With the release of our new and improved intelligent option alert system, we’re proud to introduce features that help users analyze real-time data and make informed decisions faster and more efficiently.

By gathering feedback from our version 1 and 2, we’ve been able to improve our algorithm logic and also added in a wealth of new data to give you a more comprehensive view of whats happening with the option contract.

Our goal with this updated version is to empower users with rich information that can be used to inform and improve their trading strategies. This system is not intended to be used as a standalone trading bot, but rather as a tool to supplement and inform your own ideas for execution. Keep in mind that no system is perfect, but we believe that by providing valuable data, our intelligent option alert system will give you an edge in the market.

Feature Breakdown

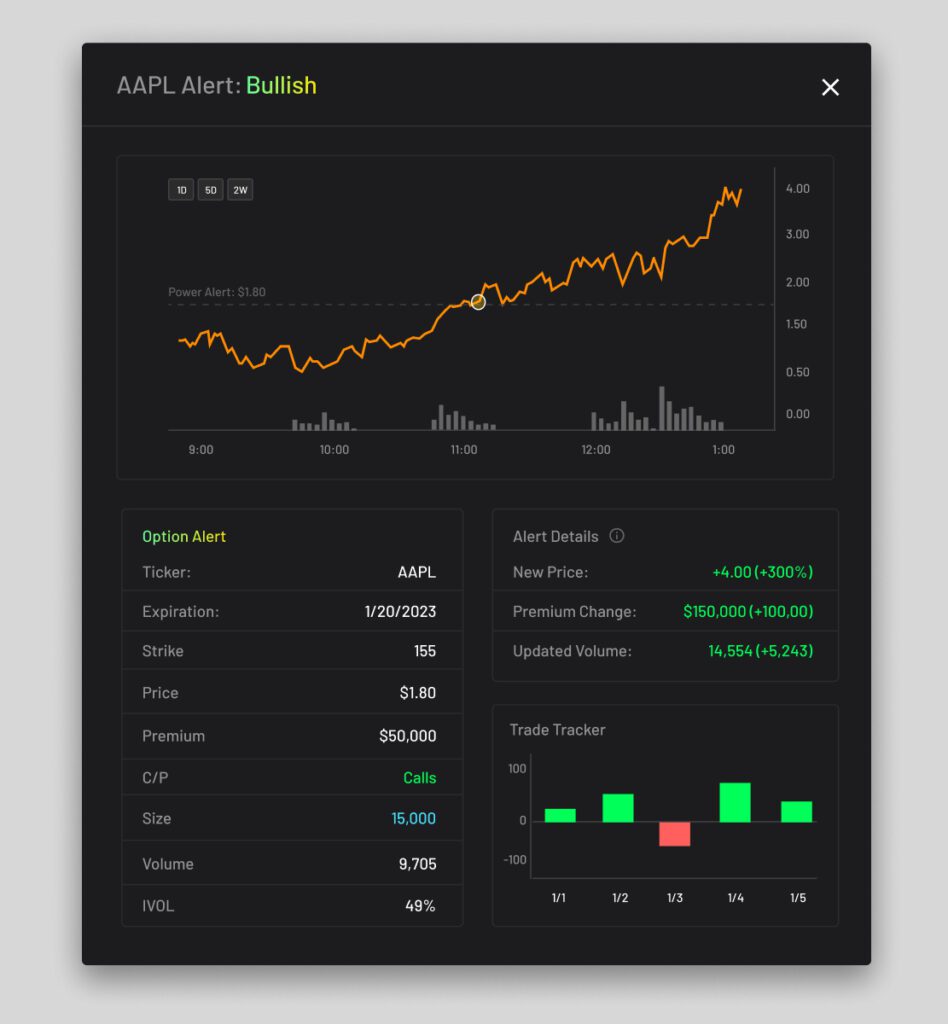

Once you click a power alert card, you will be presented with more information on the option alert.

- Interactive chart: You will now have a visual marker of where the power alert was triggered and see how the intraday movement of the option price is going.

- Option information: Full details of the option contract

- Alert details: Review the current cost of the contract to observe the premium it has earned, along with any volume alterations.

- 5-day trade tracker: Performance of the option alert over a week

How to use this information

If you are looking to integrate alerts into your trading strategies, here are some suggestions that will enable you to make more informed decisions.

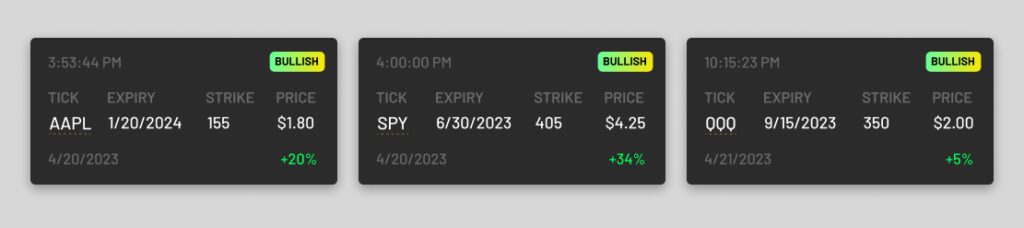

Identify Sentiment

Look at multiple orders being triggered throughout the day and previous days. Are there consecutive bullish or bearish alerts coming through? This could mean overall market sentiment is shifting. It’s important to also check chart technicals to see if any patterns or trends are starting to follow the shift.

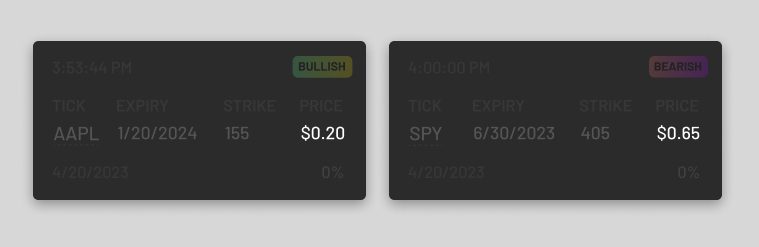

Spot cheap option contracts

If you’re searching for good option alerts, take a look at those with low contract prices. We’ve observed that inexpensive contracts ranging from $0.20 – $0.70 are more likely to yield positive results and lead to successful alerts in the long run.

An attractive feature of cheaper option contracts is their leverage potential and the possibility for higher returns. However, it’s essential to bear in mind that these are riskier investments since they are more volatile and sometimes less liquid.

Understand Volatility

During turbulent times such as November 2022, when the market is highly volatile, option alerts may not be of much help as they may not accurately reflect the current conditions. Volatility implies that prices can fluctuate swiftly and unpredictably, making it hard for investors to transact at the cost they had in mind. This is a crucial reason why trading can be quite complicated around these market conditions.

Extreme price swings can cause wider bid-ask spreads, leading to higher trading costs for options. Market volatility should always be taken into account when devising or executing trading strategies. It is sometimes wise to wait until the market calms down before making any trades, so as to maximize the chances of success. Consequently, traders must always be wary of potential shifts in volatility and adjust their strategies accordingly.

Final Thoughts

As you begin to use our Intelligent Option Alert System, it’s important to approach the information with patience and an open mind. Over time, you’ll find that the data it provides can be a valuable tool in your trading setup. Our goal with this feature is to help you quickly and easily navigate the complex world of option trading, so that you can make more informed decisions.

While it may not provide consistent winners, the system is designed to provide a wealth of reference information that can help you understand market trends and make better trades. Remember, options order flow can be difficult to understand, but with the help of our system, you’ll be one step closer to making sense of it all.