BlackRock, the world’s largest asset manager, continues to demonstrate its market dominance and resilience heading into 2024. With assets under management rebounding to $10 trillion, up from $8.59 trillion in 2022, and a market capitalization of over $123 billion, BlackRock is poised to navigate the evolving economic landscape adeptly.

- Key Data – BlackRock

- Overview of BlackRock

- BlackRock at Glance

- What services does the BlackRock Group offer?

- BlackRock Market Capitalization

- BlackRock Revenue

- Total Assets Under Management (AUM) of BlackRock

- BlackRocks Top 10 Largest ETFs

- Overview: BlackRock Investments and Acquisitions

- BlackRock Ownership Overview

- BlackRock Leadership

- How many employees of BlackRock are there?

- Where are the Headquarters of BlackRock?

Key Data – BlackRock

- As of March 2024, BlackRock‘s market cap is $123.09 Billion.

- The revenue for BlackRock in 2023 was $17.85 billion.

- As of Q2 2023, BlackRock’s assets under management (AUM) had risen to about 10 trillion U.S. dollars from 8.59 trillion in 2022.

Overview of BlackRock

| Key Stat | Key Information |

|---|---|

| Area served | Worldwide |

| Company Type | Public Company |

| Type of Industry | Investment management |

| Year Founded | 1988 |

| Type of Company | Private |

| Founders | Robert S. Kapito, Larry Fink, Susan Wagner |

| Headquarters | 50 Hudson Yards New York City, U.S.A |

| Subsidiaries | iShares |

| Key people | Larry Fink (Chairman and CEO), Robert S. Kapito (President), Philipp Hildebrand (Vice-chairman) |

| Products | Asset management, Risk management, Mutual funds, Exchange-traded funds, Index funds |

| Market Capitalization | $123.09 Billion (March, 2024) |

| Revenue | $17.85 billion (2023) |

| Number of employees | 19,800+ (2023) |

| Website | blackrock.com |

BlackRock at Glance

Established in 1988, BlackRock has grown into a leading investment management firm with assets under management (AUM) of approximately $9.4 trillion as of November 2023. The firm’s growth and influence, extending over 100 nations, are driven by a commitment to client financial well-being. BlackRock manages the renowned iShares exchange-traded funds, and its Aladdin software provides portfolio management for global institutions.

BlackRock is dedicated to sustainability. It advocates for a net-zero carbon economy by 2050 and emphasizes transparency in climate strategies. Despite criticism over investments in controversial sectors, BlackRock strives to balance returns with ethical considerations.

As a fiduciary, BlackRock prioritizes its clients’ interests. It aims to empower financial security and contribute to a more equitable world. Through its investments, the firm addresses challenges like inequality and climate change.

Looking to the future, BlackRock remains dedicated to promoting financial well-being and investing in sustainable solutions that benefit the market and society.

Source: Statista

What services does the BlackRock Group offer?

BlackRock is a significant investment player. It mainly invests in equity securities, complemented by bonds, cash, and alternative assets like real estate. Over half of these assets belong to clients in the Americas. BlackRock manages over 1,000 individual funds, offering diverse investment choices ranging from active to passive management, regional focus, asset-specific, or index-tracking funds. The tech sector has shown exceptional growth.

Their closest competitors, Vanguard and State Street, manage significantly fewer assets.

- Like BlackRock, Vanguard offers various funds.

- State Street manages over $3.4 trillion, also focuses on equities and fixed-income assets.

This landscape highlights BlackRock’s leading position and innovative investment management approach.

Source: Statista

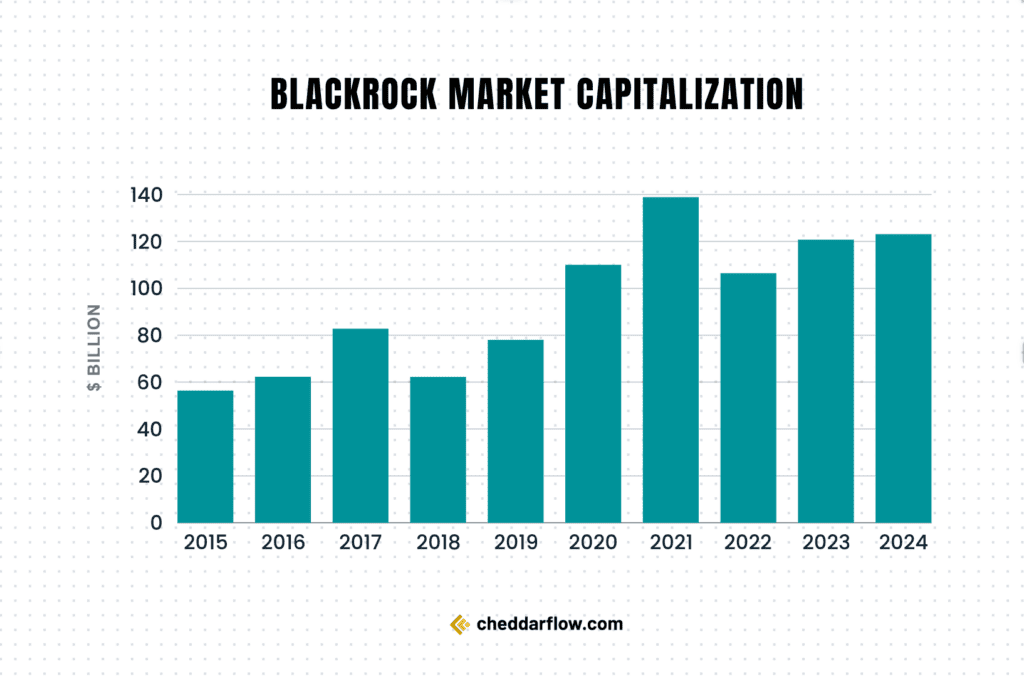

BlackRock Market Capitalization

As of March 2024, BlackRock’s market cap is $123.09 Billion.

| Year | Market cap | Change |

|---|---|---|

| 2024 | $123.09 billion | 1.93% |

| 2023 | $120.76 billion | 13.47% |

| 2022 | $106.43 billion | -23.36% |

| 2021 | $138.87 billion | 26.2% |

| 2020 | $110.04 billion | 41.05% |

| 2019 | $78.01 billion | 25.4% |

| 2018 | $62.21 billion | -24.85% |

| 2017 | $82.78 billion | 32.93% |

| 2016 | $62.27 billion | 10.44% |

| 2015 | $56.38 billion | -5.52% |

| 2014 | $59.68 billion | 11.78% |

| 2013 | $53.39 billion | 50.87% |

| 2012 | $35.39 billion | 11.36% |

| 2011 | $31.78 billion | -12.78% |

| 2010 | $36.43 billion | -16.89% |

| 2009 | $43.84 billion | 176.54% |

| 2008 | $15.85 billion | -37.65% |

| 2007 | $25.42 billion | 43.8% |

| 2006 | $17.68 billion | 154.69% |

| 2005 | $6.94 billion | 41.15% |

| 2004 | $4.91 billion | 44.49% |

| 2003 | $3.40 billion | 33.1% |

| 2002 | $2.55 billion | -4.86% |

| 2001 | $2.68 billion | – |

Source: Companies Market Cap

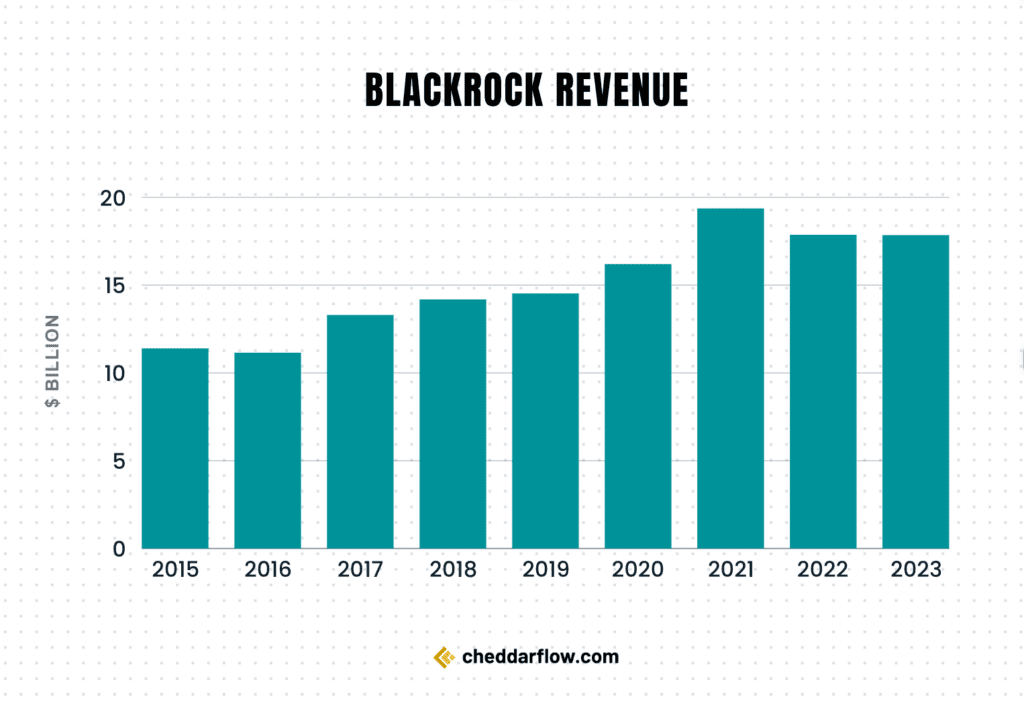

BlackRock Revenue

According to the most recent financial reports provided by the global investment management company BlackRock, the firm’s current trailing twelve months (TTM) revenue stands at a significant $17.85 billion. In 2022, the company generated an income of $17.87 billion.

This figure represents a slight decrease compared with the revenue figures from 2021, which were reported at an even higher $19.37 billion.

| Year | Revenue | Change |

|---|---|---|

| 2023 | $17.85 billion | -0.08% |

| 2022 | $17.87 billion | -7.75% |

| 2021 | $19.37 billion | 19.56% |

| 2020 | $16.20 billion | 11.46% |

| 2019 | $14.53 billion | 2.4% |

| 2018 | $14.19 billion | 6.71% |

| 2017 | $13.30 billion | 19.27% |

| 2016 | $11.15 billion | -2.16% |

| 2015 | $11.40 billion | 2.89% |

| 2014 | $11.08 billion | 8.85% |

| 2013 | $10.18 billion | 9.03% |

| 2012 | $9.33 billion | 2.82% |

| 2011 | $9.08 billion | 5.45% |

| 2010 | $8.61 billion | 83.23% |

| 2009 | $4.70 billion | -7.18% |

| 2008 | $5.06 billion | 4.52% |

| 2007 | $4.84 billion | 130.92% |

| 2006 | $2.09 billion | 76.1% |

| 2005 | $1.19 billion | 64.26% |

| 2004 | $0.72 billion | 38.69% |

| 2003 | $0.52 billion | -9.36% |

| 2002 | $0.57 billion | 7.69% |

| 2001 | $0.53 billion | – |

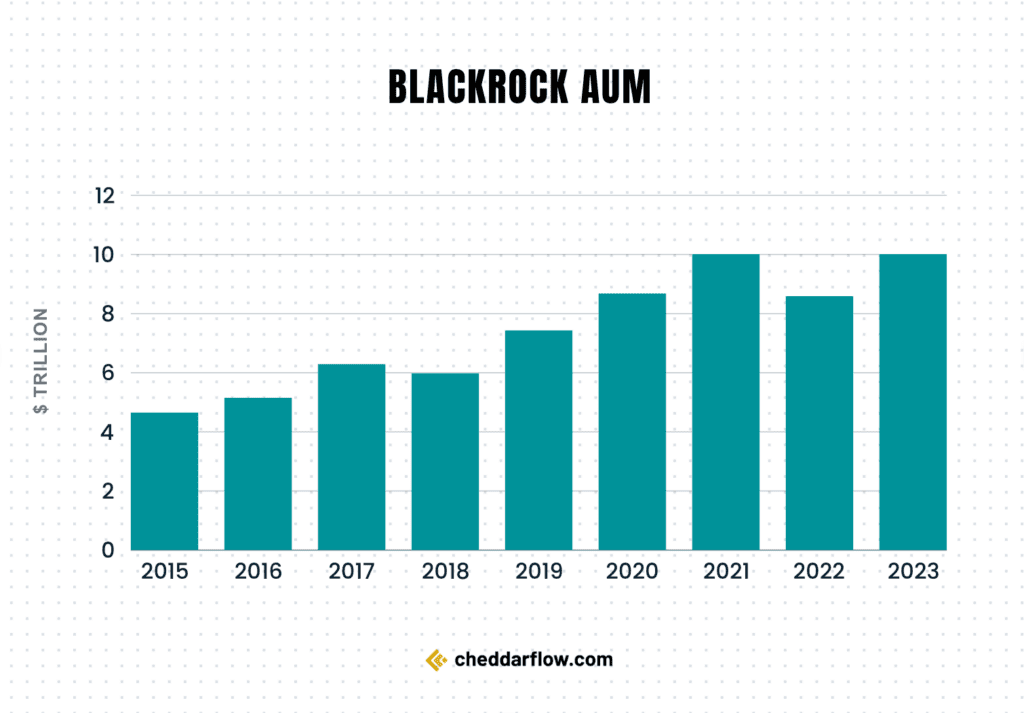

Total Assets Under Management (AUM) of BlackRock

As of the second quarter of 2023, the New York City-based asset management company BlackRock had total assets under management (AUM) of around 10 trillion U.S. dollars, compared to 8.59 trillion U.S. dollars in 2022.

| Year | Assets Under Management (AUM) |

|---|---|

| 2023 | $10.01 trillion |

| 2022 | $8.59 trillion |

| 2021 | $10.01 trillion |

| 2020 | $8.68 trillion |

| 2019 | $7.43 trillion |

| 2018 | $5.98 trillion |

| 2017 | $6.29 trillion |

| 2016 | $5.15 trillion |

| 2015 | $4.65 trillion |

| 2014 | $4.65 trillion |

| 2013 | $4.32 trillion |

| 2012 | $3.79 trillion |

| 2011 | $3.51 trillion |

Source: Statista

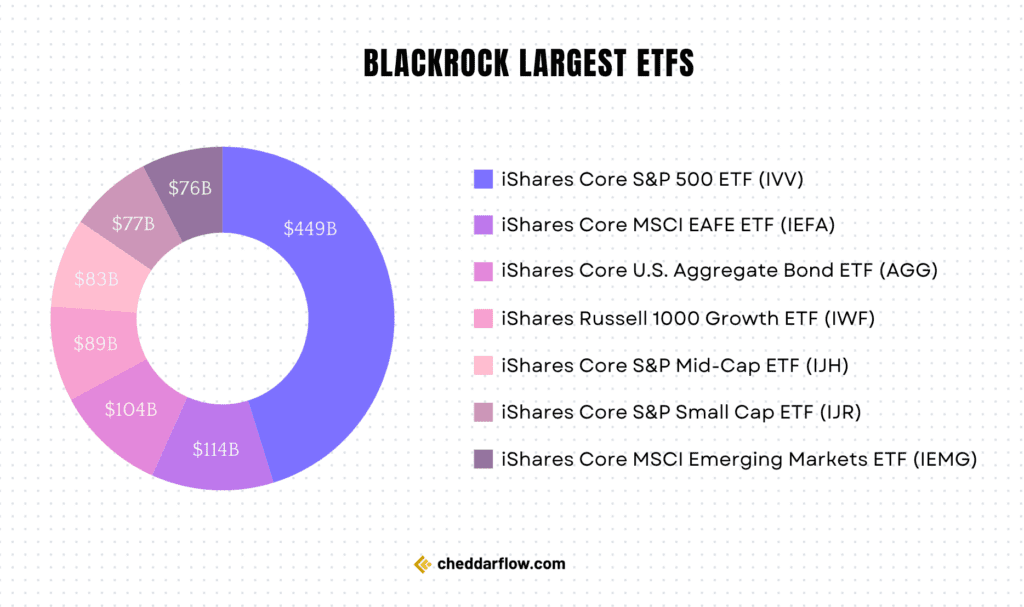

BlackRock’s Top 10 Largest ETFs

BlackRock offers a wide range of 429 exchange-traded funds (ETFs) in the United States. These U.S.-listed BlackRock ETFs collectively manage a staggering $2.77 trillion in assets. On average, the expense ratio, which represents the annual fee charged by the ETFs, is 0.30% for BlackRock’s ETF lineup

| Symbol | Fund Name | Assets (Billions) |

|---|---|---|

| IVV | iShares Core S&P 500 ETF | $449.69 |

| IEFA | iShares Core MSCI EAFE ETF | $114.57 |

| AGG | iShares Core U.S. Aggregate Bond ETF | $104.00 |

| IWF | iShares Russell 1000 Growth ETF | $89.27 |

| IJH | iShares Core S&P Mid-Cap ETF | $83.53 |

| IJR | iShares Core S&P Small Cap ETF | $77.95 |

| IEMG | iShares Core MSCI Emerging Markets ETF | $76.00 |

| IWM | iShares Russell 2000 ETF | $63.62 |

| IWD | iShares Russell 1000 Value ETF | $55.33 |

| ITOT | iShares Core S&P Total U.S. Stock Market ETF | $53.82 |

Source: stockanalysis

Overview: BlackRock Investments and Acquisitions

BlackRock Investments

BlackRock, a prominent global investment management corporation, has an impressive track record of making 338 investments. The latest addition to their portfolio of assets was made recently, precisely on March 13, 2024.

During this investment round, they financially supported a company named PPRO, which successfully raised the necessary funds to continue their initiatives and business operations.

| Announced Date | Organization Name | Funding Round | Money Raised |

|---|---|---|---|

| Mar 13, 2024 | PPRO | Private Equity Round – PPRO | €85 million |

| Mar 7, 2024 | Lodha Group | Post-IPO Equity – Lodha Group | ₹32.8 billion |

| Mar 5, 2024 | RapidSOS | Series C – RapidSOS | $75 million |

| Feb 29, 2024 | Enviria | Series B – Enviria | €185 million |

| Feb 24, 2024 | Montage Hotels & Resorts | Private Equity Round – Montage Hotels & Resorts | — |

| Feb 22, 2024 | Antora Energy | Series B – Antora Energy | $150 million |

| Feb 19, 2024 | Lake Turkana Wind Power | Private Equity Round – Lake Turkana Wind Power | — |

| Feb 15, 2024 | Kairos Aerospace | Series D – Kairos Aerospace | $52 million |

| Feb 7, 2024 | Pagaya | Post-IPO Debt – Pagaya | $280 million |

| Jan 31, 2024 | Ditrolic Energy | Private Equity Round – Ditrolic Energy | – |

Source: CrunchBase

Acquisitions

BlackRock, an influential and globally recognized company, has successfully acquired 24 organizations.

These acquisitions have further expanded its portfolio and diversified its operations. Their most recent acquisition, SpiderRock Advisors, adds to its impressive list.

This acquisition occurred on March 8, 2024, marking another strategic move by BlackRock to enhance its position in the industry.

| Acquiree Name | Announced Date | Price | Transaction Name |

|---|---|---|---|

| SpiderRock Advisors | Mar 8, 2024 | — | SpiderRock Advisors acquired by BlackRock |

| Global Infrastructure Partners | Jan 12, 2024 | $12.5 billion | Global Infrastructure Partners acquired by BlackRock |

| Kreos Capital | Jun 8, 2023 | — | Kreos Capital acquired by BlackRock |

| Environmental 360 Solutions E360S | Feb 16, 2023 | — | Environmental 360 Solutions E360S acquired by BlackRock |

| Alacrity Solutions | Feb 2, 2023 | — | Alacrity Solutions acquired by BlackRock |

| Jupiter Power | Nov 14, 2022 | — | Jupiter Power acquired by BlackRock |

| Paradigm Oral Surgery | Sep 22, 2022 | — | Paradigm Oral Surgery acquired by BlackRock |

| solarZero | Sep 13, 2022 | NZ$100 million | solarZero acquired by BlackRock |

| Akaysha Energy | Aug 16, 2022 | — | Akaysha Energy acquired by BlackRock |

| Vanguard Renewables | Jul 20, 2022 | $700 million | Vanguard Renewables acquired by BlackRock |

Source: CrunchBase

BlackRock Ownership Overview

BlackRock operates as an independent public entity, without a single majority shareholder exerting overarching control.

- The PNC Financial Services Group, Inc. holds a minority ownership stake, showcasing the broad nature of ownership within BlackRock.

- To further reinforce this independent structure, most of the members on the BlackRock board of directors are independent, not tied to any specific interest group within the company.

BlackRock’s initial public offering took place in 1999, and it has since been trading on the New York Stock Exchange under the ticker symbol “BLK”. This was a key event in the company’s journey, underlining its growth and standing in the financial sector.

In April 2011, BlackRock was added to the S&P 500 Index, a compilation of the 500 largest companies listed on the NYSE or NASDAQ.

Ownership of BlackRock’s stock, represented as BLK, is spread across a diverse range of both individual and institutional investors. The majority of the shares are held by institutional investors, such as mutual funds, endowments, and pension funds.

As of the latest data from April 2023, these institutional investors owned a significant 61.87% of BLK shares, highlighting their crucial role in the company’s financial structure.

- The Vanguard Group: 9.04%

- State Street Corp: 4.21%

- Bank of America: 3.45%

Other large shareholders include:

- Laurence D. Fink: 520,124 shares

- Susan L. Wagner: 429,362 shares

- Robert S. Kapito: 210,104 share

Source: BlackRock 1, BlackRock 2

BlackRock Leadership

BlackRock is a global investment management firm led by Chairman and CEO Laurence D. Fink. Supported by key executives such as CFO Martin Small and CLO Chris Meade, his leadership has driven BlackRock’s success.

Rick Rieder serves as the CIO of Global Fixed Income, and Samara Cohen is the CIO of ETF and Index Investments. Chief Risk Officer Ed Fishwick safeguards the firm’s assets and reputation.

Global Head of Technology & Operations Derek Stein ensures operational efficiency, and Rachel Lord and Susan Chan lead international and Asia Pacific strategies, respectively. Joud Abdel Majeid, the Global Head of Investment Stewardship, promotes ethical investment practices.

The firm’s Board of Directors, including Murry S. Gerber, Chuck Robbins, and Fabrizio Freda, provide guidance and oversight.

This team continues to drive BlackRock’s value creation for its clients, shareholders, and society.

How Many Employees of BlackRock Are There?

As of the end of 2023, BlackRock’s global investment management corporation had a total employee headcount of 19,800.

This figure encompasses all roles across the company, from executive leadership to operational personnel, and represents its worldwide workforce.

| Year | BlackRock Employees Headcount |

|---|---|

| 2023 | 19,800 employees |

| 2022 | 19,800 employees |

| 2021 | 18,400 employees |

| 2020 | 16,500 employees |

| 2019 | 16,200 employees |

| 2018 | 14,900 employees |

| 2017 | 13,900 employees |

| 2016 | 13,000 employees |

| 2015 | 13,000 employees |

| 2014 | 12,200 employees |

| 2013 | 11,400 employees |

| 2012 | 10,500 employees |

| 2011 | 10,100 employees |

| 2010 | 9,127 employees |

| 2009 | 8,629 employees |

Source: Macrotrends

Where Are the Headquarters of BlackRock?

BlackRock, a global leader in investment management, risk management, and advisory services, is headquartered in the bustling city of New York, specifically at 50 Hudson Yards.

This location is the central hub for its operations in the United States. However, it is worth noting that BlackRock’s presence extends far beyond New York.

The firm has an expansive network of 66 office locations scattered across various regions. This includes many branches throughout the United States, each critical to serving the diverse needs of their clientele and contributing to the organization’s overall success.

| Country | City | Address |

|---|---|---|

| United States | New York | 50 Hudson Yards HQ |

| United States | Atlanta | 725 Ponce de Leon Ave NE |

| United States | Boston | 60 State Street |

| United States | Chicago | 227 West Monroe Street |

| United States | Dallas | 5910 North Central Expressway |

| United States | Denver | 44 Cook Street |

| United States | Greenwich | One Lafayette Place |

| United States | Houston | 609 Main at Texas 609 Main Street |

| United States | Miami | 701 Brickell Avenue, Suite 1250 |

| United States | Newport Beach | 4400 MacArthur Boulevard |

Source: Craft