzing Tesla’s options order flow, it’s notable that there’s a high proportion of short-term bearish bets, similar to what we’re observing in the S&P 500. This indicates a bullish short-term outlook, yet the mid to long term remains bearish. It’s crucial to understand that current market trends may not persist in the coming months.

Dow Jones Bearish Territory

The Dow Jones has been one of the most bullish indexes during the bear market. However, it has struggled to match the performance of the S&P 500 and NASDAQ. This suggests that the Dow Jones is becoming weaker and is likely to be the first to show signs of a new downward trend.

If we observe a retest of the downward trendline, we can evaluate price action to determine if a new downward trend is beginning. If the Dow Jones does break below this trendline, which I anticipate happening in the first half of the year, this will signal the start of a new downward trend, with the Dow Jones likely leading the way.

Make sure to catch our full weekly recap video below: