Investors searching for ‘Canva stock’ are often met with the reality that Canva remains a private company, currently without a ticker symbol to its name. This article examines Canva’s valuation, recent financial upswings, and practical ways for potential investors to engage with Canva’s assets ahead of any future public offering.

Key Takeaways

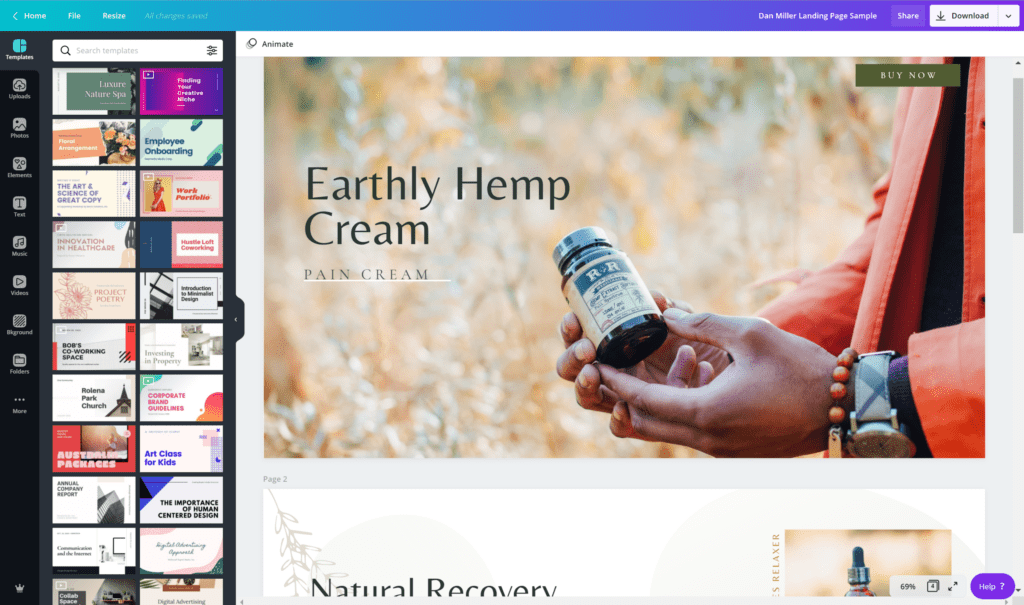

Canva, an online design platform operating on a freemium model, has maintained a significant market position and user base growth through innovation, despite competition from major companies.

Financially, Canva has demonstrated substantial revenue growth, reaching $1.7 billion, and has sustained positive cash flow since 2017, presenting itself as an attractive investment opportunity.

While Canva remains private with a valuation around $25.5 billion, it offers pre-IPO investment opportunities to accredited investors through specific funds and platforms, albeit with high risks associated with private company investments.

Understanding Canva: The Company and Its Market

Launched in 2013, Canva is on a mission to empower everyone to design anything and publish anywhere. This online design and visual communication platform provides collaborative tools for businesses of all sizes, including:

Template branding

Design sharing

Asset management

Integration with other platforms such as HubSpot.

Operating on a freemium business model, Canva has attracted a significant user base, with many users transitioning to paid subscriptions, indicating a robust monetization of the platform. Despite facing competition from companies like Adobe, Autodesk, and Microsoft in the design software market, Canva has managed to maintain its market position through consistent innovation and platform scaling.

Canva’s Financial Health: Revenue and Profitability

A glimpse into Canva’s financial health reveals a thriving business. The company’s annualized revenue has seen a significant increase, reaching $1.7 billion from the $1 billion projection at the end of 2021. This rapid growth trajectory has allowed Canva to more than double its revenue year-over-year, surpassing $1 billion by 2022.

Furthermore, Canva has managed to sustain a positive cash flow since 2017, an indication of the company’s profitability and financial stability. These figures suggest that Canva is in a strong financial position, making it a potentially attractive investment opportunity.

| Year | Annualized Revenue |

|---|---|

| 2023 | $1.7 billion |

| 2022 | $750 million |

| 2021 | $1.1 billion |

| 2020 | $325 million |

| 2019 | Not Available |

Canva’s Private Company Status and Valuation

At present, Canva continues to be a privately owned company. Its valuation has seen fluctuations over the years, reaching a peak of $40 billion following a funding round in September 2021. However, by 2022, the valuation had decreased to $26 billion.

Different investors have proposed adjustments in Canva’s valuation. Here are the different valuations:

One venture capital fund valued it at approximately $25.6 billion

Another suggested it could be as low as $13 billion

The most recent valuation has pegged Canva at $25.5 billion, following the entry of two new investors in late 2023.

Canva IPO: Speculations and Timeline

Despite the heightened anticipation for Canva’s potential IPO, the COO, Cliff Obrecht, indicates that it may not be happening soon. Instead, 2026 seems to be the likely year for a Canva IPO mainly due to the current unfavorable market conditions for tech IPOs.

Significant interest from buyers in Canva’s shares on the secondary market indicates a readiness for liquidity. There’s also evidence of early investors selling stock, possibly in preparation for an IPO. Despite this, as of the latest information, Canva remains a private company and not a publicly traded company, with no formal public offering announcements or a Canva stock symbol, making it difficult to buy Canva stock directly.

How to Invest in Canva Pre-IPO: Options for Accredited Investors

Accredited investors can explore options to gain exposure to Canva pre-IPO, even though it continues to be a private company. Funds like The Fundrise Innovation Fund, which has invested $6 million into Canva, offer such opportunities.

Platforms like Forge Global and Blackbird Ventures specialize in pre-IPO investments and offer opportunities for accredited investors to buy pre-IPO shares, such as potentially acquiring Canva shares before they are publicly traded. However, these investments come with high risks, including the speculative nature of such investments, illiquidity issues, and the potential for total loss.

Therefore, investors may seek guidance from experienced venture capital firms when investing in private companies like Canva to effectively navigate associated risks.

Alternative Investment Opportunities: Canva Competitors

Investors seeking alternatives can consider Canva’s competitors as potential options. Companies like Adobe, Autodesk, and Microsoft, all competing in the design software market, offer considerable potential for investment.

Investing in these competitor stocks requires careful evaluation of their performance and growth potential. By accessing these stocks and their stock symbol through various brokerage accounts, individuals can take advantage of the opportunities presented in this dynamic market.

Opening a Brokerage Account

To start investing in Canva’s competitors, the first move would be to open a brokerage account. It’s essential to choose the right brokerage, considering factors such as:

Account minimums

Fees

Features

Investment options

Available educational resources.

Investors must also decide between a margin account, which allows for borrowing funds for investing, and a cash account, which only permits investing available funds. Personal identification, tax information, and income details are required for Know Your Client (KYC) verification. Once this is done, the brokerage account can be funded through various methods like bank transfers, wire transfers, and mailing checks.

Researching and Diversifying Your Portfolio

Investing in Canva’s competitors necessitates thorough research and portfolio diversification. It’s important to analyze their:

Financial statements

Recent news

Product offerings

Market trends

This will help assess their long-term growth potential, especially when analyzing relevant video footage.

Diversifying an investment portfolio across multiple stocks, including competitors to Canva like Adobe, Autodesk, and Microsoft, can help reduce risk. Conducting extensive due diligence on the company, its competitors, and the management team’s background is crucial when investing in private companies. Diversifying across multiple private company investments can help mitigate risks rather than concentrating capital in a single venture.

Canva’s Impact on the Design Industry and Future Growth Potential

The influence of Canva on the design industry has been substantial. Canva has:

Provided an intuitive user interface

Offered an extensive template library

Included collaborative features

Made professional design accessible to non-designers

Supported the growing trend towards dynamic multimedia content with its animation and video editing capabilities.

Investments in AI have revolutionized the roles of marketers and creatives, saving users significant time on design tasks and streamlining workflows without replacing human creativity. With Canva’s platform being used by 85% of Fortune 500 companies and experiencing strong team adoption growth, it’s clear that Canva has penetrated the market significantly.

Furthermore, Canva’s diverse user base and dedication to education and up-skilling suggest broad-based growth and a commitment to inclusivity in design tools.

ETFs and Funds with Exposure to Canva

Investment funds, as opposed to passive ones like ETFs, can provide exposure to private entities like Canva, given they are not publicly traded. For instance, the T. Rowe Price Blue Chip Growth Fund has made a substantial investment in Canva, with a financial stake valued at $99.1 million.

For individual investors interested in indirect access to Canva, the Fundrise Innovation Fund has allocated a $6 million investment in the company. This offers an opportunity for investors to gain exposure to Canva’s growth potential.

Risks and Considerations When Investing in Canva

Despite Canva’s allure as an investment opportunity, it’s important to take into account the considerable risks involved. Investing in private companies like Canva comes with risks due to the lack of Securities and Exchange Commission (SEC) oversight, leading to a higher vulnerability to misrepresentation and potential fraud.

Investing in a privately held company, which is a type of private company, is considered speculative and high-risk, attracting many investors who need to be prepared to potentially lose their entire investment. Furthermore, private company shares are typically illiquid, meaning investors should be prepared to hold their investment for a long time, possibly 5-10 years, unlike shares of a public company.

Despite a significant data breach in 2019, Canva has enhanced its security measures and maintained transparency with users to protect their data and trust.

Summary

To sum up, Canva is a robust player in the design software market, with a significant user base and a healthy financial standing. While the company remains private with potential IPO speculations surrounding 2026, there are opportunities for accredited investors to gain exposure to Canva pre-IPO. Investors can also consider alternative investments in Canva’s competitors like Adobe, Autodesk, and Microsoft. However, it’s essential to navigate these investment opportunities with careful research, diversification, and an understanding of the associated risks.

Frequently Asked Questions

Is Canva a public company?

No, Canva is a privately held company and does not have a public stock price.

What is Canva valued at?

Canva is valued at $40 billion, following its most recent funding round in 2021.

Is Canva stock free?

Yes, with a Canva Pro account, you can access and customize royalty-free stock videos and visual content for personal or commercial use.

Did Canva have an IPO?

No, Canva has not had an IPO as of now. There are no filings with the SEC and no estimated date for an IPO.