18 Day reversal

The grey line, which indicates all-time highs and lows, served as a predictor of resistance levels during bear market rallies, such as those seen in March, August, and November-December. While the market broke out above this line, it is expected to retest the level soon, likely resulting in a minor bounce.

However, a fall back below this level could trigger an acceleration of selling and a significant downward trend, as the breakout was deemed a fakeout. This phenomenon often results in extreme price movements in the opposite direction.

Massive SPY option bet

February saw a very large $14.8 million put option order, which was placed at the high of market action. This trade was incredibly successful, doubling the initial investment. The order was uncommonly large, with premiums exceeding 10 million dollars for the put side. It has been closely followed since early February, and the success of this trade is rare.

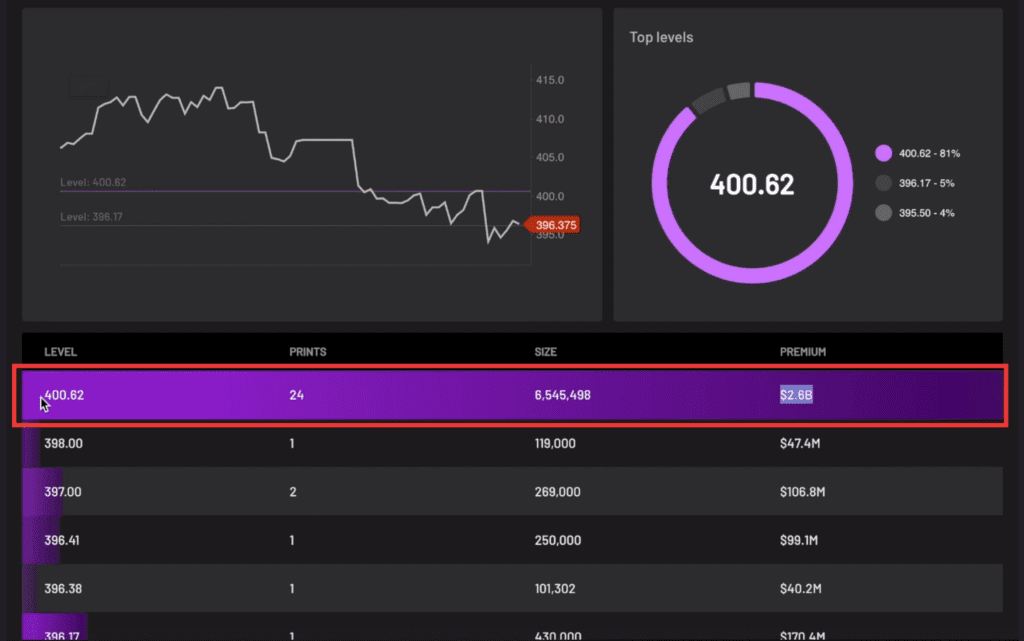

Dark pool activity

Dark pool levels indicate a premium of 2.6 billion at the 406.6 level, which is a significant amount. Premiums exceeding two billion are less common, and those above three billion are highly unusual. While there has not been much accumulation so far, it is noteworthy that there have been more sizable sells above the 400 range, such as those seen on Tuesday and in previous days.

Dow Jones Industrial bearish moves

The consolidation phase observed in the market has been likened to a coiled spring, with the market’s direction having a pronounced effect. It is currently in a distribution phase, with a downward trend line that has been respected during the bear market. While the trend line has already been retested once, it is expected to be retested again in the coming weeks, likely resulting in a collapse below the trend line.

This consolidation will have a significant impact on the Dow’s price action and will weigh on the general market, despite the Dow’s relative strength. There may be further consolidation this week due to the downward pressure seen so far.

Make sure to catch our full weekly recap video below: