Market participants are widely expecting the Federal Reserve to raise interest rates by 25 basis points at its May 3rd meeting. This would bring the terminal rate of 5% to 5.25% in-line with what the Fed has been projecting since December.

The Fed’s $8.5 trillion balance sheet will also be in the spotlight as investors will be looking forward to hearing Jerome Powell’s remarks on further balance sheet run0ffs. Since last year, the Fed has committed to $95 billion in quantitative tightening (QT) per month.

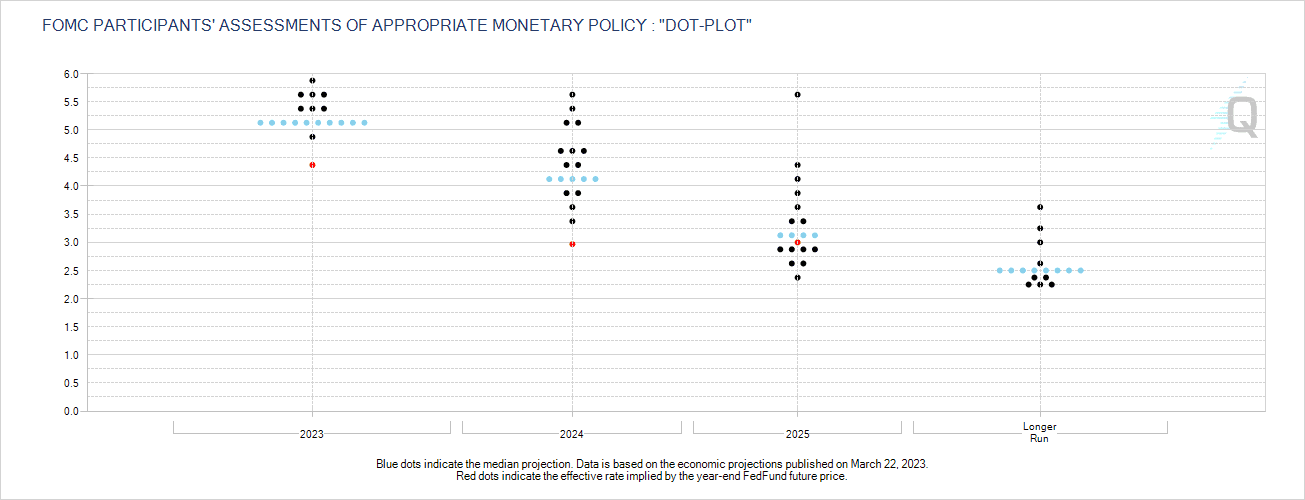

Also front and center will be the projected interest rate path going forward. In the March meeting, Powell made it clear stating, “rate cuts are not in our base case.” Nonetheless, as shown in the dot-plot below, 7 members see rates going higher than the 5.1% terminal rate. The bond market is also calling the bluff, pricing in three 25bps rate cuts by the end of 2023.

To Pause or Not Pause

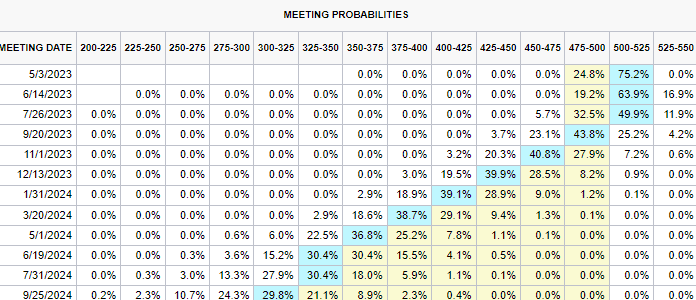

While the Fed has not explicitly given direction about a pause, the bond market sure believes the Fed will. The current FOMC meeting has a 75% chance of a 25 basis point hike and a 25% chance of a pause. As shown in the chart below, after this hike in May, the bond market is pricing a pause in rate hikes through the July FOMC meeting and a 25 basis point cut starting in September.

It is no secret that the Federal Reserve is largely data-dependent for its interest rate path. At the last FOMC meeting in March, Powell said, “The Committee will closely monitor incoming information and assess the implications for monetary policy.” Along with this, Fed members updated their economic projections. They slightly raised their expectations for inflation, with a 3.3% rate for 2023. Unemployment was lowered to 4.5%, while the outlook for GDP was lowered to 0.4%

Since then, the Fed will see a slew of economic data releases. Already released has been the March CPI reading at 5.% and core CPI at 5.6% showing that inflation might be much more “sticky” than the Fed has hoped for. This is well above the committee’s long-term goal of 2% inflation.

Also released have been the Non-Farm Payroll numbers at 236K, unemployment at 3.5%, average hourly gains at 0.3%, and GDP at 1.1%. Besides the slower GDP rate, these are all signs of a resilient economy and a strong labor force. The last major economic release before the May 3rd FOMC meeting will be PCE on 4/28. This is the Fed’s preferred inflation gauge.

Debt Ceiling, Financial Conditions, and the Yield Curve

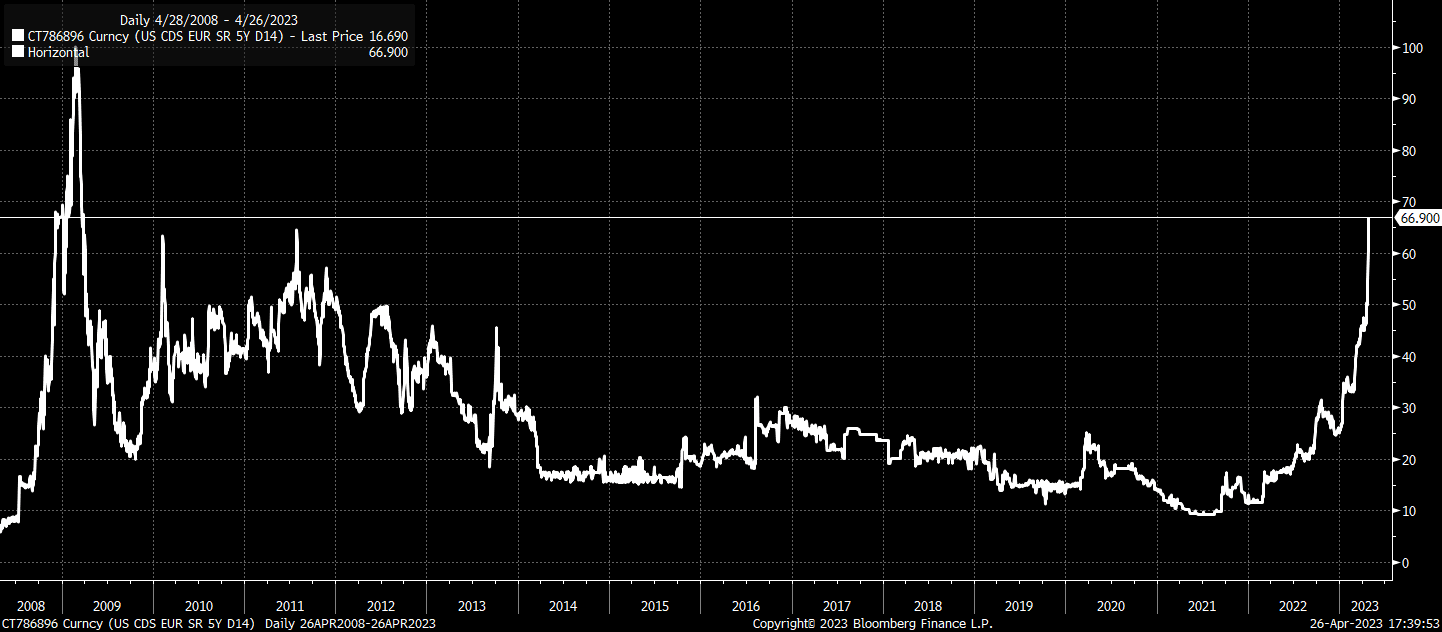

With the debt ceiling issues looming and a June 5th deadline, 5 yr US credit default swaps are at the highest value since 2009. While the US hasn’t intentionally ever defaulted on its debt, investors are buying protection in case Congress can’t come to a solution by the deadline.

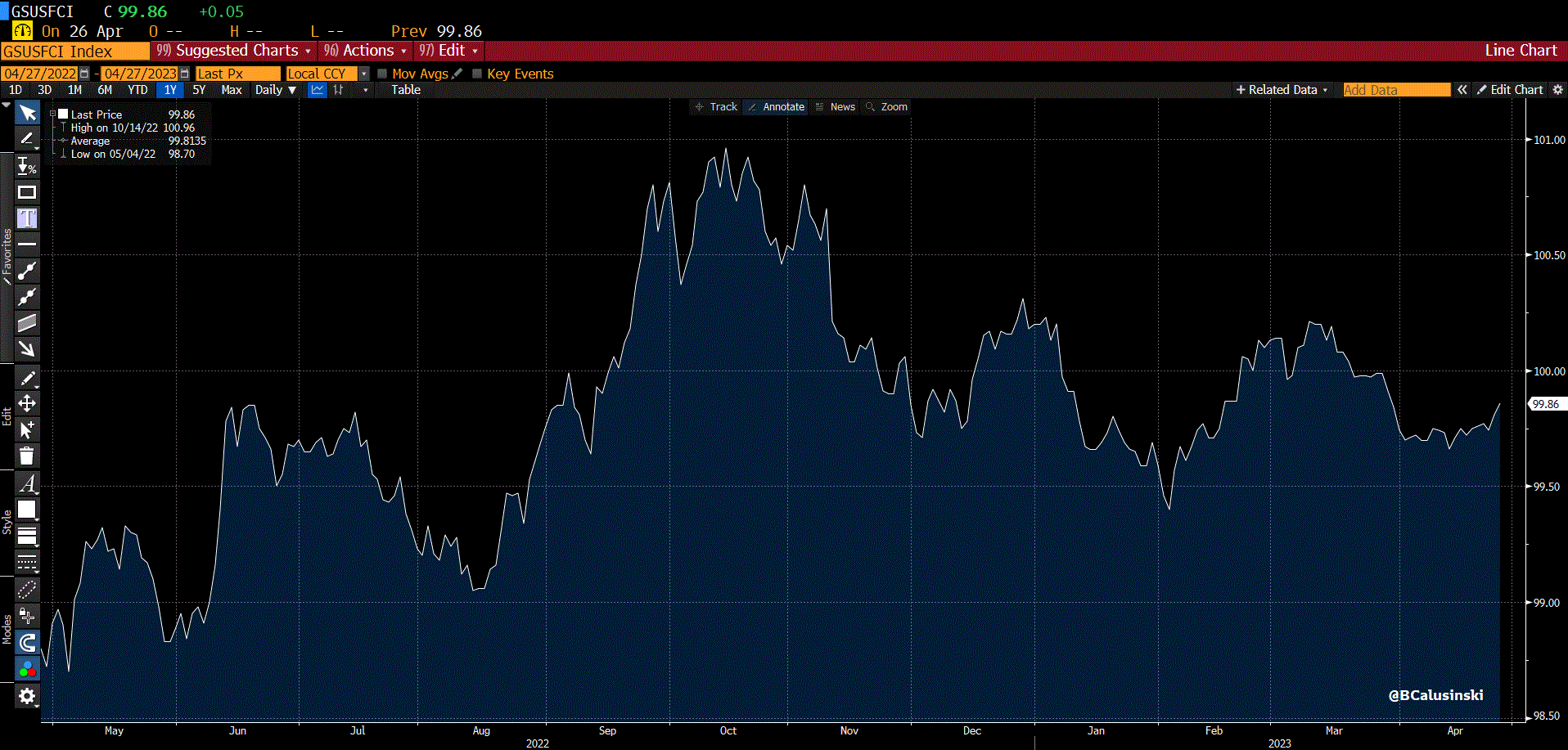

Goldman Sachs Financial Conditions Index

Since the March banking crisis, financial conditions have eased but remained at the same level since June 2022. So far during April, we have seen a small tightening in financial conditions. Powell has made it clear that he wants conditions to tighten to slow down the economy.

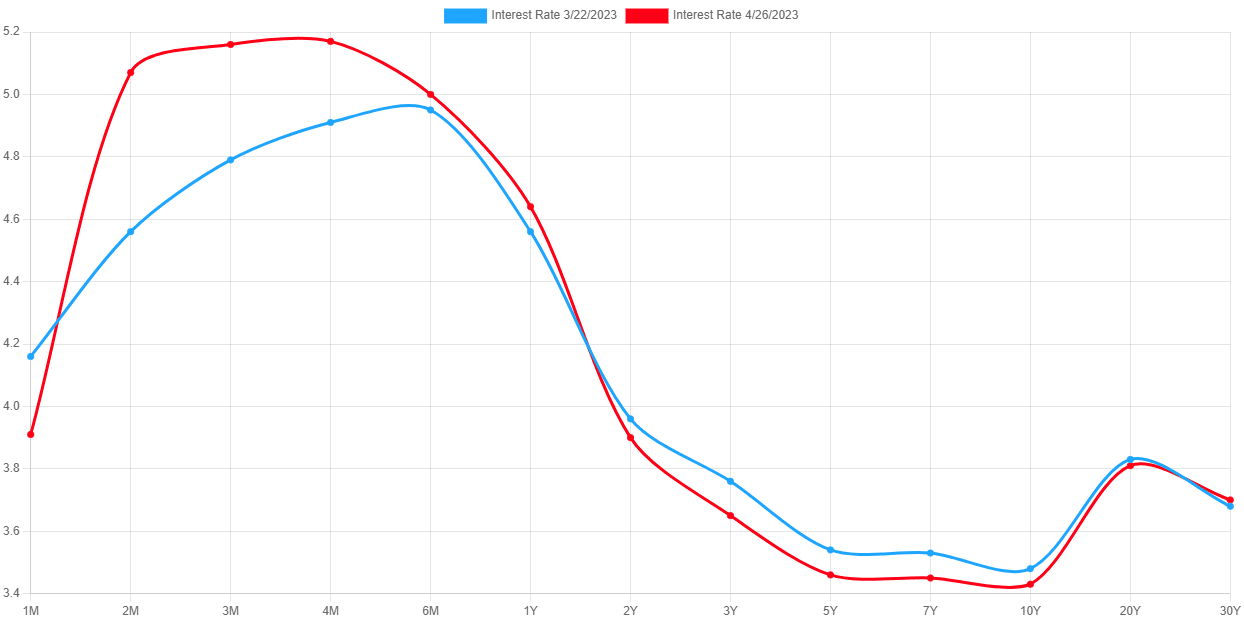

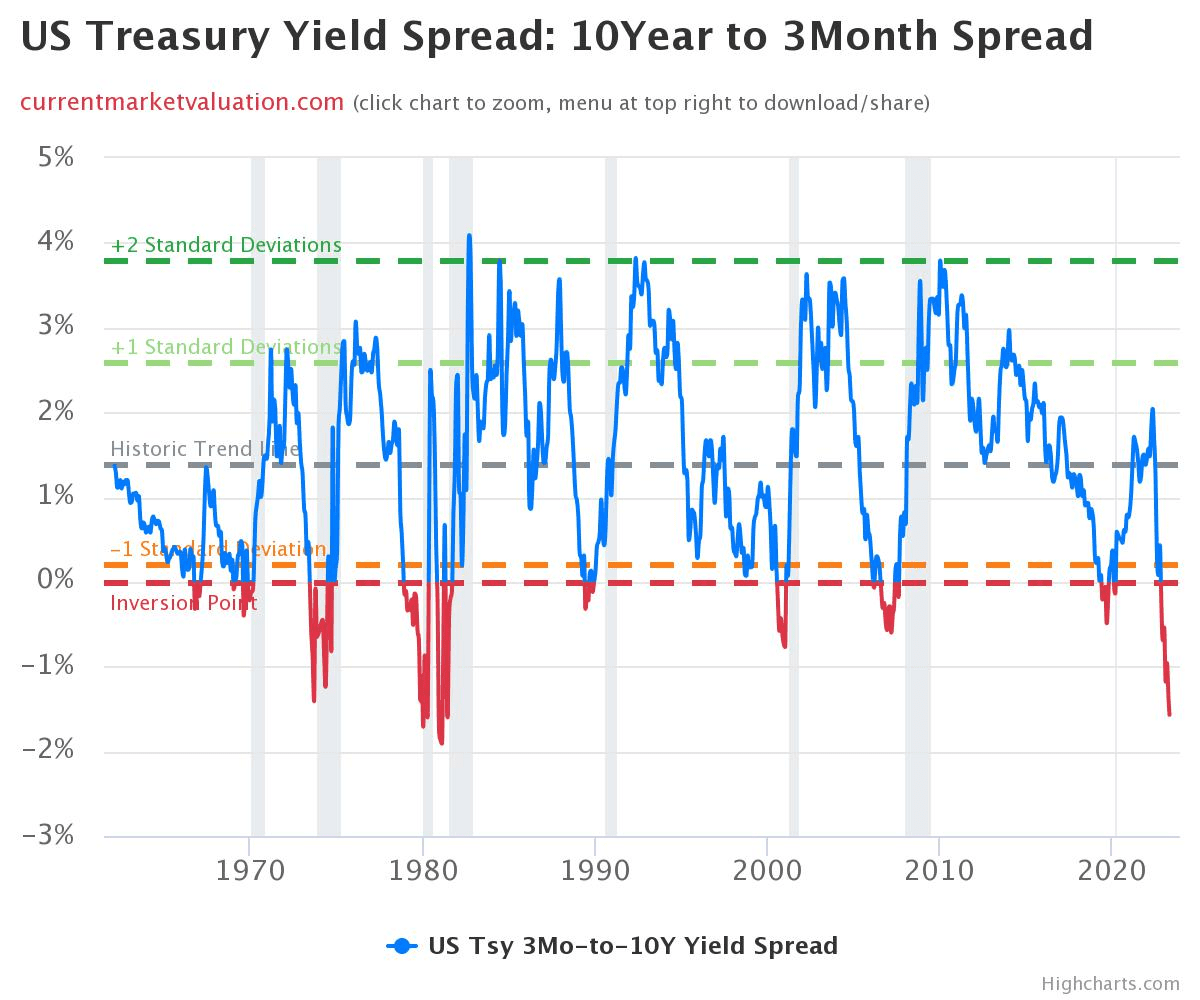

Yield Curve and Inversion

The Fed wants the long end of the yield curve to rise. Since the last FOMC meeting, you can see that the long end has dropped while the short end is actually higher. This has further steepened the inversion between 3M/10YR. The Fed uses this inversion in its recession models. The chart below is showing the steepest inversion since the 1980s. The inversion has predicted every single recession since 1950 with only 1 false signal. That false signal was the credit crunch in 1967.

Conclusion

With debt ceiling issues looming, this upcoming FOMC on May 3rd will prove to be one of the most pivotal meetings since the Fed started tightening. Investors should watch for Powell’s tone to understand if a pause is in the cards while looking at the statements for further QT signals. The outcome of this meeting will drive the broad market direction in the foreseeable future. Higher for longer or pause, the question that will be answered soon.